Pristine Capital Long-Term Investing Program

Target Retirement Portfolios Designed to Help You Build a Better Future

Hi Team,

In this post, I am going to share my long-term investing philosophy with you, as well as the hand-crafted Pristine Target Date Portfolio Lineup!

Inspiration

I began my professional career working as a series 7/63 licensed Brokerage Investment Professional at the Vanguard Group, which is world’s largest mutual fund company. I had the opportunity to chat with retail clients of all levels, help them construct portfolios using the Vanguard methodology, and prepare them for retirement! Below are the key ingredients behind the strategy that has led millions of investors to the promised land since the 1970’s:

The Methodology

Dollar Cost Average

Set aside a percentage of your paycheck that is automatically transferred from your bank account into your investment accounts every month. This money will be used to buy more assets, regardless of if the market moved up, down, or sideways!

Time in the Market, not Timing the Market!

The vast majority of investors will epically fail at attempting to time the market! The goal is to take advantage of the long-term trend of risk assets, which is up and to the right!

By investing consistently into the market, you will likely outperform most investors that attempt to time their buys perfectly, and can earn respectable investment returns over a long time horizon, with little-to-no effort!

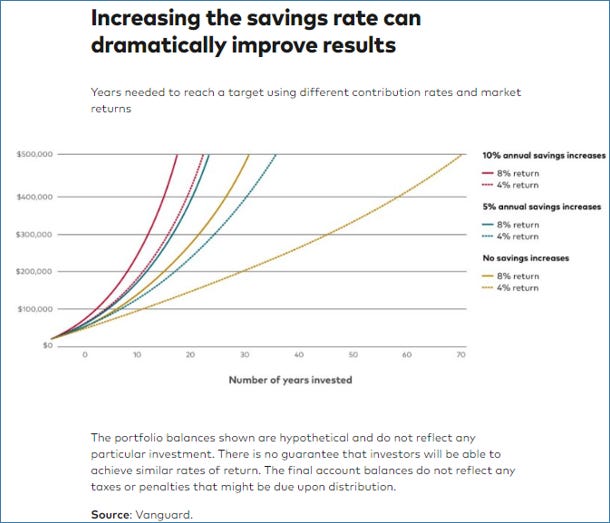

If your goal is to accelerate your wealth creation journey, the most powerful action you can take is SAVING MORE MONEY.

With this said, there is no free lunch. In exchange for earning investment returns over long time periods, one must be willing to endure market volatility.

The Problem

The Vanguard Target Retirement Date portfolios, as well as every other target retirement date portfolio I’ve ever come across, are not truly diversified. The traditional stock/bond portfolio is outdated for a few reasons:

Stocks and bonds are marketed as being inversely correlated, which should protect investors in times of market stress. This is not always the case anymore, as central banks use bond buying programs (which boost the price of bonds), as a means to inflate stock market prices, leading to higher correlations between these two asset classes.

Stocks and bonds are important portfolio building blocks, but what about commodities? What about precious metals? What about TIPS? What about cryptocurrency?

Why limit yourself to ETF’s from one fund provider, when you can hand-pick the best ETFs from multiple providers?