🔥MSOS Earnings Season Incoming!

Pristine Market Analysis & Watchlist 8.5.25

Team,

Even while on vacation, I’m flooded with ideas to improve both the newsletter and our TradingView tools. Our goal is to build something timeless—a community of traders people can look back on years from now as a valuable source of insight and information.

More to come… for now…let’s take a look under the hood of the market. HAGE🍻

-Andrew

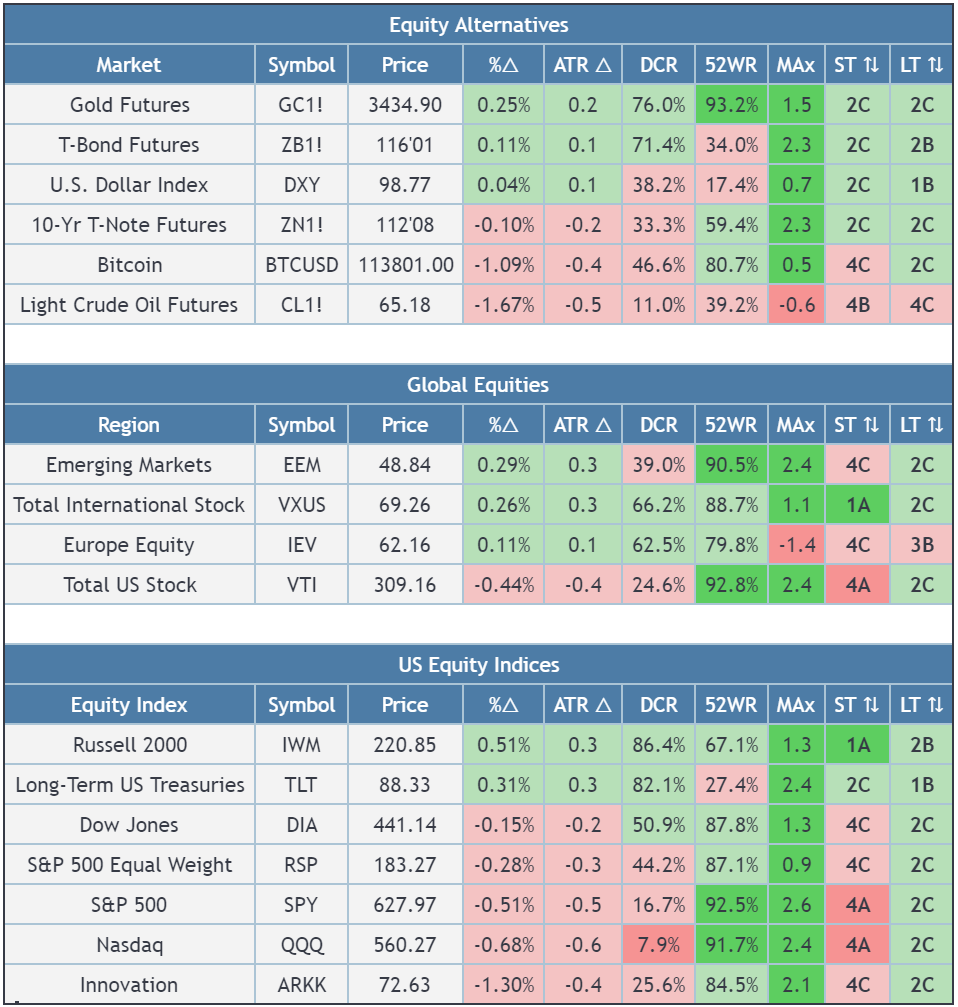

Market Update 📊

IWM Small caps outperforming as TLT long-term treasuries potentially bottomed on last week’s light jobs report and today’s weak ISM services report👇

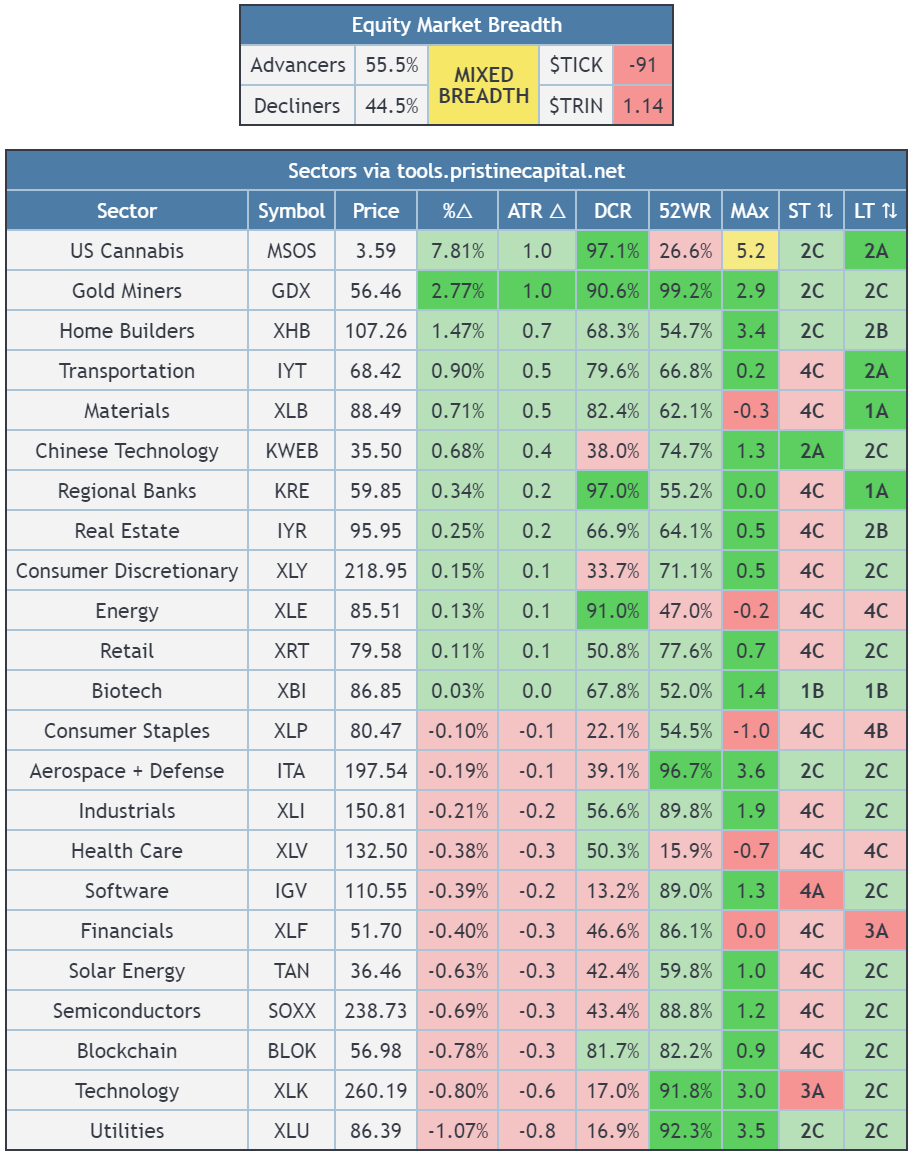

MSOS Cannabis stocks outperformed. It’s almost as if…cannabis is going to be rescheduled! LT Stage 2A breakout! 👇

Index YTD Price Returns 📈

Portfolio progress is highly dependent on the market environment

The best index is up less than 10% YTD! If you are hanging tough, you are still in the fight! 👇

News Flow🌎

Pristine TradingView Indicators ⚙️

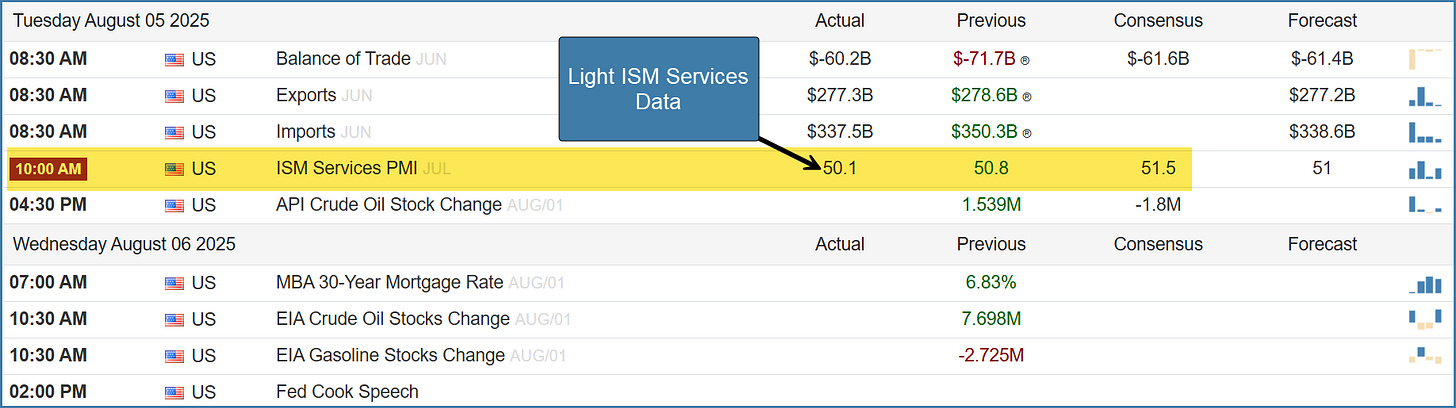

Economic Calendar - Weak ISM Services!🌎

ISM Services Breakdown: >50 = Expansion & <50 = Contraction

Services make up a much larger share of the U.S. economy than manufacturing—so any weakness in the services sector deserves close attention 👇

US Investing Championship Record🏆

│2025 YTD (7/31): +10.49% │2024: +254.0% │2023: +103.5% │

Below we’ll assess this snapback rally, outline three trading setups, and more. Just scroll down…