📊 NVDA Earnings Incoming!

Pristine Weekend Watchlist 11.17.24

Hi Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

If you’ve been enjoying our free content, and are committed to putting in the work to make 2024 your best trading year yet, consider upgrading your membership and becoming a premium subscriber.

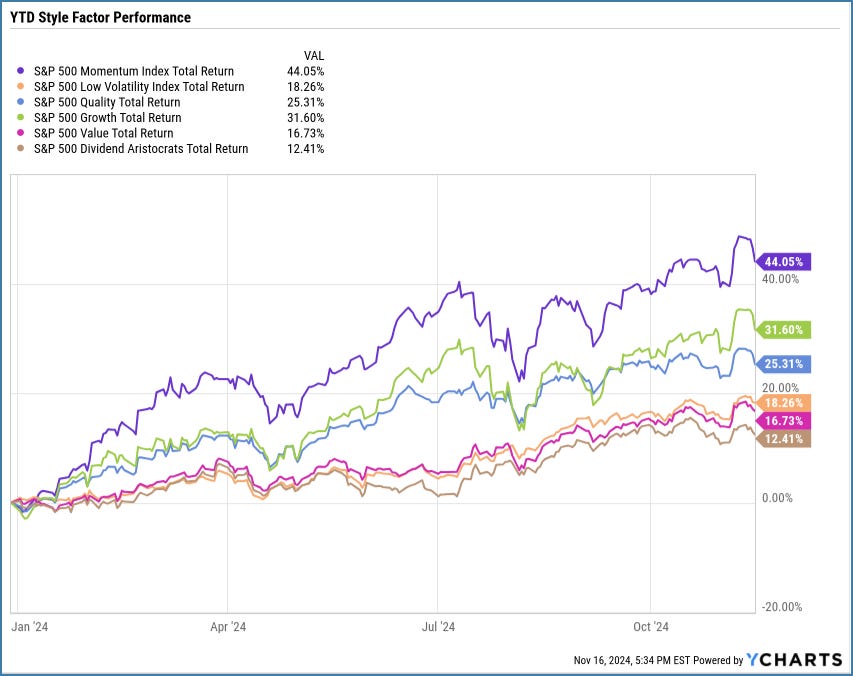

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

Style Factor YTD Performance

Minor correction in all style factors

For context, the S&P 500 momentum index has performance data going back to 2016, and this year’s return is the by far the highest on record! Zooming out to the big picture, 2024 has been a fantastic year for momentum trading👇

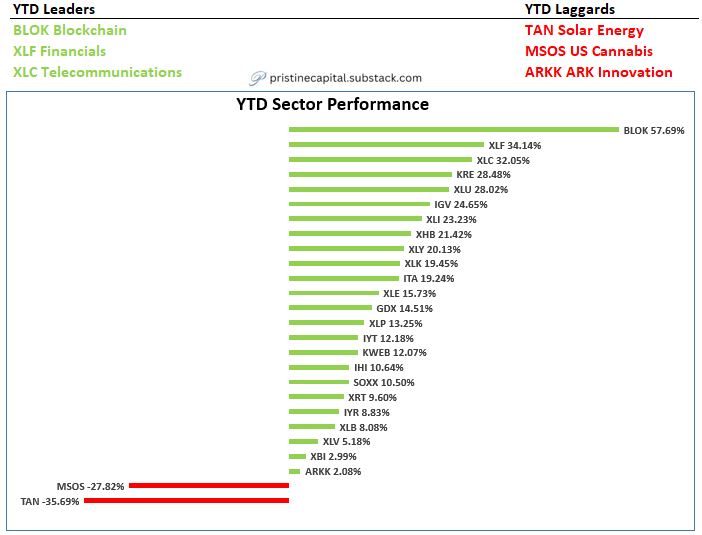

YTD Sector Performance

BLOK blockchain emerged as the #1 YTD group by a landslide. The market is signaling that monetary debasement is coming.

MSOS cannabis and TAN solar are YTD laggards as these are widely considered Kamala and/or democratic presidential trades 👇

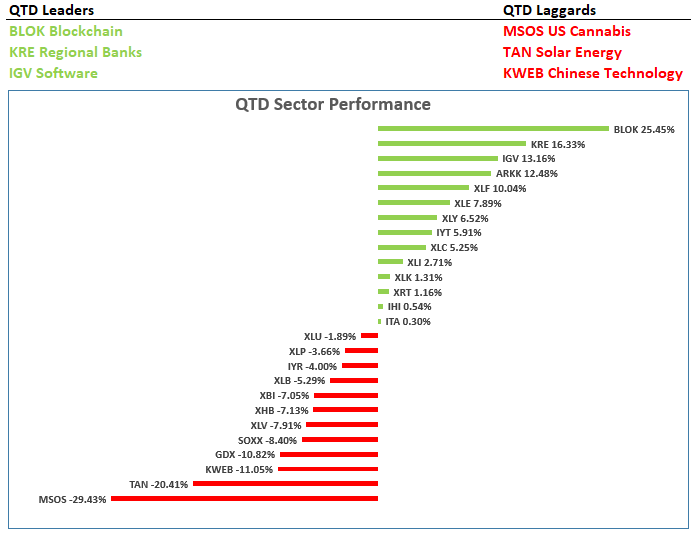

QTD Sector Performance

KRE regional banks are the #2 ranked group this quarter despite the rise in interest rates. Perhaps the market believes that this interest rate move is temporary 👇

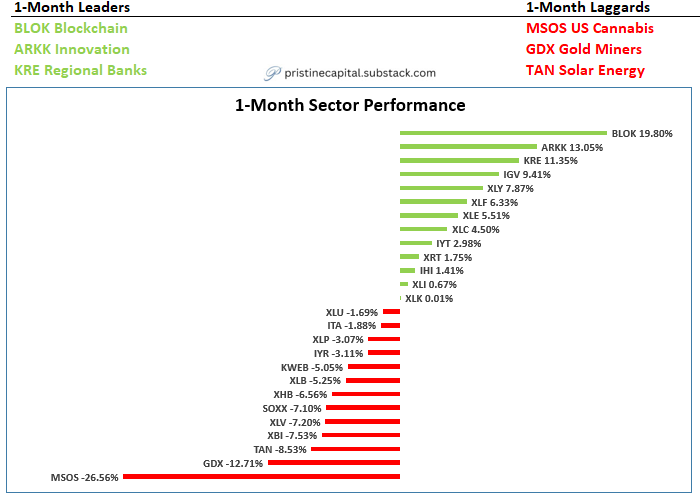

1-Month Sector Performance

ARKK innovation is another group that tends to perform well during periods of monetary debasement and low inflation. Now in the #2 spot 👇

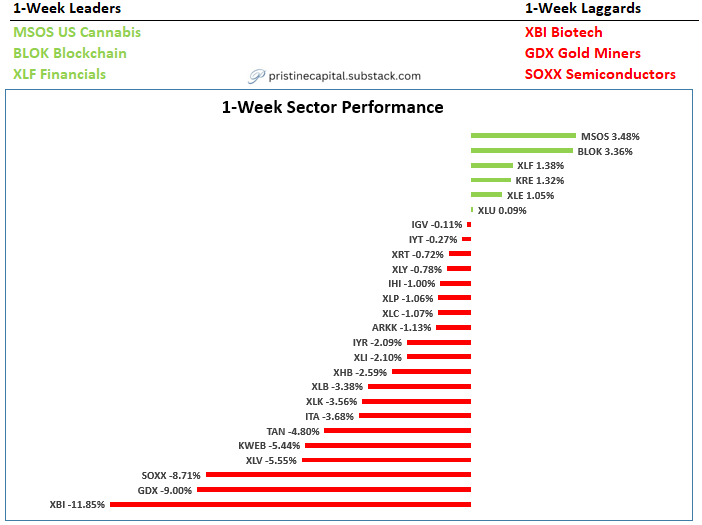

1-Week Sector Performance

MSOS cannabis showed signs of life last week. Mean reversion from the Trump victory crush 👇