🚀 Looking Ahead to 2025

Pristine Market Analysis & Watchlist 12.11.24

Team,

The November results are FINALLY in and we finished strong. We’re doing better than the top ETFs YTD! Nerdwallet published the best performing ETFs (as of November 29) and we’re outperforming the top-listed ETF by 237 percentage points!

My strategy takes advantage of asymmetric opportunities in the market where the upside potential is far greater than the downside potential. I made a big event-driven bet on MSOS that I expect will pay off in either January or March after the DEA holds a hearing on rescheduling recreational cannabis, but in the immediate-term, traders are capitulating on their losing bets and high net worth investors are taking advantage of tax-loss harvesting opportunities, translating to a slight performance decline in Q4. But I’m still ahead and looking forward to a strong finish at year-end. I’ll be reporting the results below to the US Investing Championship. HAGE 🍻

-Andrew

Market Update 📊

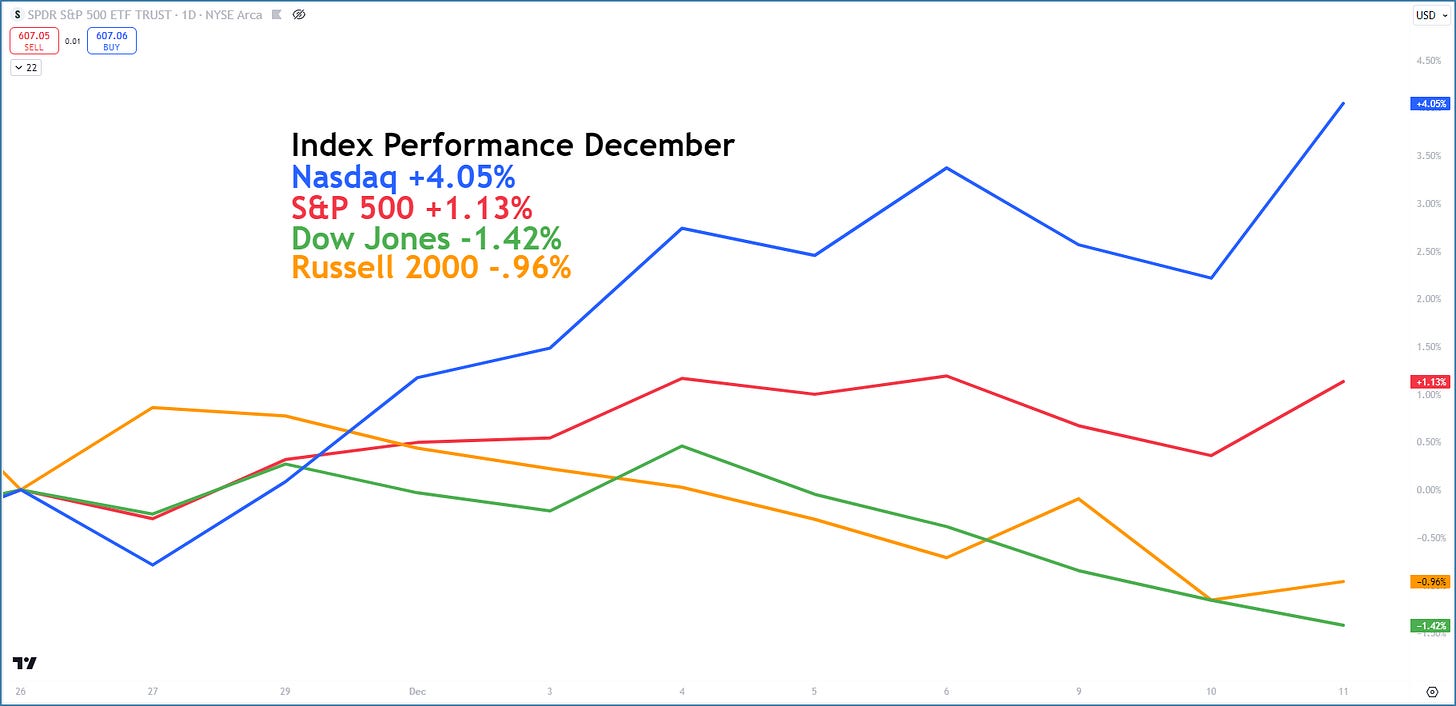

Index Performance December 📈

Observing the monthly performance of the indices is useful, because it gives you a barometer for how much potential there is to make progress in the market.

News🌎

Economic Data 🌎

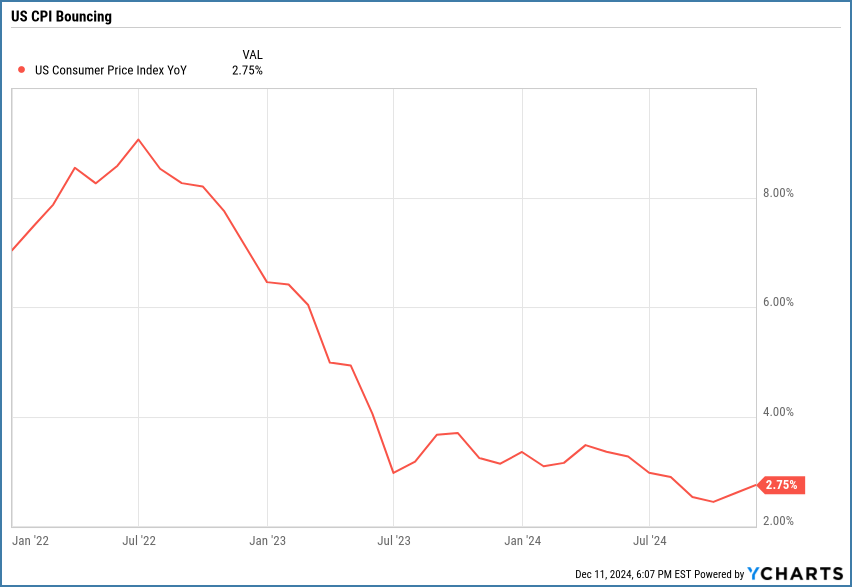

CPI +.3% MoM → In-line with expectations 👇

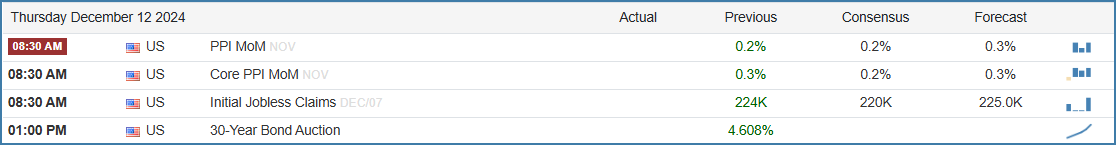

PPI incoming tomorrow 👇

Pristine Performance Track Record 🏆

US Investing Championship 2024 YTD through October: +363.15%

US Investing Championship 2023: +103.5%