Pristine Market Analysis & Watchlist - 1/17

US PPI Incoming

Good evening everyone,

A choppy day on the surface of the S&P 500, but a much deeper story unfolded under the hood.

We have a ton to cover tonight, so buckle up!

-Andrew

Economic Data

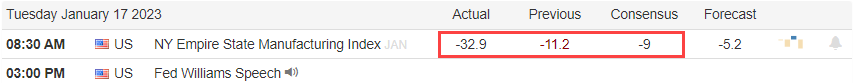

The day’s events kicked off with the NY Empire State Manufacturing Index:

The number came in significantly below expectations, and was the fifth worst contraction in the history of the dataset!

I’d normally expect such weak manufacturing data to lead to a weak dollar index as traders price out future rate hikes, and a rally in long-term bonds on the prospect of a weaker economy, but the dollar was shockingly resilient:

FX

The USD dollar index finished the session flat +0.00%:

Perhaps it is because most players are already short the dollar 👀

10YR Treasury

Despite the weak US data, the 10yr treasury future ZN_F sold off! This is important because every big rally we’ve seen in high-growth stocks has coincided with a rally in the 10yr treasury futures. Declines in the 10yr treasury futures have often preceded selloffs in equities:

Equity Dashboard

45.6% UVOL - Breadth was mixed!

Volatility across all tracked indices moved significantly higher 🚩

Finviz Heatmap

Overall this heatmap looks…mehhhh

A few names TSLA NVDA AAPL carried the S&P 500 SPY today:

S&P 500 ES_F Price Analysis

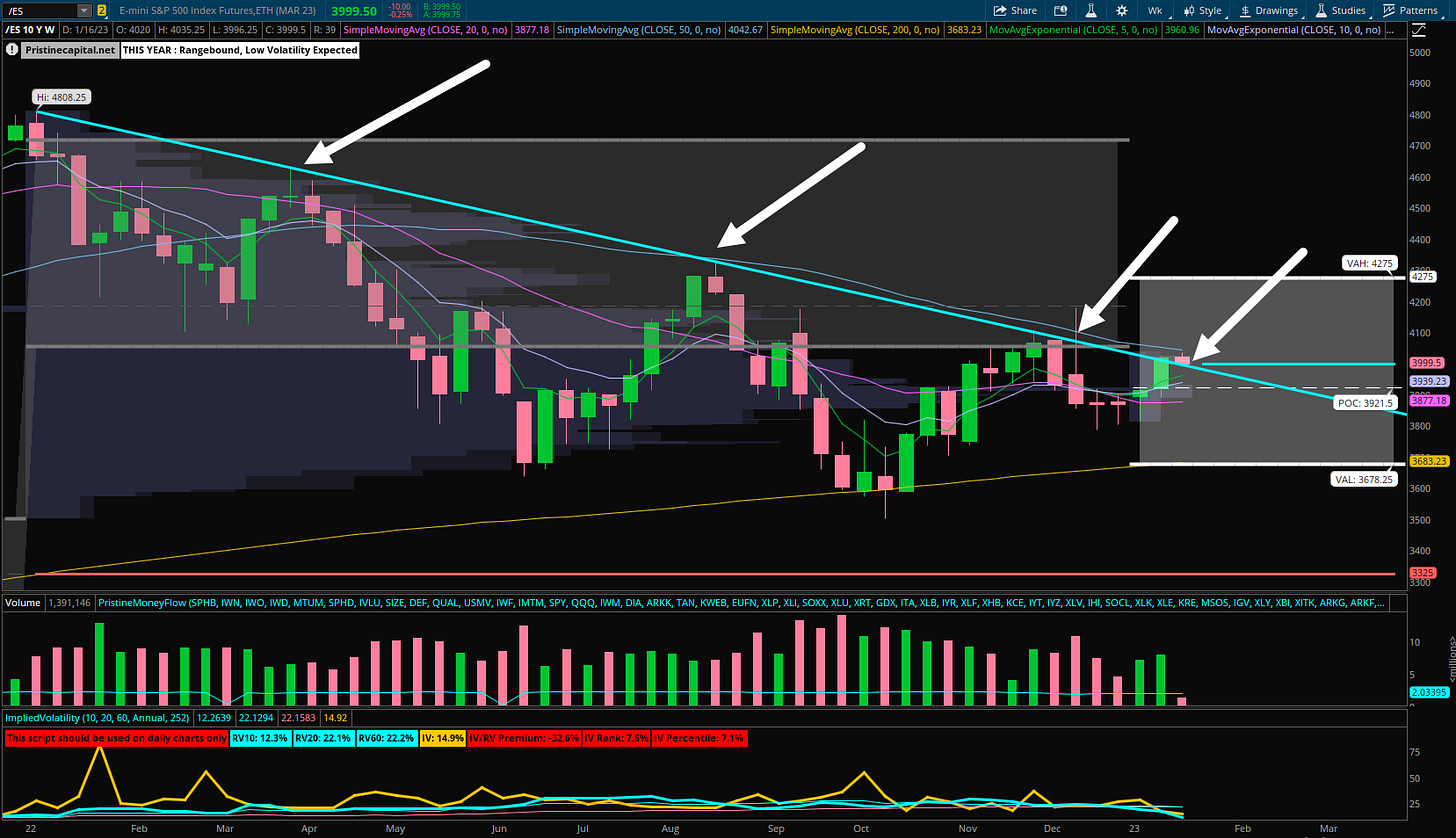

The S&P 500 finished the session -.18%, and once again…. RIGHT ON TOP OF THE TEAL DOWNWARD TRENDLINE! Bulls and bears are playing a game of chicken. No one wants to miss the breakout, but not one wants to buy the top either!

S&P 500 ES_F Breaking out of Value?

Breakout or fakeout? All it would take is one day of bullish/bearish price action to completely change this technical picture. Upgrade your subscription to see how I am approaching this situation:

Nasdaq NQ_F Price Action Analysis

The Nasdaq finished today’s session +.20%, but we are trading up to overhead supply:

With earnings season kicking off, most of the megacap tech stocks that comprise the Nasdaq will be reporting earnings in the next few weeks, so it is tough to get too opinionated on them at this moment.

Crude Oil CL_F Price Action Analysis

Put this in the category of things that should not be happening if inflation is completely behind us. In my estimation we are about one green candle away from this becoming a concern for investors that have gone all-in on the inflation victory thesis:

Sectors - Ranked by Momentum

BLOK remains in the top momentum slot

Profit taking in KWEB China tech, which was one of the original leaders for this rally

Earnings on Tap

I will be covering all of these reports and reactions in Discord

Key Takeaways

US manufacturing is softening

Crude oil is breaking out of the monthly value area

Leading groups are being sold in exchange for prior laggards

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅ One of my proprietary risk models and the signal it is sending

✅Market Strategy - My trading plan post-CPI

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities