Pristine Market Analysis & Watchlist 9/5

The Megacap Safety Trade

Team,

Breadth is deteriorating under the surface! Let’s discuss…

-Andrew

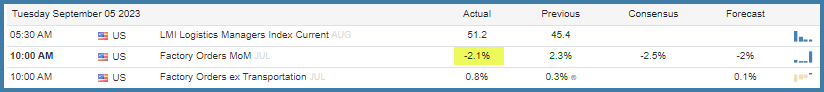

Overnight/Economic Data

US Factory Orders MoM came out negative, but slightly better than expected.

But the REAL news this morning was as follows:

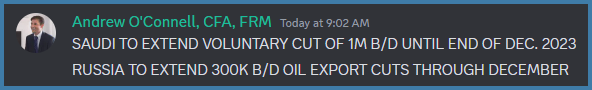

With news of oil production cuts hitting the tape, we saw crude oil rally and close at $86.83/barrel.

And long-term treasuries got absolutely smoked toward the low end of the recent range.

The DXY dollar index closed toward the high of the day.

We are approaching max pain for the BOJ, and they will likely intervene if the dollar gains more strength from these levels.

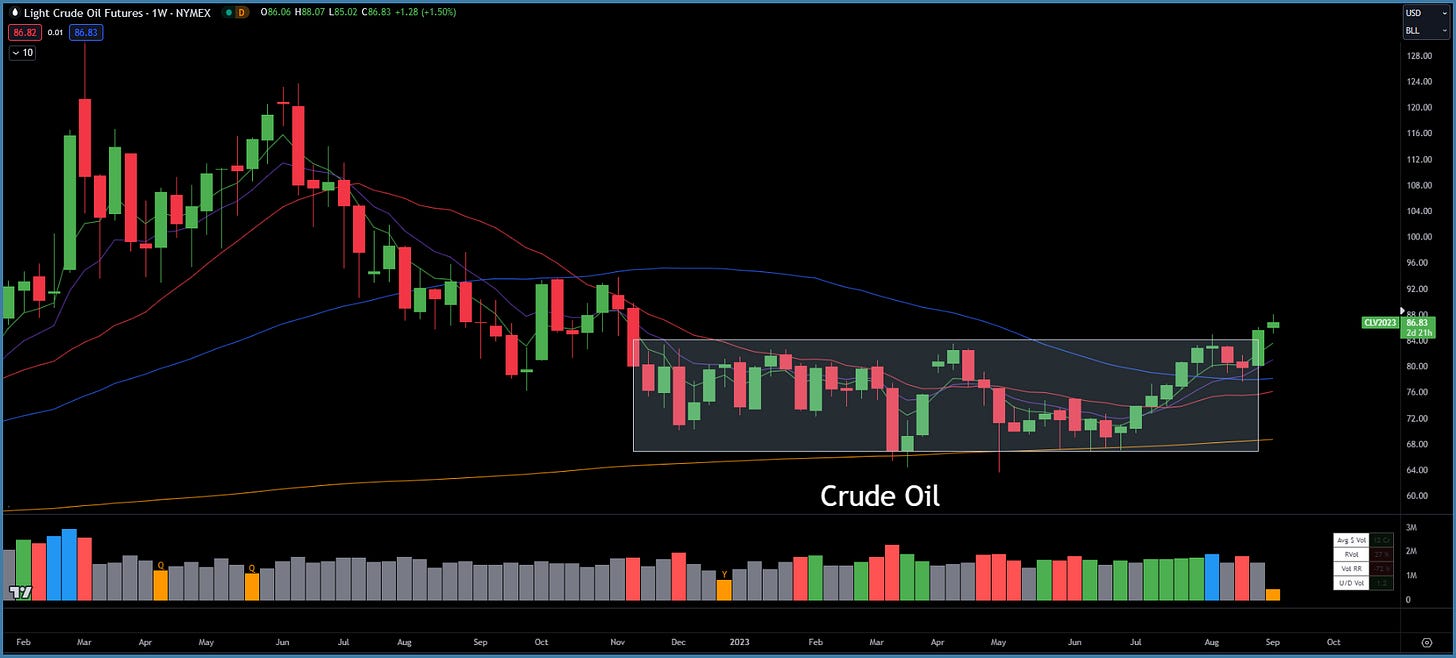

Equity Dashboard

Stark contrast between small caps and megacaps today in equity land.

Can MSFT and TSLA hold the market up? It doesn’t seem likely. We need increased participation!

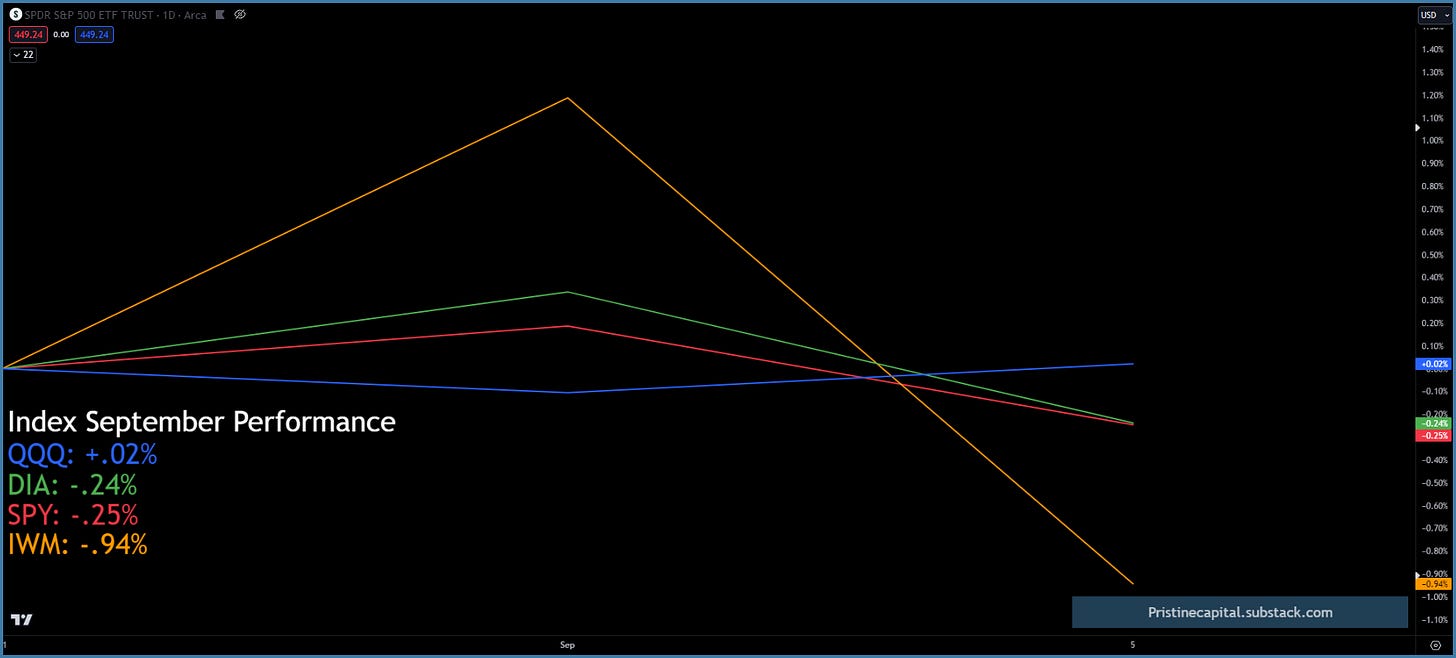

Equity Index MTD September Performance

The QQQ is the only index in positive territory so far for September.

Index Price Cycle Monitor

We have new monthly value areas for September!

ES S&P 500 - Testing the 50-day SMA

NQ Nasdaq - Above key moving averages

YM Dow Jones - Below key moving averages

RTY Russell 2000 - Below key moving averages

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities