Pristine Market Analysis & Watchlist 2/15

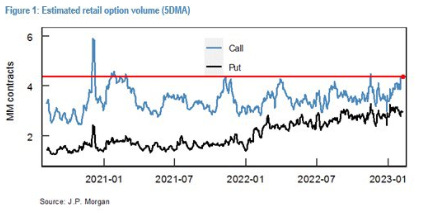

Retail Call Buyers Capitalize

Team,

We have PPI tomorrow morning and opex on Friday. There is a lot to cover tonight, so let’s dive right in!

-Andrew

Today’s events kicked off with a hotter-than-expected Retail Sales report:

Most markets reacted in a predictable manner. The DXY dollar index strengthened +.64%, as a stronger economy could result in higher interest rates for a longer period of time:

And the ZN_F 10yr treasury futures contract sold off in tandem. It has officially given back all of it’s YTD gains:

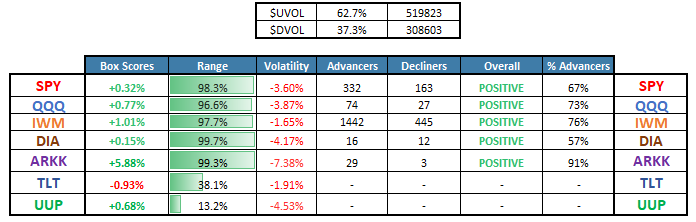

Equity Dashboard

Stocks continued to rally in the face of a stronger dollar and higher interest rates.

And volatility was crushed once again. It appears that investors were well prepared for a risk-event heading into the 2/14 CPI report, and since then have puked up their protection. Over the last two trading sessions, the VIX and VVIX have declined significantly, but the volatility crush, which normally provides upside fuel for the market, hasn’t been able to take the SPY much higher. I believe there is distribution occurring under the hood, and that it will become apparent now that there is much less volatility to crush!

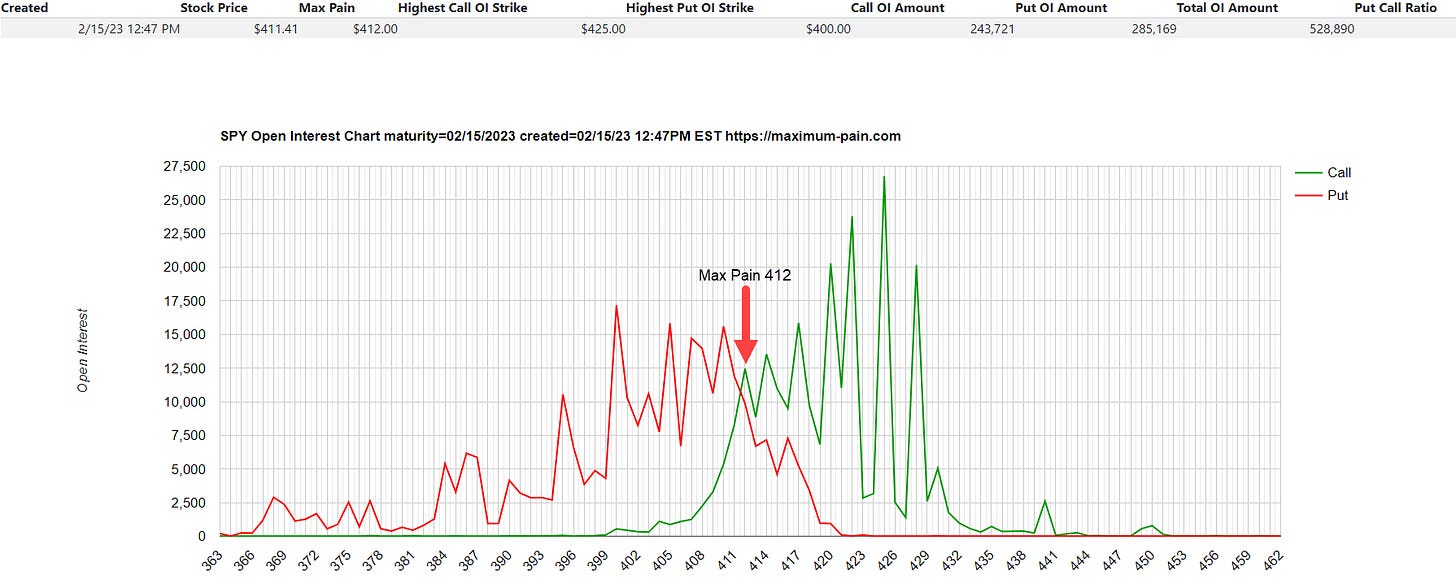

All SPY Options Go To Heaven

The vast majority of the puts for today’s SPY options expiry expired out-of-the-money, but to be fair, most of the calls did as well.

We’ve cited the positive stock buyback associated with legacy put option positions decaying into the 2/17 options expiration for the last two weeks. But keep in mind, the positive flows associated with options positioning ended with today’s VIX expiry. The market is going to have to stand on it’s own two feet into arguably the worst seasonality of the year.

SPY Price Action Analysis

The S&P 500 topped on Feb 2nd, and has been stair-stepping lower in a narrow channel ever since. We closed above the upper end of the channel today. I’m sure there were market participants that threw in the towel and got bullish today! I was not one of them.

Heading into the week, the options market implied a 2/17 SPY close between 397.13 and 418.27. I believe a large directional move is coming into the end of the week.

Beware the Jaws

The stock and bond market are pricing in two different realities, and only one will end up being correct.

The gap between the Nasdaq QQQ ETF and the 10yr US treasury future continues to grow! The last time the jaws setup emerged was in August of ‘22. In that instance, the 10yr treasury futures contract peaked on Aug 1st, and the Nasdaq QQQ ETF peaked two weeks later on Aug 15th. If we were to follow a similar timetable for the current setup, the Nasdaq is at risk of rolling over any day now.

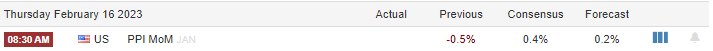

Perhaps tomorrow’s incoming PPI report at 8:30 AM ET can shake things up a bit.

We also have a few Fed speakers that will be gracing us with their views later in the session.

Will they say anything that might disrupt the retail call option party?

Let’s find out together.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities