Pristine Market Analysis & Watchlist 10/23

Bill Ackman Moves Bond Market - Bitcoin Soars!

Team,

Could Bill Ackman have put a top in bond yields? More on this topic and the positive divergences for risk assets below! HAGE 🍻

-Andrew

News/Economic Data

No significant economic releases this morning, but we did get some market moving headlines!

Like clockwork, the TLT ETF rallied hard immediately after Bill Ackman’s tweet.

Long-Term Treasuries

The week is still young, but treasury futures are off to a good start👇

We could see significant upside convexity in bonds given the cracks emerging in the consumer 👇

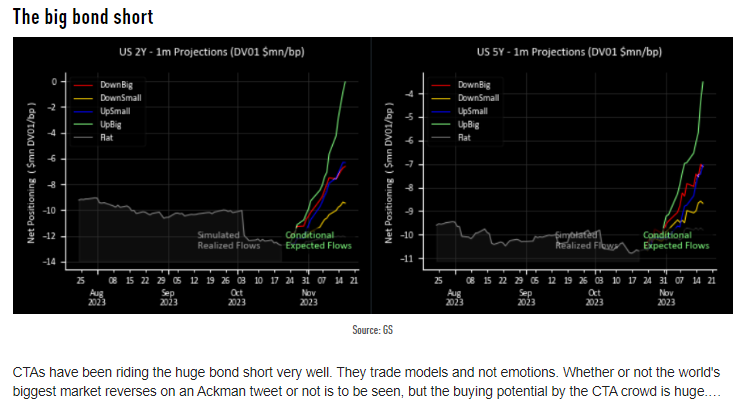

And the positioning in bonds👇

FX Market

The dollar index cascaded decisively below the white trend channel, which is a POSITIVE DIVERGENCE for risk assets ✔️

Energy

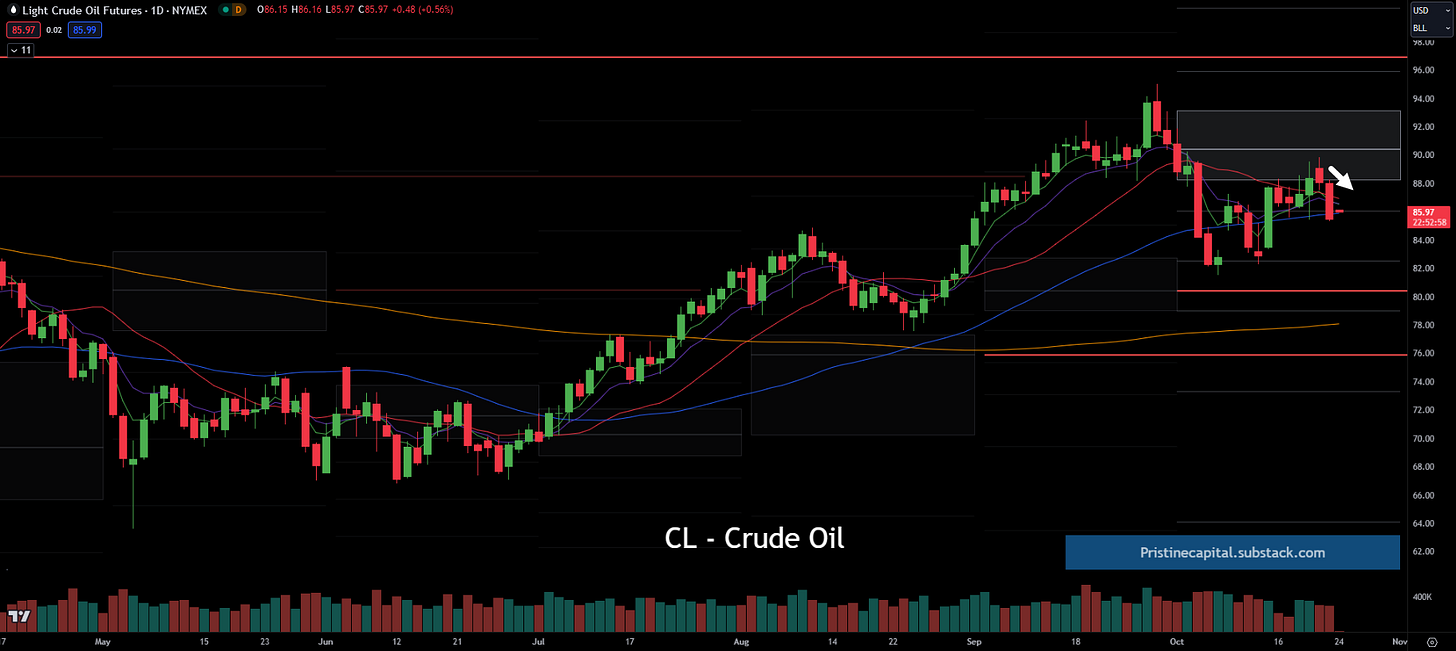

Crude oil rejected out of the monthly value area and is trading at $86/barrel. A tame energy market is another BULLISH DIVERGENCE 🐂

Equity Dashboard

Equities finished with only 29.0% advancers. Volatility DECLINED ✔️

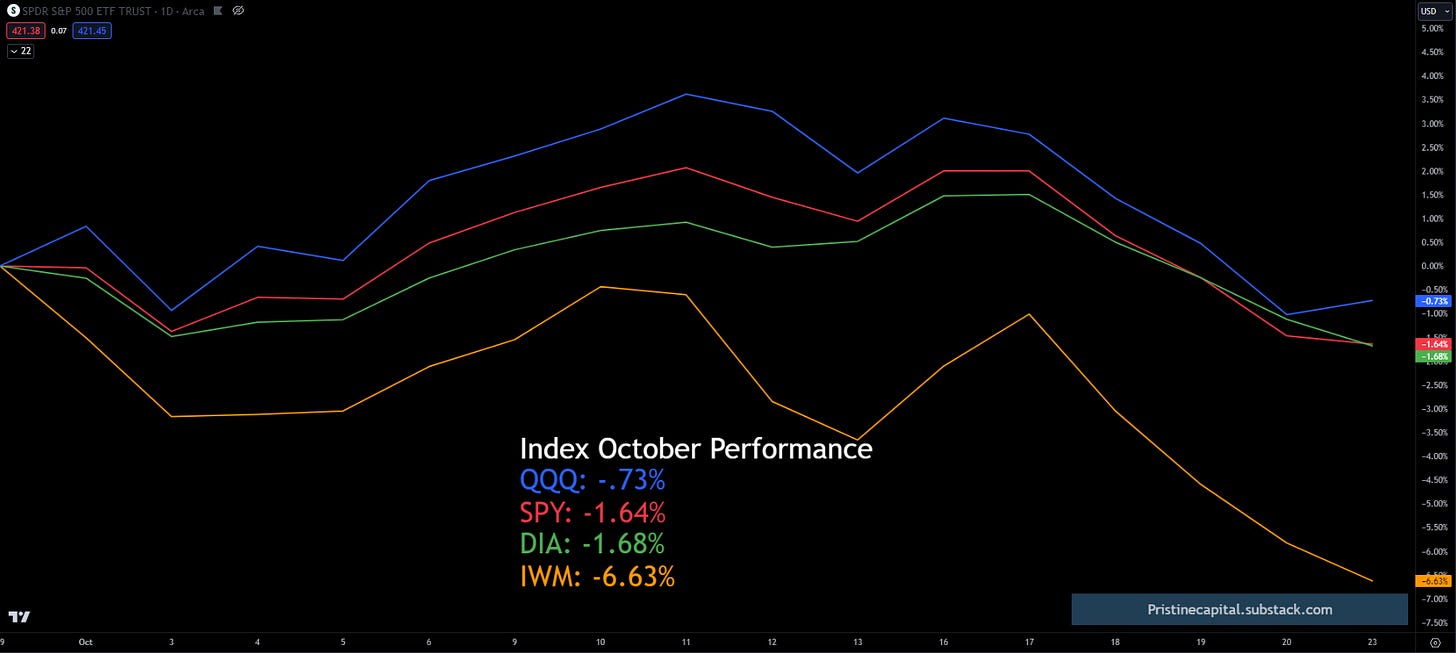

Equity Index October Performance

0 out of 4 tracked indices are in positive territory MTD. The IWM small cap underperformance is extreme. Barring the end of the world, looking for a bounce in small caps.

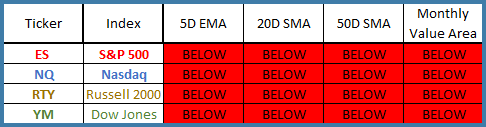

Index Price Cycle Monitor

Indices are trading below their short-term moving averages 👇

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities