Pristine Market Analysis & Watchlist 3/14

Zoom Out!

Team,

Banks blew up, the fed stepped in, markets and narratives are moving quickly, , and it’s all a lot to handle! For tonight’s letter, we are going to take a look at the price action as we always do, and then discuss the only thing that truly matters.

-Andrew

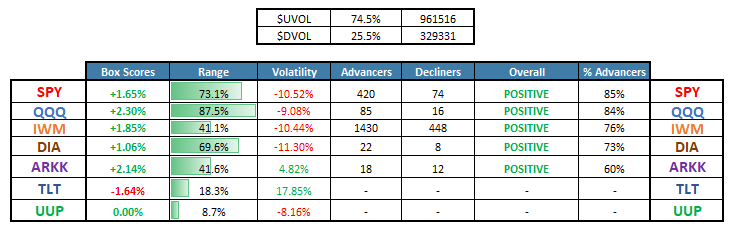

3rd Inning Scoreboard!

Despite all of the commotion over the banking crisis, most of the weakness has been concentrated in the IWM small caps, which are the most highly exposed index to regional banks.

Equity Dashboard

Volatility was crushed, equities rallied, and the flight to safety trade in TLT reverted to the mean.

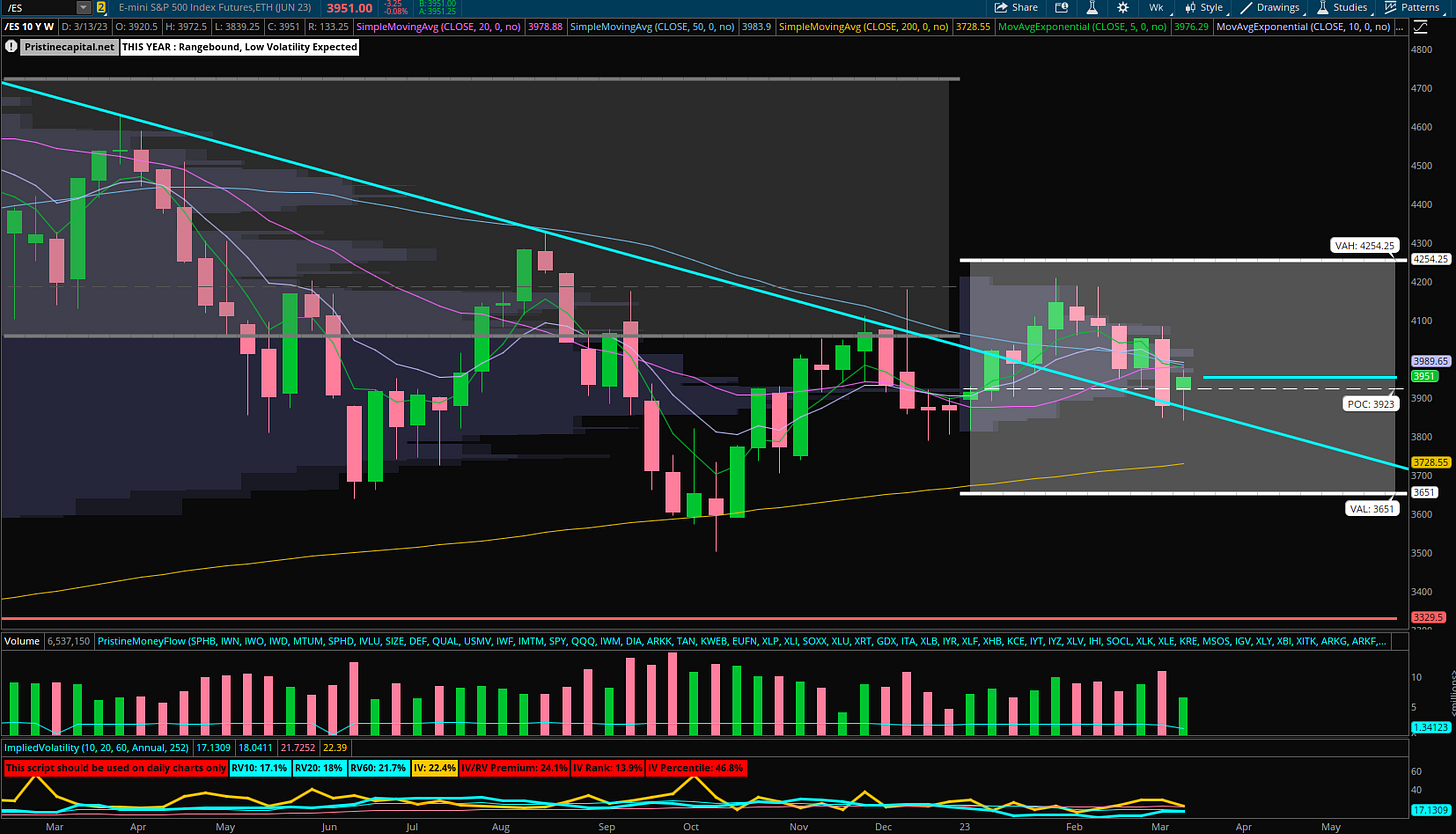

ES_F S&P 500 Price Action Analysis

The S&P 500 found support at the teal downward trendline, and also finished above the yearly point of control ~3,923.

Zooming in to the hourly chart, the S&P 500 has re-established itself inside of the weekly value area. There was a significant intraday dip this afternoon that shook out below the VAL ~3,912.75, but the market finished the session strong and inside value. If the 80% rule were to play out, that would target a move up to the weekly value area high ~4,055

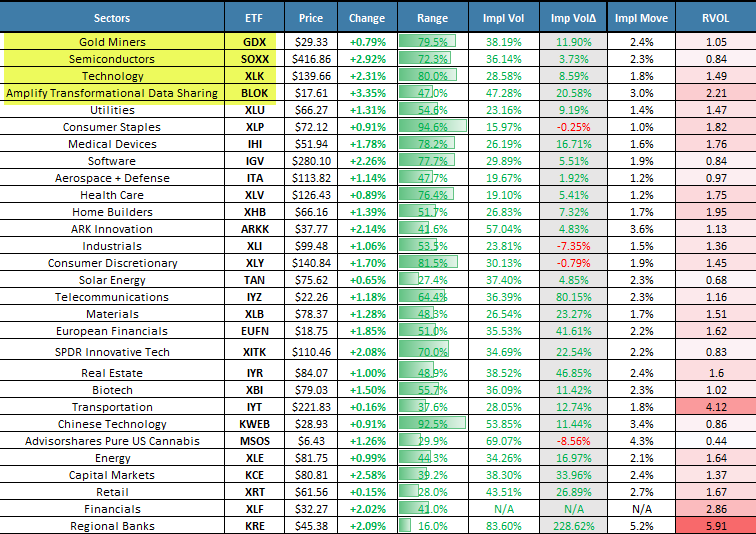

Sectors - Ranked by Momentum

GDX gold miners and SOXX semiconductors remain in the top momentum slots. BLOK blockchain assets were today’s top performer:

Okay, you’ve made it this far. Now let’s talk about the only thing that matters…if you haven’t already, upgrade your membership. I’m incredibly biased, but it’s totally worth it!

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities