Pristine Market Analysis & Watchlist 2.21.24

It's Time to Move on from NVDA 🔥

NVDA earnings come and go

Now what?

Team,

When a company like NVDA reports earnings, everyone watches, everyone has an opinion, everyone has a position…but then what do you do when the event turns out to be a nothing burger? It is still so early in this trading year. Let’s crush it! 🍻

-Andrew

Market Update

February Monthly Performance

Considering the weak February seasonality, this month is shaping up to be strong! But small caps are lagging. I believe the small caps will have a catch up trade at some point this year! Important to be vigilant for when this rotation occurs👇

Economic Data/News

Your backward-looking fed minutes update 👇

NVDA Earnings

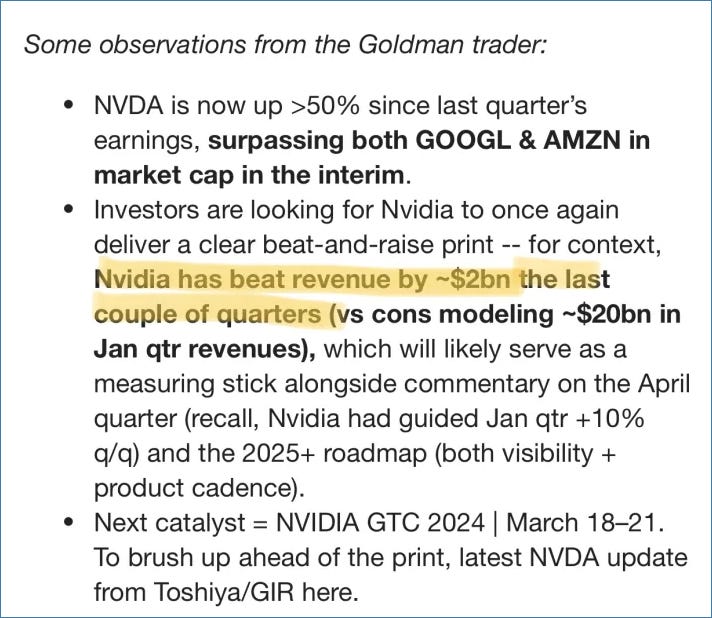

NVDA beat on sales by almost $2BB. Pretty stellar right? These numbers are fantastic when viewed in isolation…

But the crowd knew that these numbers were coming, so compared to expectations…par for the course 👇

The expected move priced into the options market heading into the report was +/- 11%, and it looks like the earnings move is going to fall inside of those expectations. NVDA is trading back up to levels not seen since…two days ago👇

Any investor considering buying into NVDA from these levels should not be thinking about tonight’s earnings report…they should be considering whether NVDA will beat on revenue by ANOTHER $2BB next quarter. Let’s see what the river brings 🌊