Investors Hit the Panic Button🚨

Pristine Weekend Watchlist 8.4.24

Hi Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

If you’ve been enjoying our free content, and are committed to putting in the work to make 2024 your best trading year yet, consider upgrading your membership and becoming a premium subscriber.

I was on vacation last week, and am evaluating the market with a fresh perspective 🙌

Sector/Style Factor Relative Strength Analysis

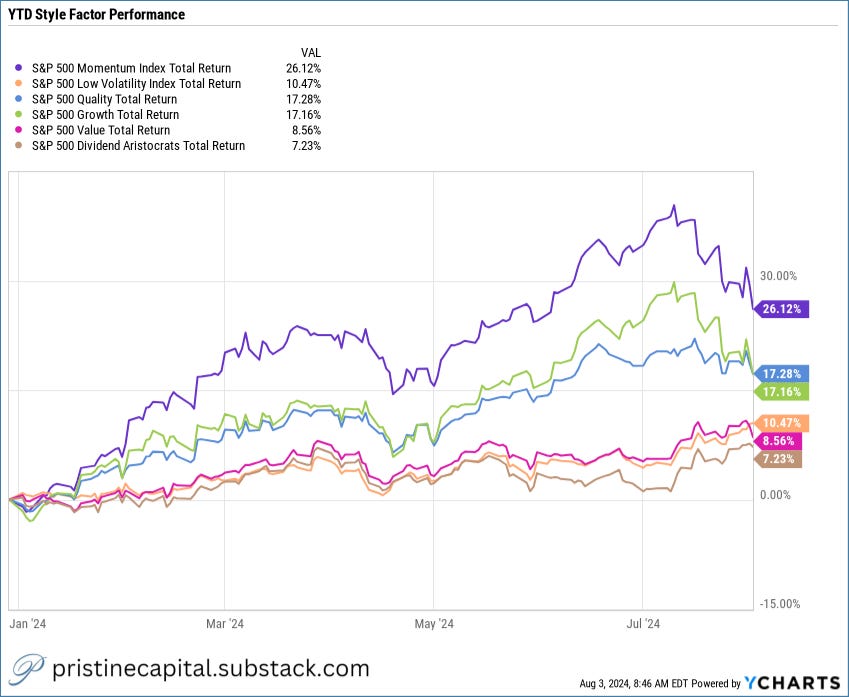

The momentum style factor was +38% YTD just a few weeks ago, and has corrected down to +26.12%. Zooming out, this is still a stellar performance👇

In a typical bull market year, the top leadership group is established in Q1 or early Q2, and momentum builds throughout the year, creating a self-reinforcing pattern of chasing the leadership groups into year-end.

SOXX just completely lost it’s momentum, disrupting this pattern of self-reinforcing buying

XLU utilities are the new YTD leader, and this group makes up a much smaller percentage weight in the SPY S&P 500 than does SOXX semiconductors.

It will take investors either rotating back to semis, or a new leadership group emerging for the headline indices to regain their momentum. So far we have zero evidence of this occurring👇

Lower interest rates are a positive catalyst for XHB homebuilders, KRE regional banks, and IYR real estate. The strength in these groups confirms that market participants are pricing in a new regime of lower interest rates👇

Brutal 1-month drawdown in SOXX 👇

I’m glad I was on vacation last week! Brutal move risk-on groups 👇