📊 Melting Up Into The Election

Pristine Weekend Watchlist 10.20.24

Hi Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

If you’ve been enjoying our free content, and are committed to putting in the work to make 2024 your best trading year yet, consider upgrading your membership and becoming a premium subscriber.

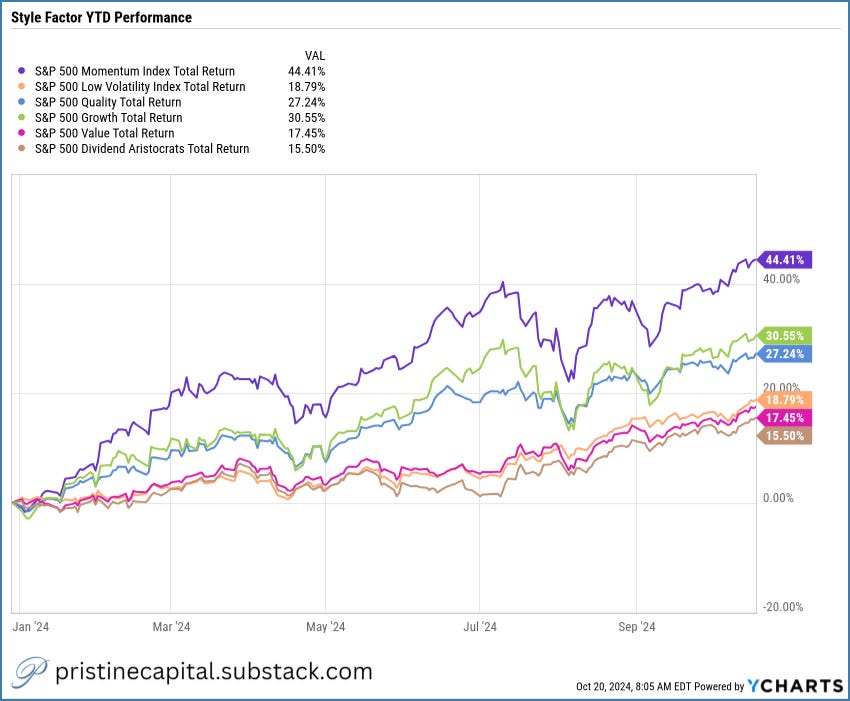

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

Style Factor YTD Performance

Momentum style factor NEW YTD high 👇

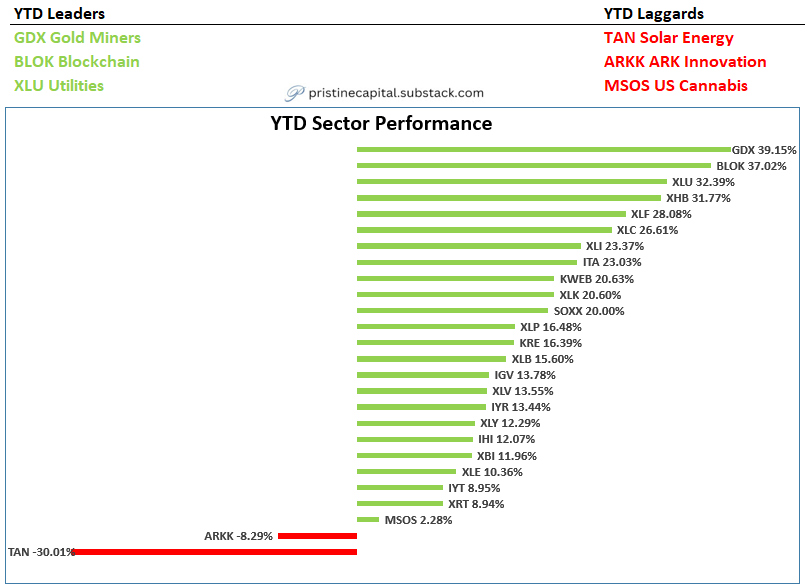

YTD Sector Performance

GDX gold miners and BLOK blockchain continue to lead our YTD scoreboard👇

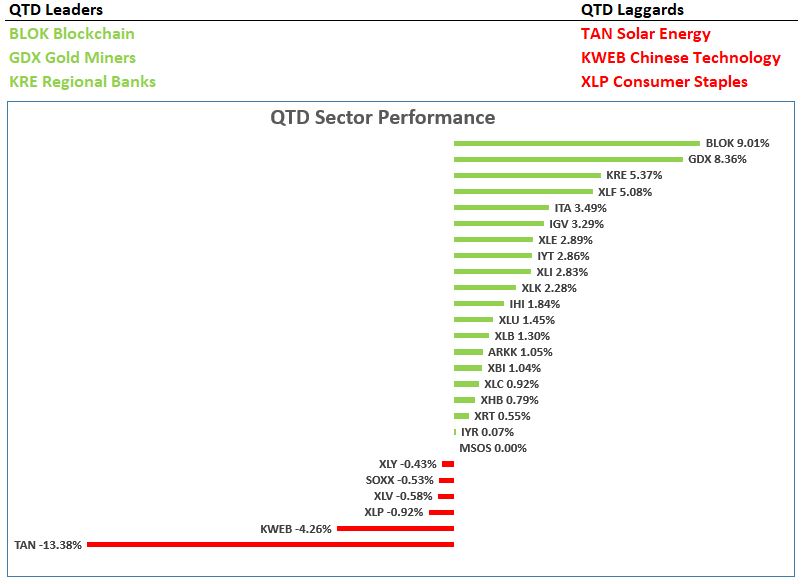

QTD Sector Performance

It appears that the market is pricing in global monetary easing/lower interest rates moving forward 👇

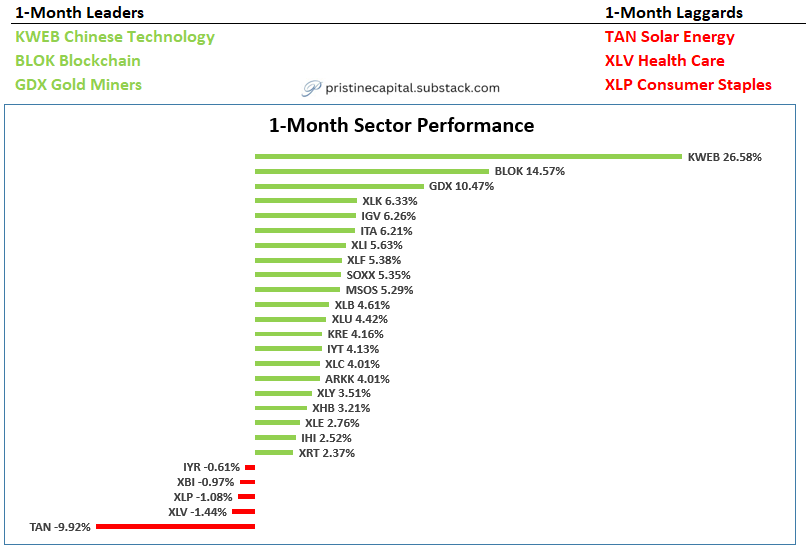

1-Month Sector Performance

KWEB China stocks exploded on stimulus news 9/23. We were beneficiaries of this explosion via BABA calls and common shares. Now with earnings season approaching, let’s see if these companies deliver the goods via quarterly results👇

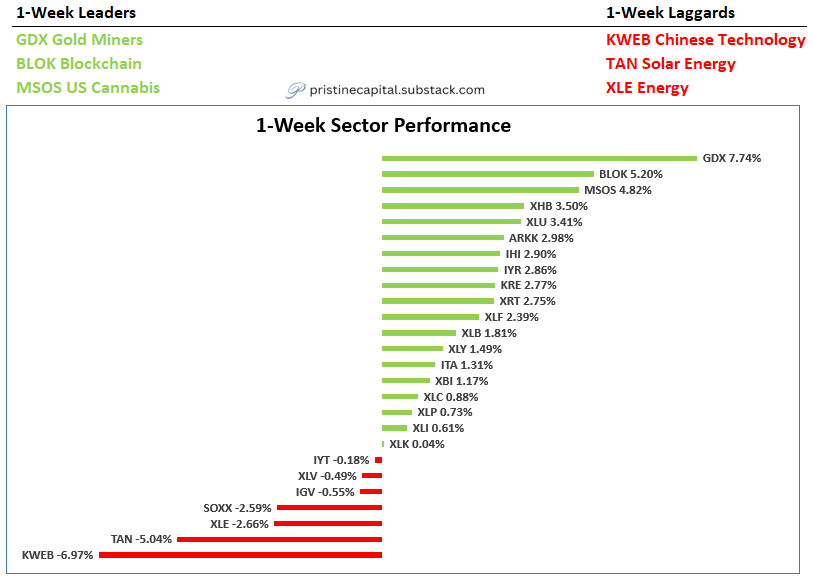

1-Week Sector Performance

MSOS cannabis stocks were a sneaky outperformer last week👇