Pristine Market Analysis & Watchlist - 12/29

Tech Liquidations Finally Over?

Good evening everyone,

I am overwhelmed by the early support for this newsletter! If you are reading this, know that I am grateful to be able to share my passion with you!🙏

Okay, enough being mushy😂

We have a lot to cover tonight, so let’s dive in!

Market Dashboard

91.2% UVOL - Strong market breadth 🦾

Green price action across all indices with bonds bid and the dollar index sold

Declining volatility

Night and day difference from yesterday’s dashboard 👍

S&P 500 ES_F Price Action Analysis

Bullish engulfing candle after yesterday’s vicious selloff

Reclaimed the monthly value area low 3826.25

Reclaimed the 5-day EMA

Still chopping around in a tight two-week range

So long as we trade below value, we must remain open to a test of the 3699.75 VPOC(see what I did there?) 😉

Finviz Heatmap

Megacap tech stocks TSLA AAPL MSFT META had powerful bounces after being liquidated into year-end

AAPL Providing A Valuable Market Clue

Context: We noted in prior newsletters that investment managers were likely under pressure into year-end, and were forced to sell off their most liquid, megacap tech stocks as a result. Yesterday’s auction was an absolute puke, creating an extended range red candle and a finish on the lows! 🤮

Today’s candle was a prime example of ‘when what should happen, does not’. AAPL had every reason to continue it’s downtrend toward the VPOC at ~121.27, but instead, it gapped significantly higher, and advanced throughout the session.

This signals to me that the worst of the tech puke is likely behind us, and that today was likely the beginning of the substantial bounce in technology stocks mentioned in last night’s newsletter.

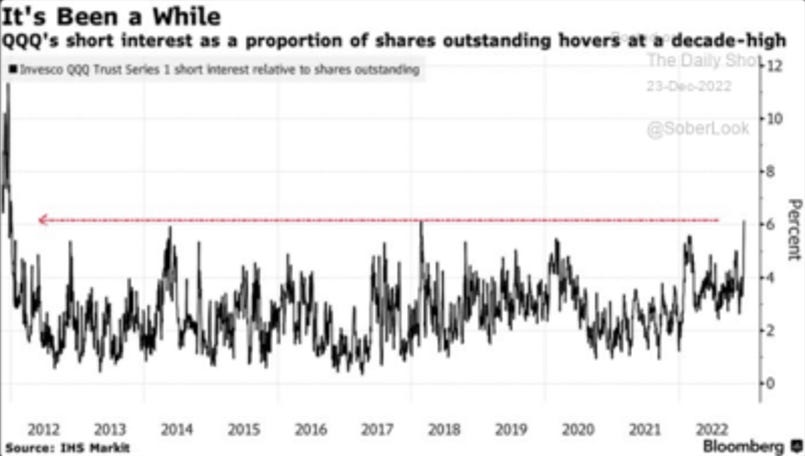

Nasdaq QQQ Short Interest

Even after today’s bounce, there is still likely a record level of short interest in Nasdaq!

Do not assume that you missed the entire move if you did not participate in today’s tech rally

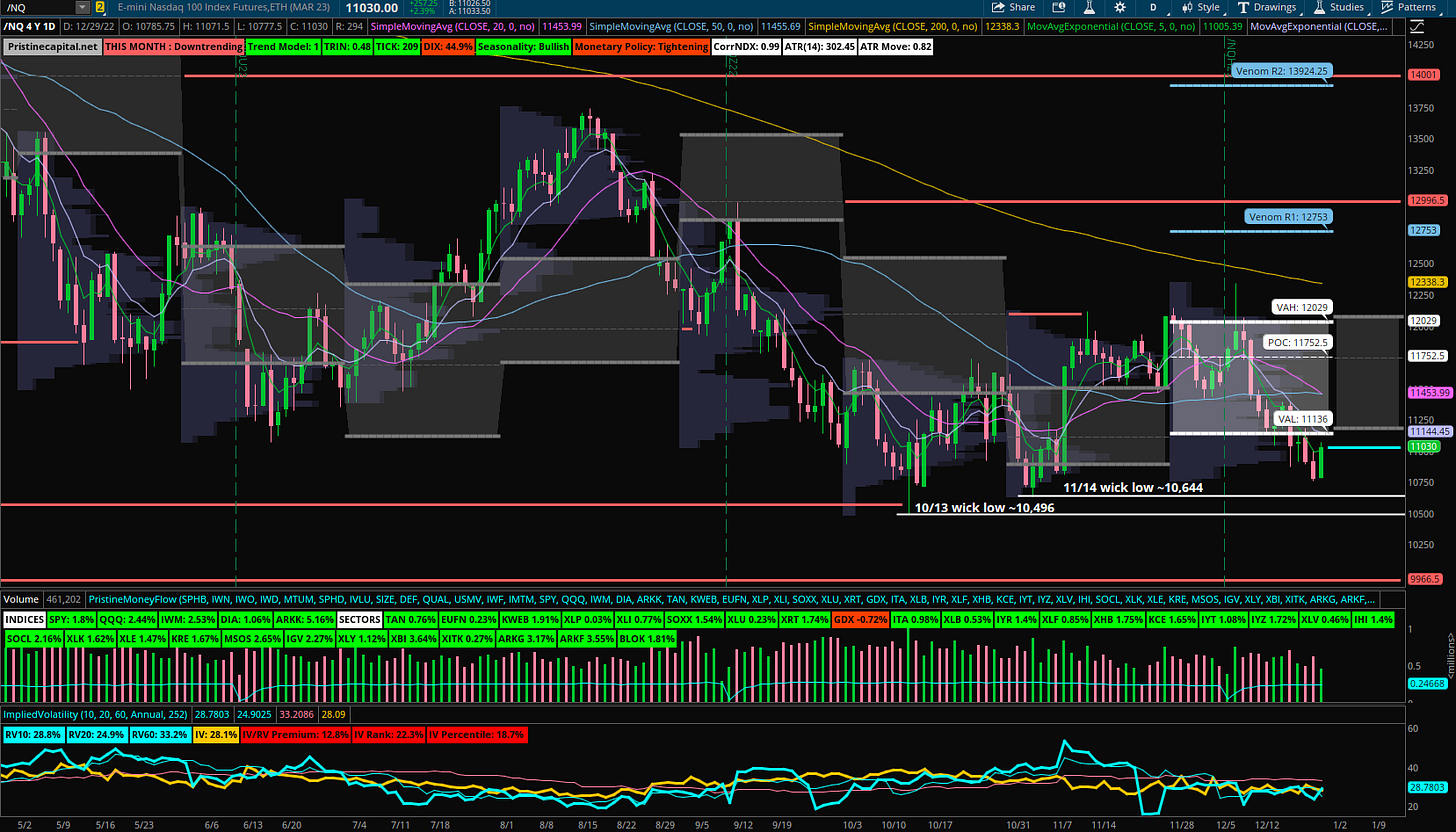

Nasdaq NQ_F Price Action Analysis

Bullish engulfing of yesterday’s capitulatory candle

Reclaimed the 5-day EMA

Price failed to revisit the prior lows from 11/14 and 10/13 🚨🚨🚨

Sectors - Ranked by Momentum

Bounce in the most highly speculative market groups ARKK XBI MSOS

Key Themes

The S&P 500 reclaimed technical support

The megacap bounce trade could be underway

Tomorrow is the final trading session of 2022! Use this as an opportunity to clear out any old positions that may be weighing your portfolio down, and position yourself for the first session of the NEW trading year!

Holiday Trading Schedule

With this being the final trading week of the year, it makes sense to reduce screen time to primarily the first and last hour of the trading session, and use the rest of the day to do post-trade analysis and prep for a successful 2023!

If you have not yet checked out our Path to Victory Trading Calculator, I highly recommend doing so to map out a game plan for the new year:

Pristinecapital.net/tools

Spotlight Trade

Consider subscribing to the paid version of the newsletter for actionable trade ideas like the above! We added a position in this stock on the open today.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Access - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅ Trading Account Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the highest reward/risk opportunities