📊 NVDA Earnings Incoming!

Pristine Weekend Watchlist

ANNOUNCEMENT: We are launching our Pristine Tradingview Indicators when I return from my honeymoon (to prevent users from signing up and being unable to access the tools until I return). I’ll be out of office from 5/30 - 6/6. I appreciate all the support! Best wishes to you and your families 🙏

- Andrew

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this note, we’ll cover the following topics to prep for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

Style Factor YTD Performance

The Momentum style factor led the 2023 & 2024 bull market, and is leading in 2025!👇

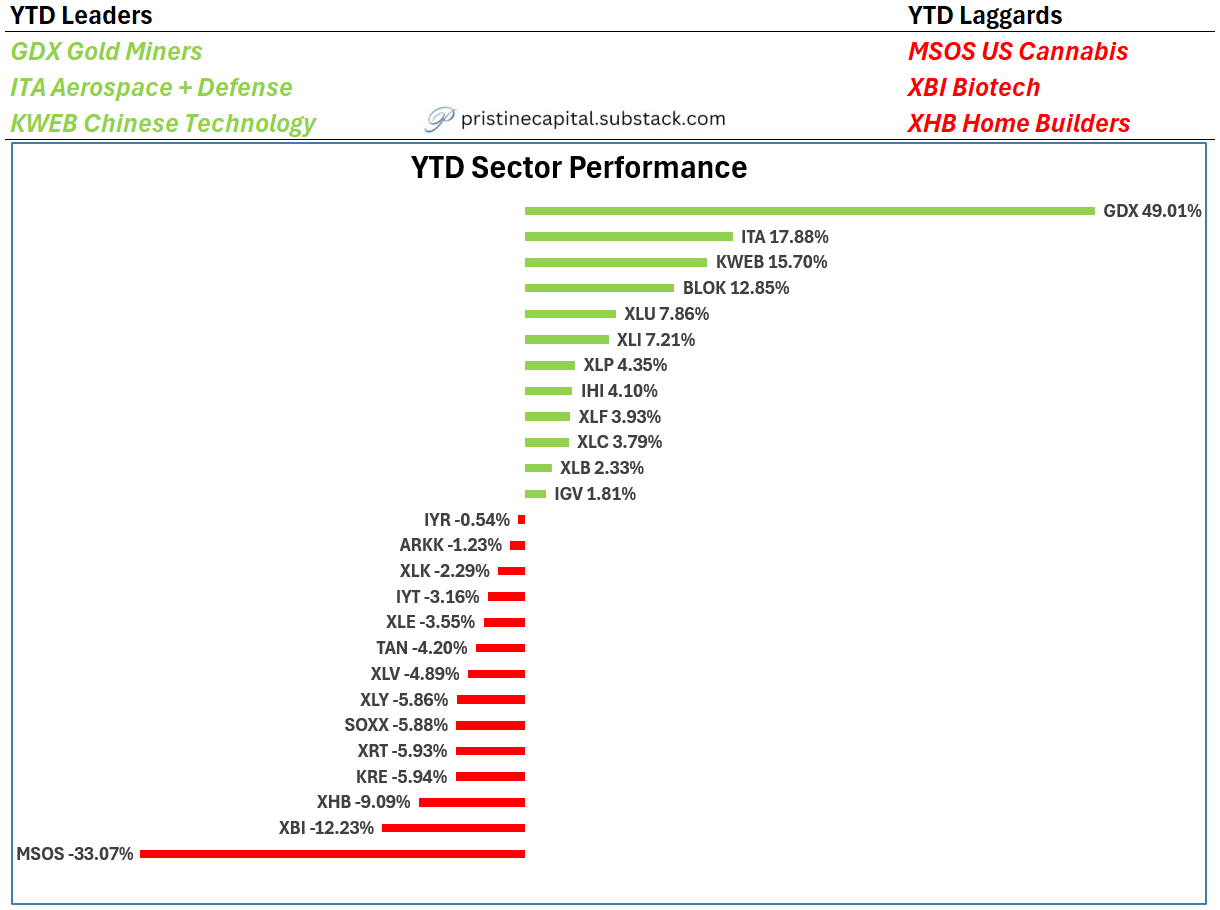

YTD Sector Performance

GDX & ITA leading → Investors have clearly put money to work, but they are doing so in defensive areas 👇

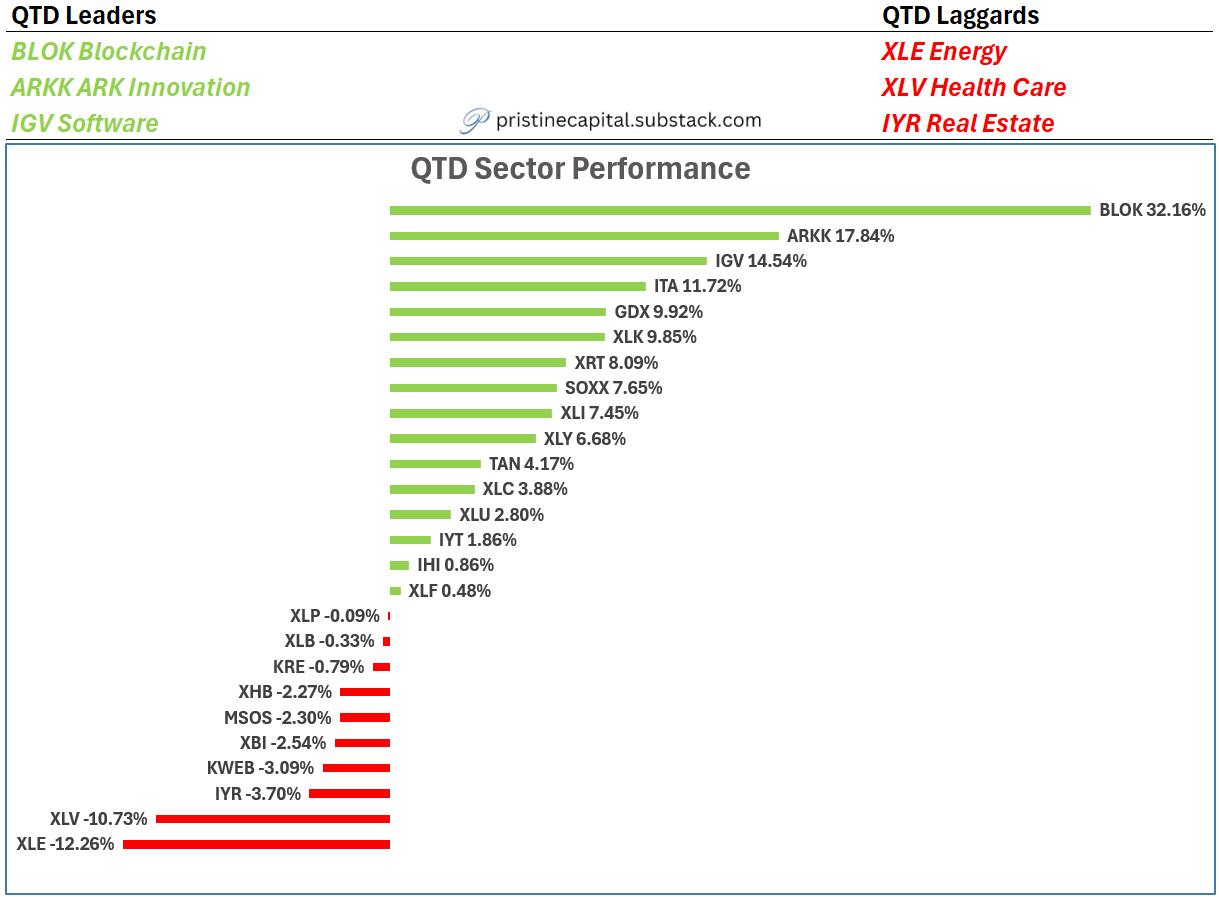

QTD Sector Performance

BLOK blockchain the clear leader in Q2 👇

1-Month Sector Performance

SOXX semiconductors are rallying hard into NVDA earnings 5/28 👇

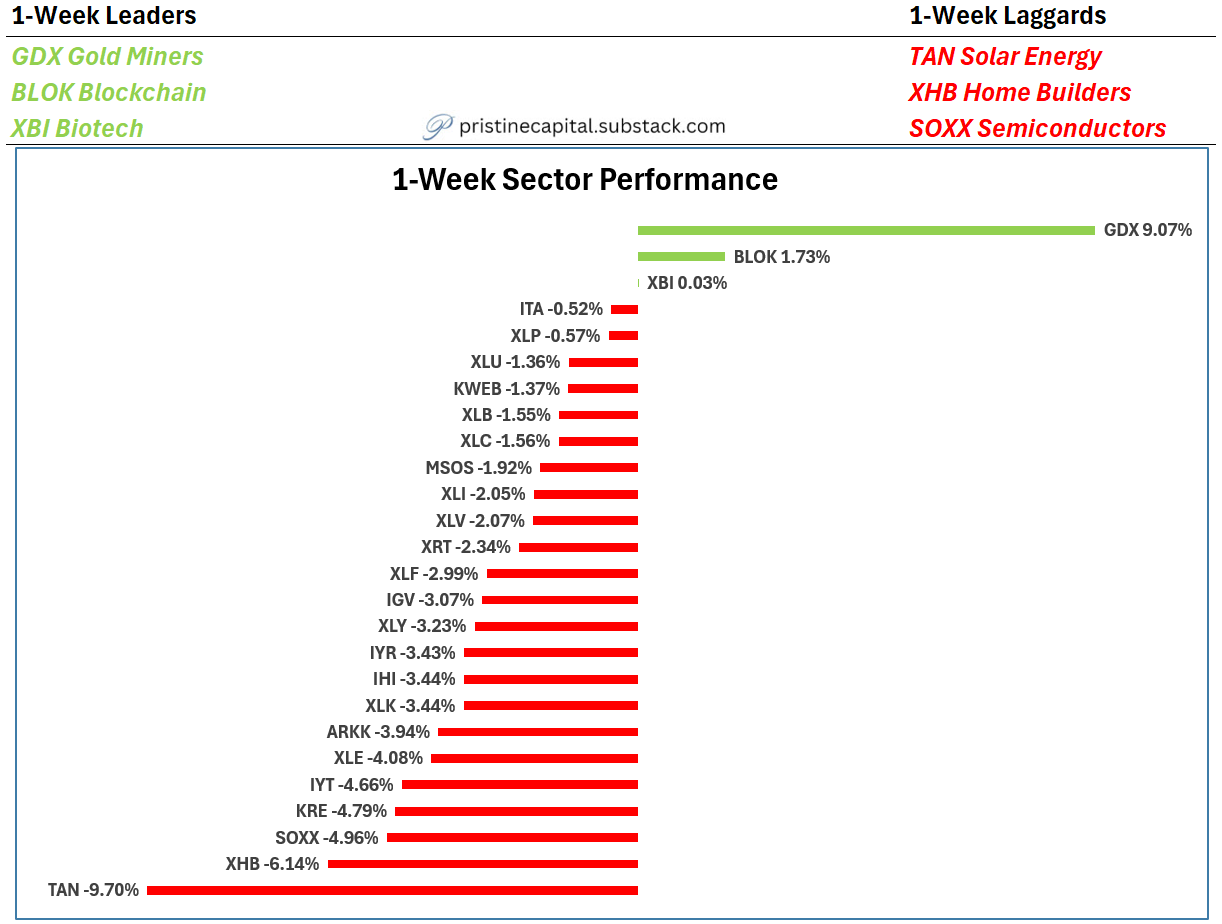

1-Week Sector Performance

Risk-off action last week 👇

Below, we’ll share our key ideas for the week ahead, assess market price action, and share three trade setups.

All that and more, just scroll down.