Pristine Market Analysis & Watchlist 12.6

📈The market uptrend is under pressure

Nasdaq closes below the 20-day SMA

Trend model flips negative

Team,

We flagged some early warnings that the market tide could be turning over the last few sessions, and we are continuing to get more signs to be defensive. Defense wins championship! HAGE🍻

-Andrew

News/Economic Data

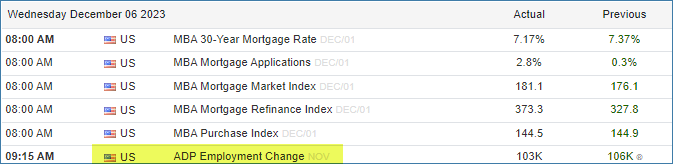

The ADP employment report came in lighter than expected 👇

Yield Curve Flattening

The slowing economic data combined with the lighter inflation data has put significant downward pressure on bond yields. They’ve retraced back to levels from three months ago.

The TLT long-term treasury ETF was steadily trending higher, until the last two sessions, where the trend has turned parabolic👇

FX Market

The dollar index is bouncing sharply, and has reclaimed the 20-day SMA.

Energy

Crude oil is now trading below $70/barrel! This is another trend that has accelerated over the last few days.

The price action in bonds, the dollar, and energy is starting to become extreme, and it makes me wonder if the market is pricing in a risk-off event on the horizon. I am glad that I closed some trades out a few days ago for this reason.

Equity Dashboard

The Nasdaq led today’s minor pullback in equities👇

Index Price Cycle Monitor

Beginning to see more red on the price cycle monitor.

Index Performance Monthly

Two out of four tracked indices are in negative territory for the month👇

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - Our trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities