Pristine Market Analysis & Watchlist 4/25

MSFT Takes Off

Team,

Another epic day in the market, followed by market-moving earnings after the bell! Keep putting one foot in front of the other. No trader left behind!

-Andrew

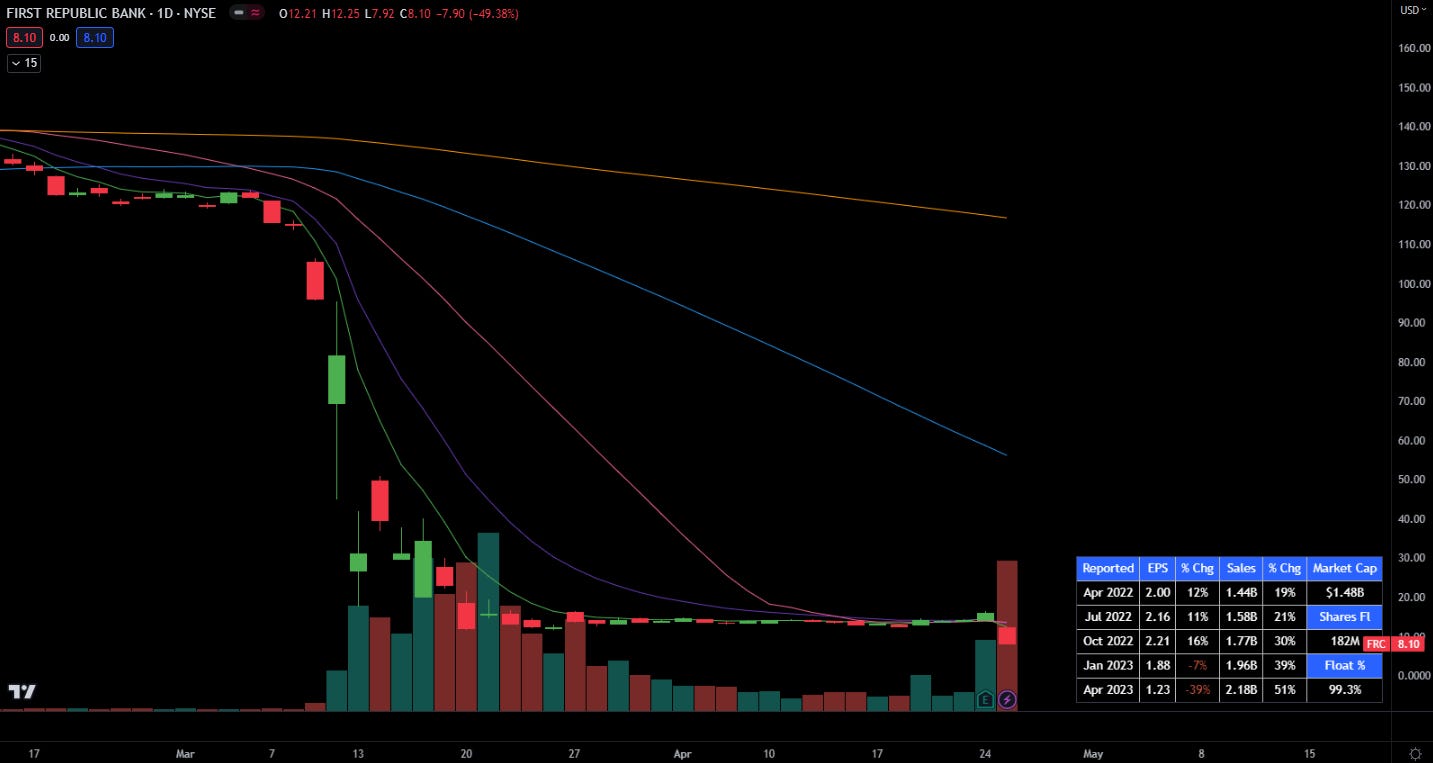

Equities sold off and volatility zoomed higher today after FRC First Republic Bank reported earnings…and fell 49.38% in a single session! When the daily candles are living inside the volume bars…that’s when you know you have a problem on your hands.

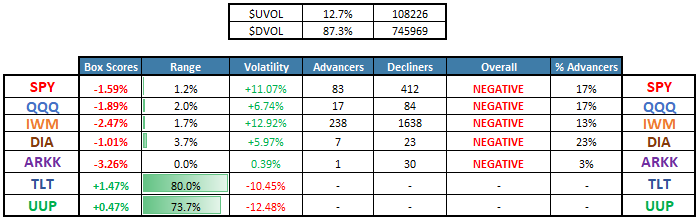

Equity Dashboard

All headline indices fell sharply, bread was extremely weak with only 12.7% advancers, and investors fled to the safety of TLT long-term treasuries.

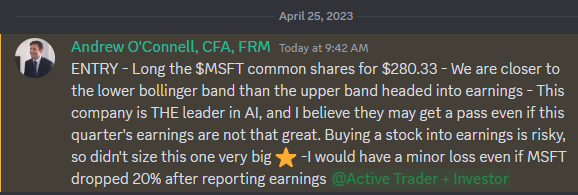

The megacap tech stocks that rallied hard in Q1 were sold once again…creating a unique opportunity for us ahead of MSFT earnings!

We purchased the MSFT common shares this morning ahead of the earnings report given Microsoft’s unique leadership position in the AI race, and the fact that the stock was trading down at the lower bollinger band ahead of the print!

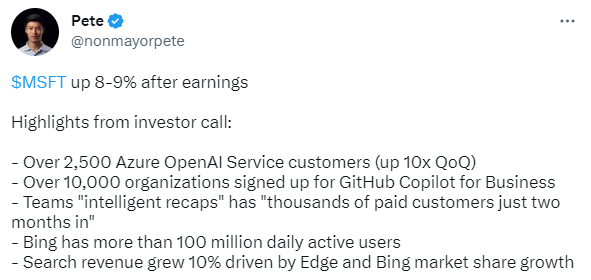

MSFT posted the following earnings after the bell and proceeded to sprint to the upside!

Microsoft Q3 EPS $2.45 Beats $2.23 Estimate, Sales $52.90B Beat $51.02B Estimate

Microsoft Sees Q4 Total Revenue $54.85B-$55.85B vs $54.84B Est.

Did you miss this trade alert? Upgrade your membership to premium to receive live updates like this in the future.

ES_F S&P 500 Price Action Analysis

So where does this leave us? The S&P 500 broke decisively below the 20-day SMA, and we’ll need more than just MSFT and GOOG (also bounced after reporting earnings) to carry the market higher. One piece of guidance as we navigate this new sequence in the market…Just because the market was down big today does not mean it has to be up big tomorrow. If you recall from 2022, we experienced selloffs that lasted 3-6 weeks at a time, with small bounces in between. Always wait for a buy signal or one of your technical entry points in a stock before getting aggressively long. Buying just to buy can get you hurt.

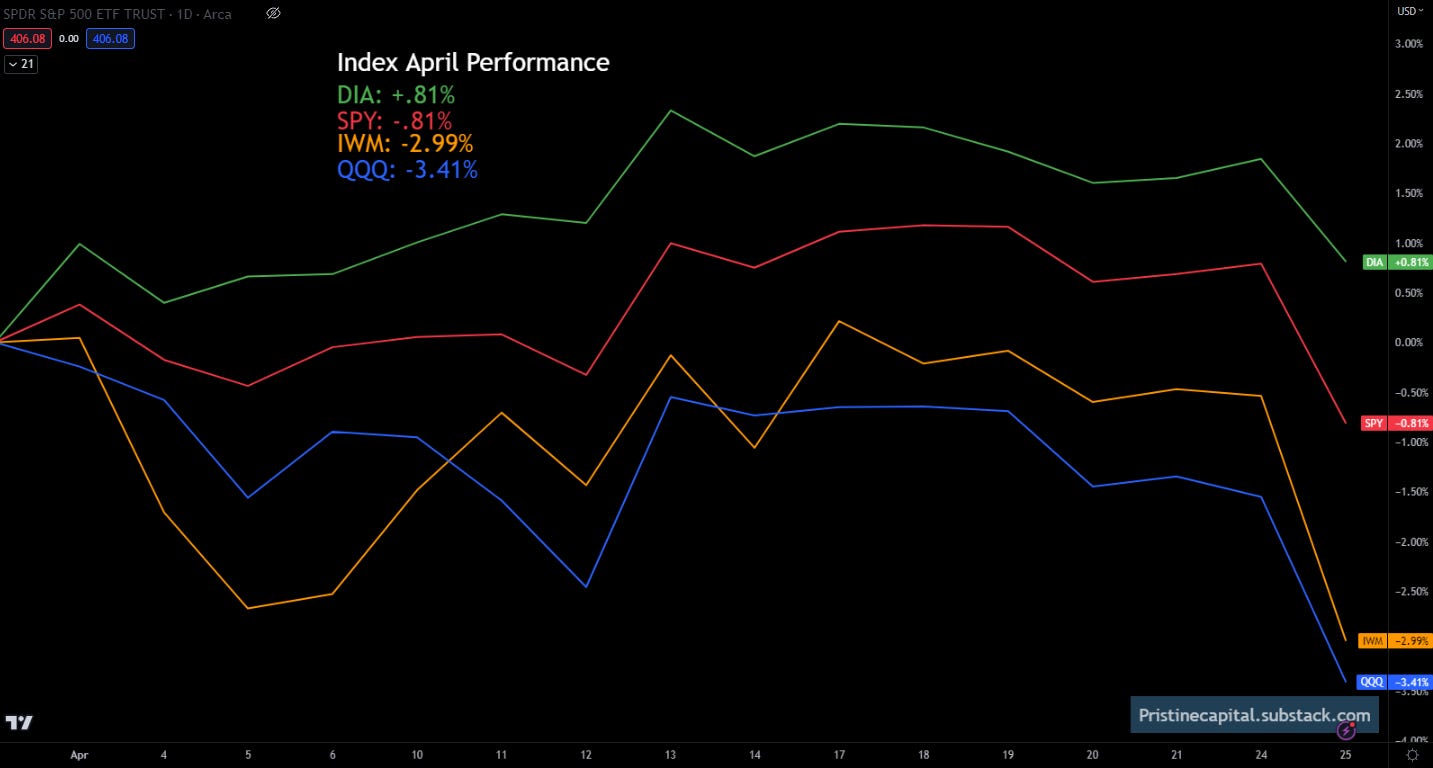

Index April Performance

There are only three trading sessions left in April, and SPY has officially flipped into negative territory. Defense wins championships!

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities