📊 Navigating the US Presidential Election!

Pristine Weekend Watchlist 11.3.24

Hi Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

If you’ve been enjoying our free content, and are committed to putting in the work to make 2024 your best trading year yet, consider upgrading your membership and becoming a premium subscriber.

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

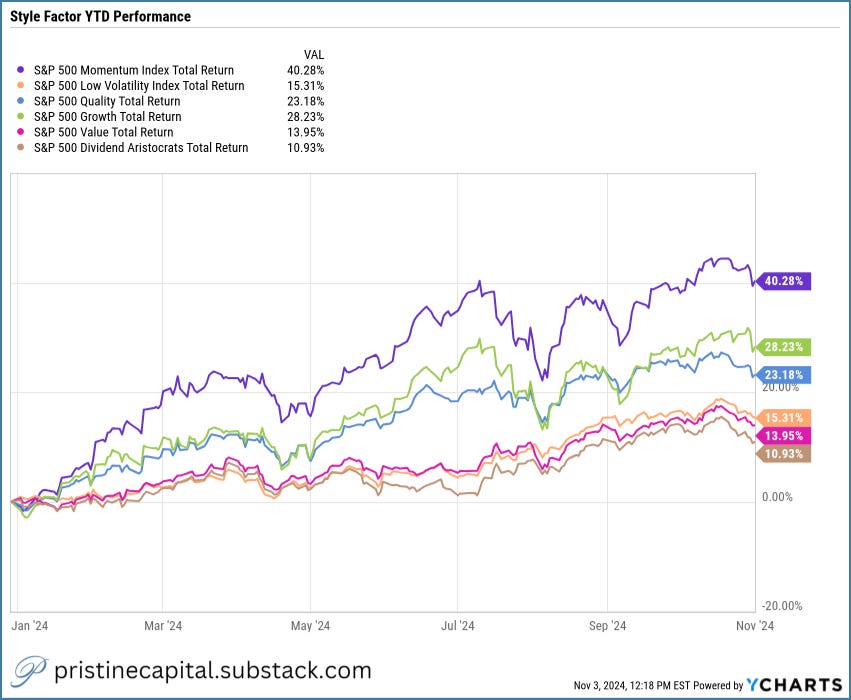

Style Factor YTD Performance

A pullback in the momentum style factor ahead of the US election 👇

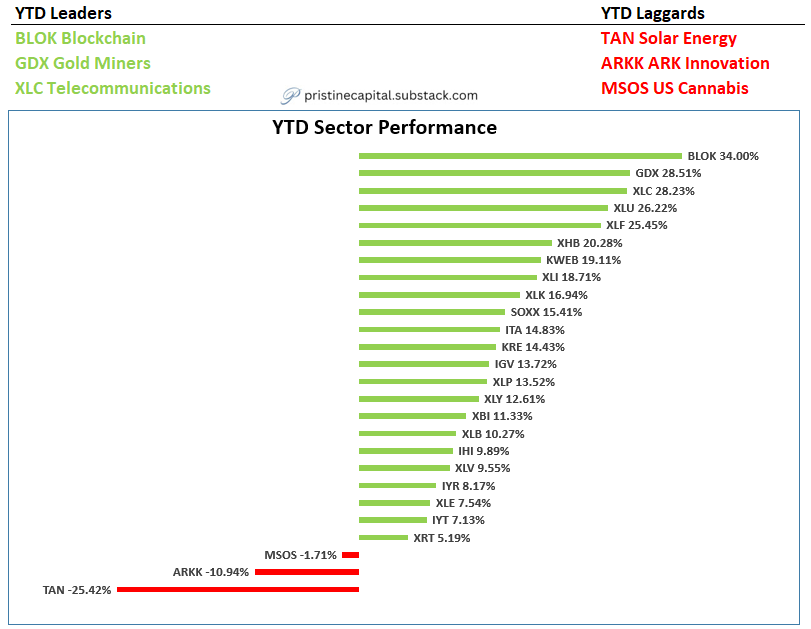

YTD Sector Performance

BLOK blockchain & GDX gold miners are our 2024 leaders. These groups tend to function as safe havens and/or hedges against fiat currency debasement. Curious to see if investors rotate out of these groups or double down post-election. TBD👇

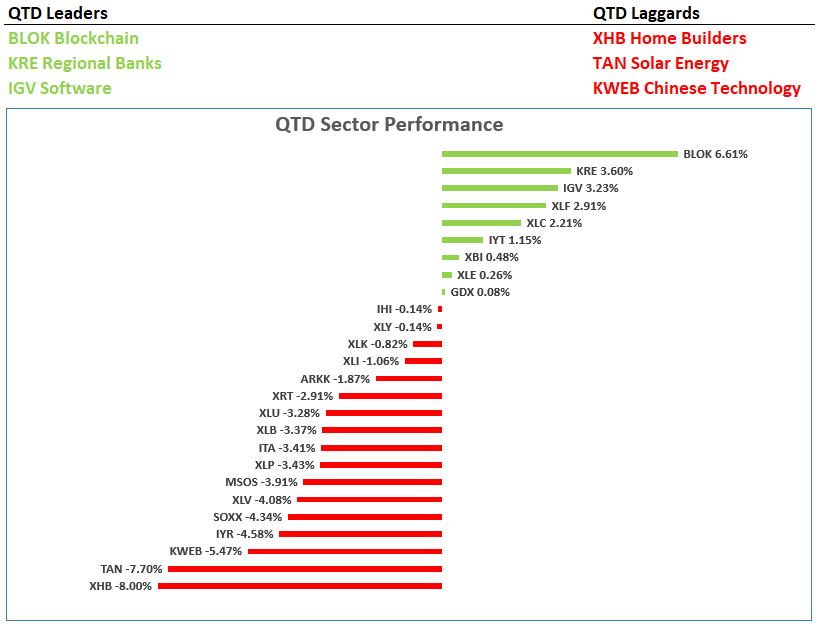

QTD Sector Performance

The market hasn’t exactly been red hot so far in Q4 as measured by the number of red sectors so far! 👇

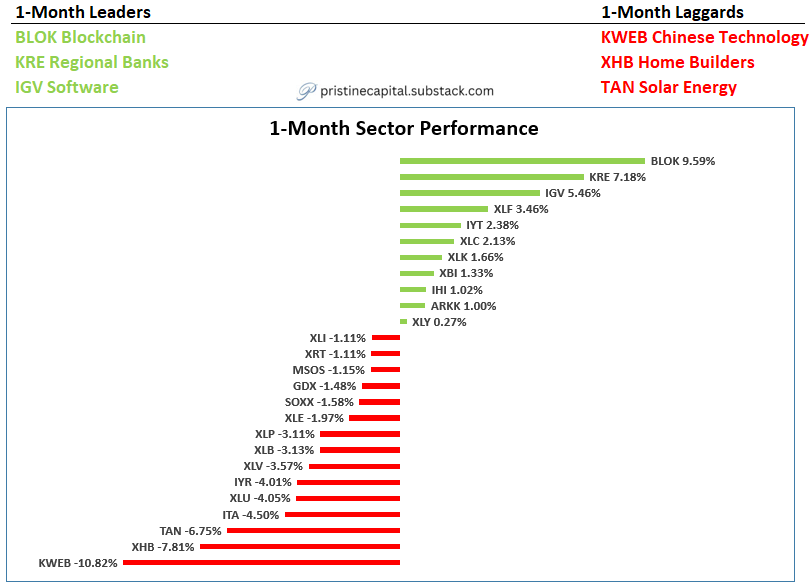

1-Month Sector Performance

KRE regional banks are outperforming despite the move higher in bond yields. If bond yields start declining post-election, this group could lead the market into the holiday season 👇

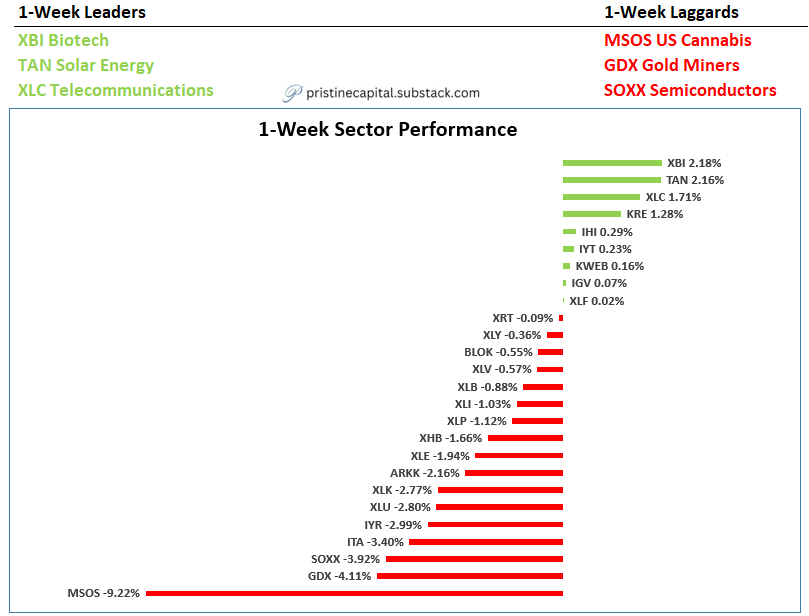

1-Week Sector Performance

XBI biotech and TAN solar led the week. Tough to make much out of this into the election 👇