Market Hits Pause ~ Looming Jobs Report

Pristine Market Analysis & Watchlist

Hey Everyone,

Overall, it was a cautious, slightly downbeat day on Wall Street, with traders mostly playing it safe ahead of tomorrow’s jobs data. The market’s recent momentum from tech stocks and strong earnings has hit a bit of a speed bump as everyone waits to see what’s next for the economy and U.S.-China relations.

-John (sitting in for Andrew this week).

Andrew is on his honeymoon and will return 6/6!

Market Update 📊

Equities and Indices - June 5, 2025

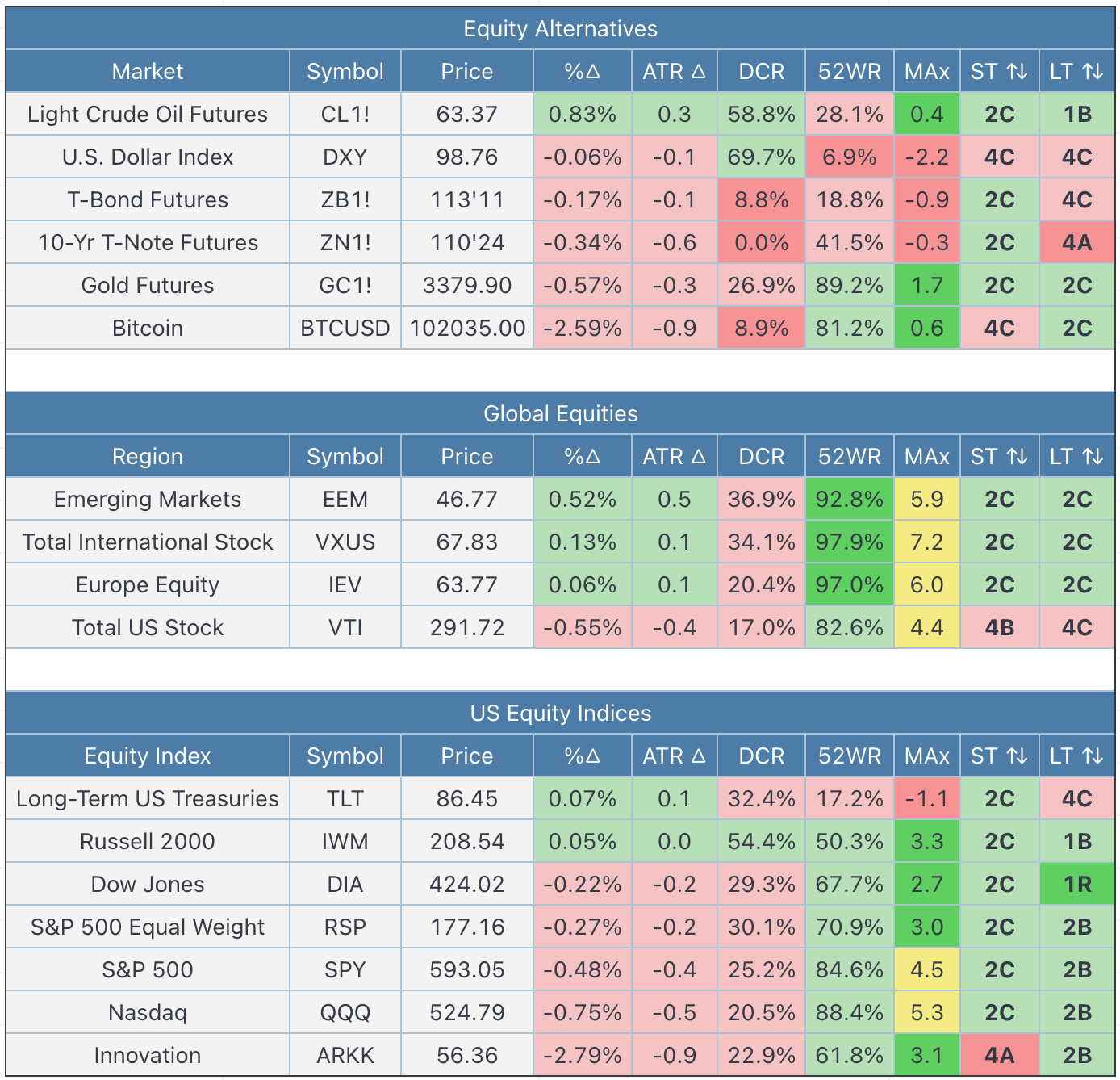

There is a mild risk-off tone across markets, with US equities and alternatives under pressure, while global equities—especially outside the US—show relative resilience.

Trend signals are mixed, with short-term trends generally more positive than long-term signals, suggesting potential for further consolidation or correction.

Breadth is Mixed, indicating a slight tilt toward weakness but not an overwhelming trend in either direction. Not much showing leadership today. Most sectors are either flat or under pressure, reflecting an uncertain and selective market environment 👇

Index Performance June 📈

Portfolio progress is highly dependent on the market environment

Russell 2000 (IWM) holding a slight lead month-to-date, up 1.7%! 👇

S&P 500, the only index up on the year! 👇

News & Econ Data🌎

Trade Tensions and Tariff Talks Dominate Market Sentiment

Markets remain volatile as investors closely watch ongoing trade negotiations between the U.S. and China. Recent phone calls between President Trump and President Xi have provided some hope, but uncertainty over tariffs continues to weigh on sentiment.

Technology Sector Remains a Bright Spot Amid Choppy Action

Despite broader market indecision, technology stocks—especially those tied to AI and semiconductors—are showing resilience, helping to offset weakness in more cyclical and defensive sectors.

Federal Reserve Rate Cut Expectations Rise After Tepid Data

Weaker economic indicators, including contracting services activity and slower hiring, have reinforced expectations that the Federal Reserve will cut interest rates later this year, leading to a rally in U.S. Treasuries.

Market Calm May Be Temporary as Volatility Expected to Return

Analysts warn that the recent calm could give way to heightened volatility in the coming quarters due to lingering economic and policy uncertainties.

US Investing Championship Record🏆

USIC 2025 YTD (4/30): +33.0% | USIC 2024: +254.0% | USIC 2023: +103.5%