Pristine Market Analysis & Watchlist 5/16

The Debt Ceiling Debate

Team,

Mental toughness is important here. We are all going to make it!

-Andrew

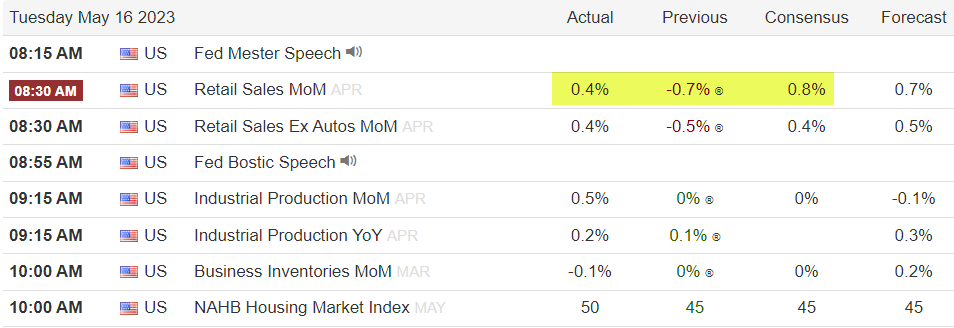

Economic Data

Today’s session kicked off with lighter than expected retail sales data:

Treasury Action

Fed Fund Futures

Fed fund futures were quiet, but March ‘24 futures moved higher.

10Yr

ZN_F 10yr treasury futures finished below the 50-day SMA. I was surprised at how weak treasuries were despite the retail sales data. This could have something to do with the debt ceiling overhang:

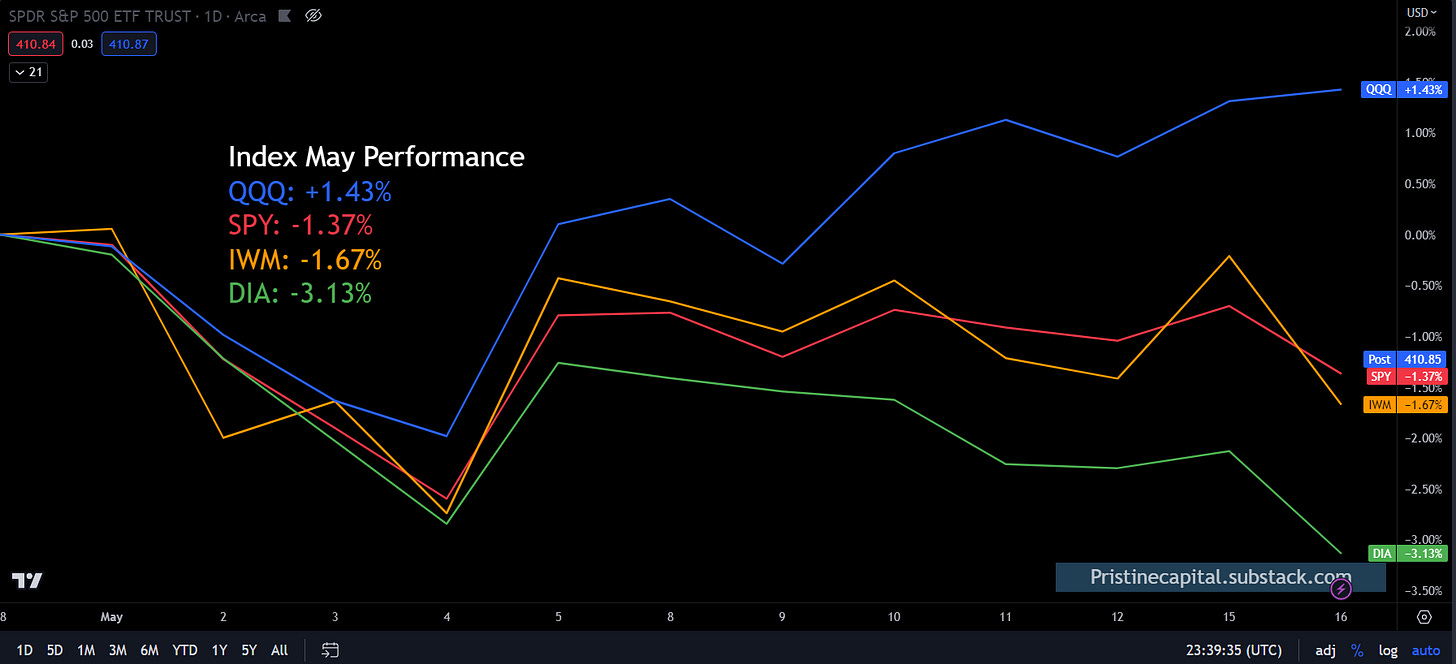

May Index Performance

The Nasdaq remains the only index in positive territory for May!

Equity Dashboard

Market breadth was weak with 15.1% advancers, but and the ARKK names fell back to reality:

Megacaps MSFT NVDA GOOGL AMZN AMD were the only bright spots in a weak tape.

Index Price Action

Every index looks completely different. ES is flirting with a breakdown from the monthly value area, while the NQ has been the clear outperformer and RTY the clear underperformer.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities