Pristine Market Analysis & Watchlist - 1/10

Front-Running CPI

Good evening everyone,

One more sessions before the all-important US CPI report!

While equity investors cheered the end of inflation today, the bond market told a slightly different story.

Let’s dive in!

-Andrew

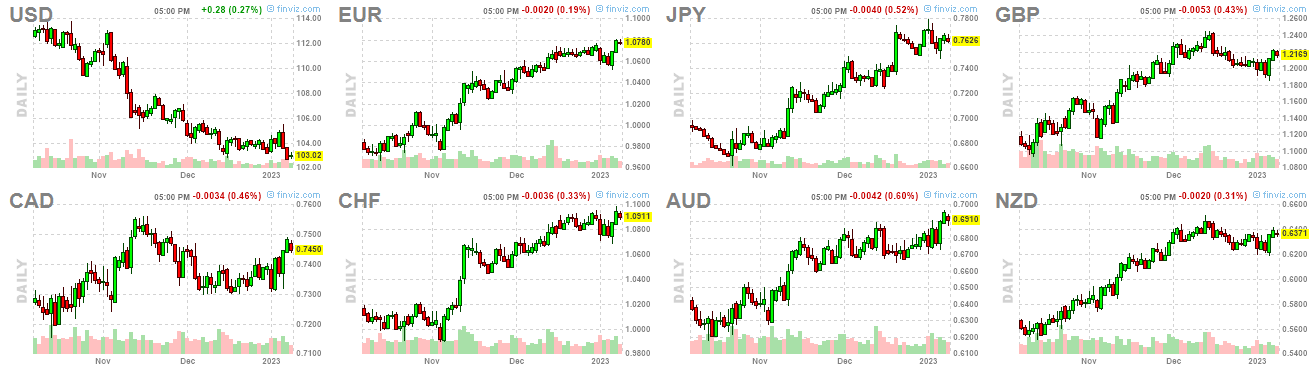

FX Market

The USD dollar index finished today’s session +.27% after selling off for two consecutive sessions:

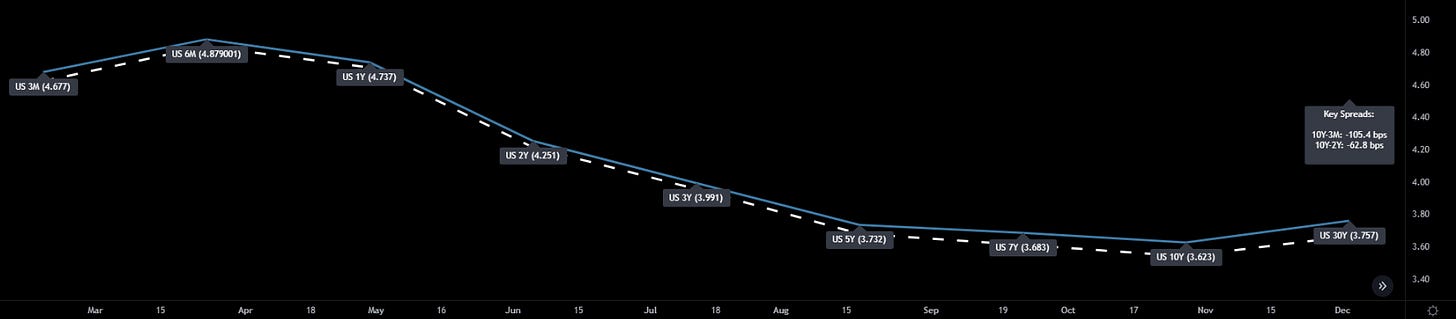

US Yield Curve

Profit taking in treasuries across the curve after two consecutive green sessions, with yields moving higher as a result:

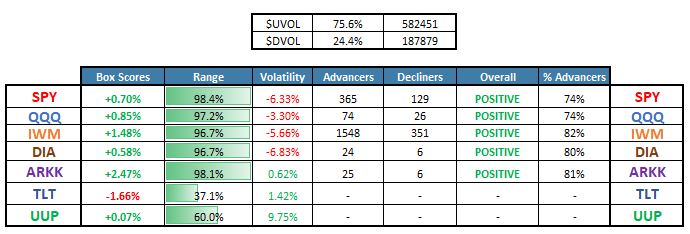

Equity Dashboard

The equity market did not take it’s queues from the dollar index or treasuries today. While it’s not necessary that these markets move in perfect unison every single day, it is worth noting when these markets diverge:

75.6% UVOL with volatility declining across most tracked indices

ARKK and IWM led today’s gains, signaling risk-on sentiment

Finviz Heatmap

Green across the screen, with rotation out of the XLP consumer staples group and XLV healthcare. Money is flowing out of defensives, and being deployed in more speculative areas of the market, contrary to the price action we experienced throughout almost all of ‘22:

S&P 500 ES_F Price Analysis

The S&P 500 finished the session +.70% and above the yearly POC ~3919.75, but below yesterday’s high of ~3975.00. I see the setup into Thursday’s CPI event as completely binary. On a lighter than expected print, the S&P 500 could push up to 4000 in a flash, while if the numbers come out hotter than expected, it could flush down to 3800 just as fast:

S&P 500 ES_F Stuck in a Balance Area

The S&P 500 is probing the top end of the 16 session range. Equity investors are viewing the CPI report optimistically:

Net New Highs/Lows

I am seeing more optimism reflected in individual stocks than at the index level. 70 individual stocks made new highs today while 22 stocks made new lows, resulting in 48 net new highs:

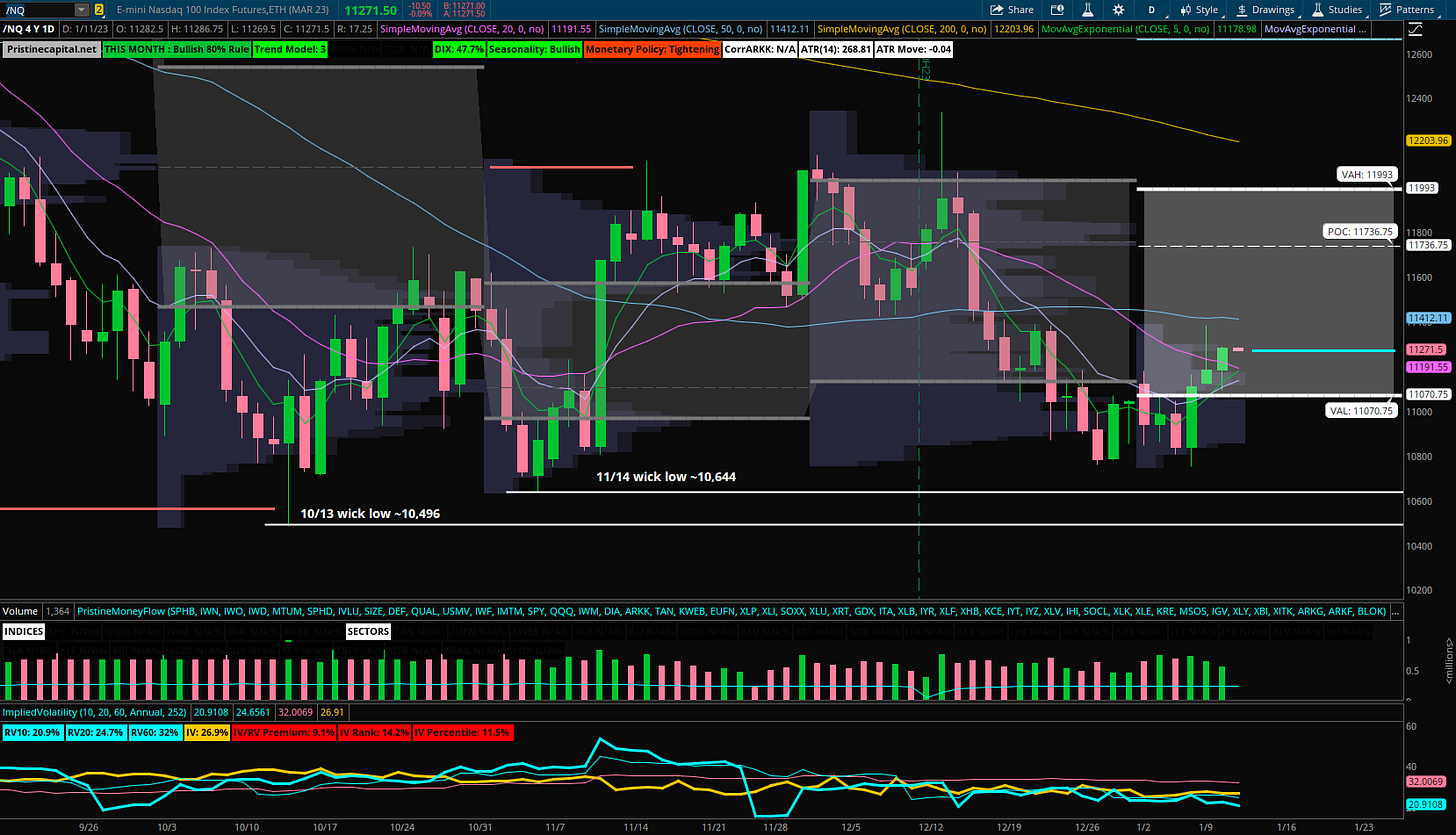

Nasdaq NQ_F Price Action Analysis

The Nasdaq shook out below yesterday’s lows before finishing the session above the 20-day SMA!

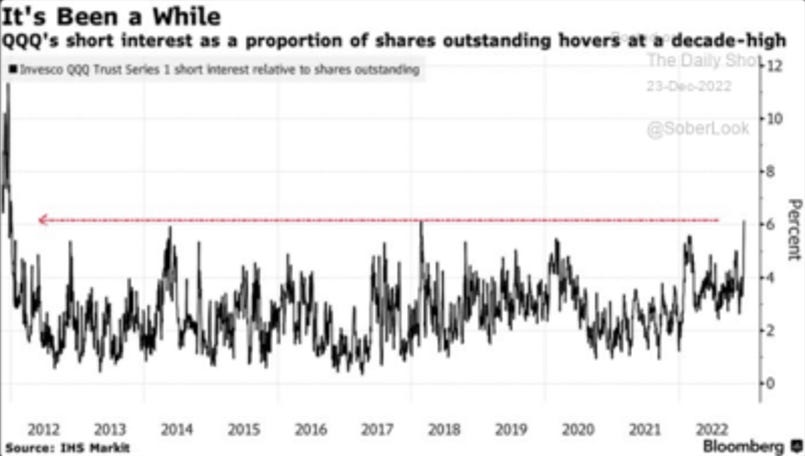

I continue to believe that the majority of the upside following a lighter than expected CPI report will accrue to the most hated areas of the market from ‘22, given the light positioning in these areas:

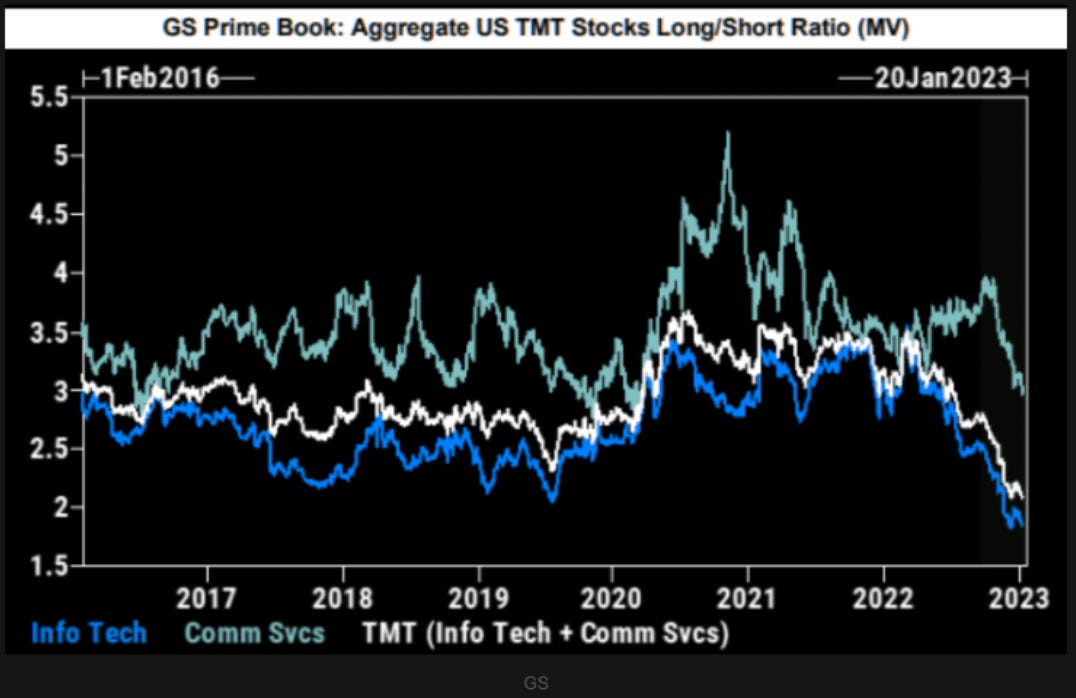

Technology Hated

Investors remain underexposed to TMT (technology) stocks via Goldman Sachs’ prime brokerage data:

Nasdaq QQQ Short Interest

Nasdaq QQQ ETF is a consensus short:

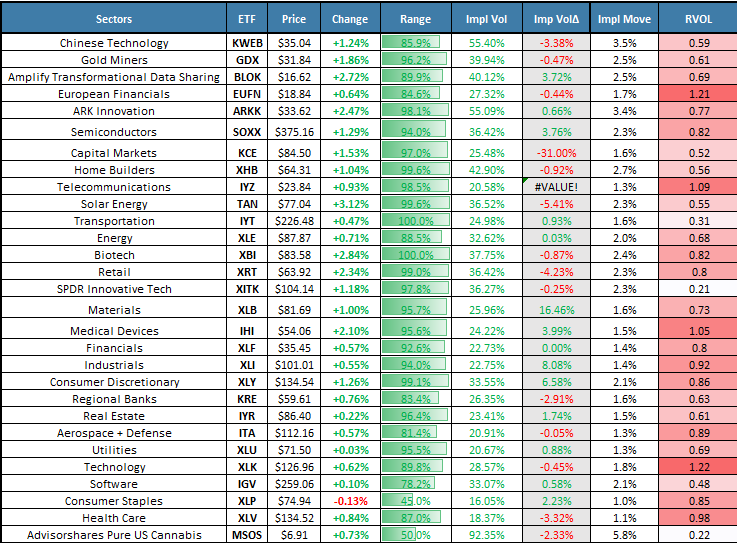

Sectors - Ranked by Momentum

BLOK, ARKK, and TAN are advancing in our momentum list, while XLV and XLP are now at the bottom:

Key Takeaways

The Bond and FX market diverged from the Equity market

Investors are front-running a light CPI print via rotation to risk-on equities

We are still stuck in the S&P 500 chop zone!

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities

✅Market Strategy - My trading plan heading into CPI