Pristine Market Analysis & Watchlist 2/14

All CALLS go to Heaven

Team,

If you’re reading this message, that means you survived today’s CPI print! If you avoided overtrading today, that is a huge win, and you should be proud of yourself.

We are going to keep things brief tonight, as I’m cooking dinner tonight for Valentine’s day! Enjoy your evening with loved ones.

-Andrew

Today’s events kicked off with the highly anticipated US CPI report, which came in slightly higher than analyst estimates:

Equity Dashboard

While bonds sold off today, equities remained close to unchanged, and volatility declined significantly for all tracked indices

I’m assuming based off these moves in the volatility indices that investors were hedged into the event, which dampened the moves we saw in equities, and led to a volatility crush!

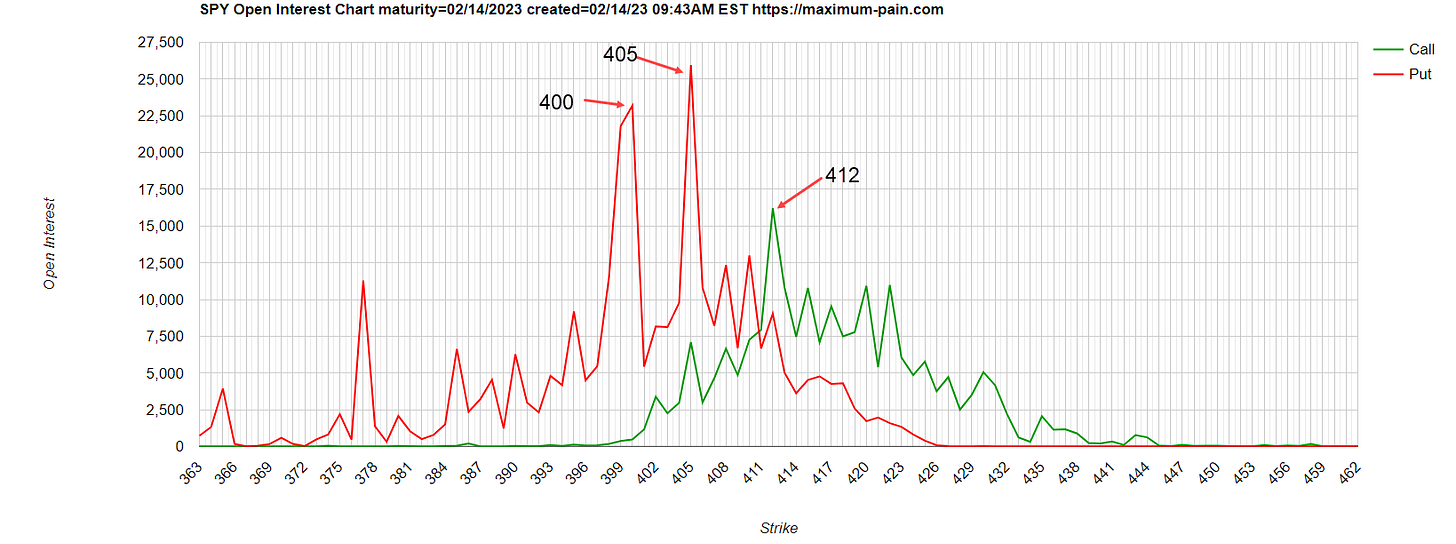

All SPY Puts Go To Heaven

And we can corroborate this with the SPY options open interest for today’s expiry. Puts were highly concentrated at the 405 and 400 strikes, and calls were most heavily concentrated at the 412 strike. Today’s SPY close of 412.64 expired the high open interest puts worthless, and the 412 calls only slightly in-the-money. This was a big win for the market makers!

We’ve cited the positive stock buyback associated with legacy put option positions decaying into the 2/17 options expiration for the last two weeks. But keep in mind, the positive flows associated with options positioning end tomorrow 2/15 with VIX expiration. The market is going to have to stand on it’s own two feet into arguably the worst seasonality of the year.

SPY Price Action Analysis

The S&P 500 topped on Feb 2nd, and has been stair-stepping lower in a narrow channel ever since. We closed at the upper end of the channel today. This is a max pain/max ambiguity close! I’m sure there were market participants that threw in the towel and got bullish into resistance today! I was not one of them.

Heading into the week, the options market implied a 2/17 SPY close between 397.13 and 418.27. I believe a large directional move is coming into the end of the week.

Beware the Jaws

The stock and bond market are pricing in two different realities, and only one will end up being correct.

The gap between the Nasdaq QQQ ETF and the 10yr US treasury future continues to grow!

To summarize:

Volatility was crushed. Investors are no longer protected from downside via puts. Shields are down!

The S&P 500 is trading at the upper end of a downward trend channel.

The bond market is signaling that stocks are trading too rich.

The market didn’t drop on CPI day, so now most investors believe that the market. ‘can’t go down’

I love this setup😎

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities