📊Earnings Season & CPI Incoming!

Pristine Weekend Watchlist 1.11.26

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this note, we’ll cover the following topics to prep for the upcoming trading week:

🦾 Sector relative strength analysis across multiple timeframes

🌎Macro Analysis

📈Three A+ Trade Setups

And much more! Let's get started! 👇

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

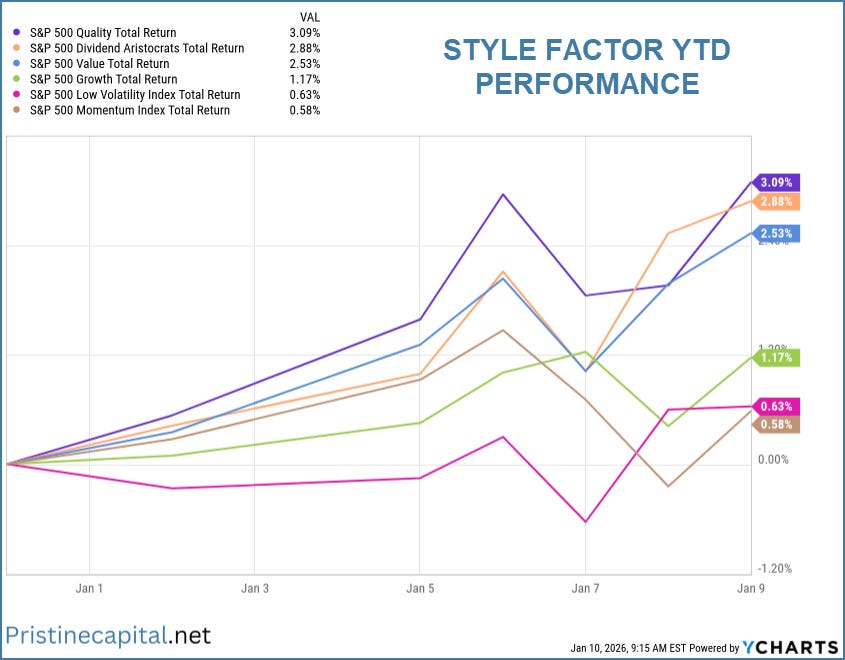

Style Factor YTD Performance

The Quality style factor is leading, indicating investors are moving out of a speculative mindset, and into a conservative mindset👇

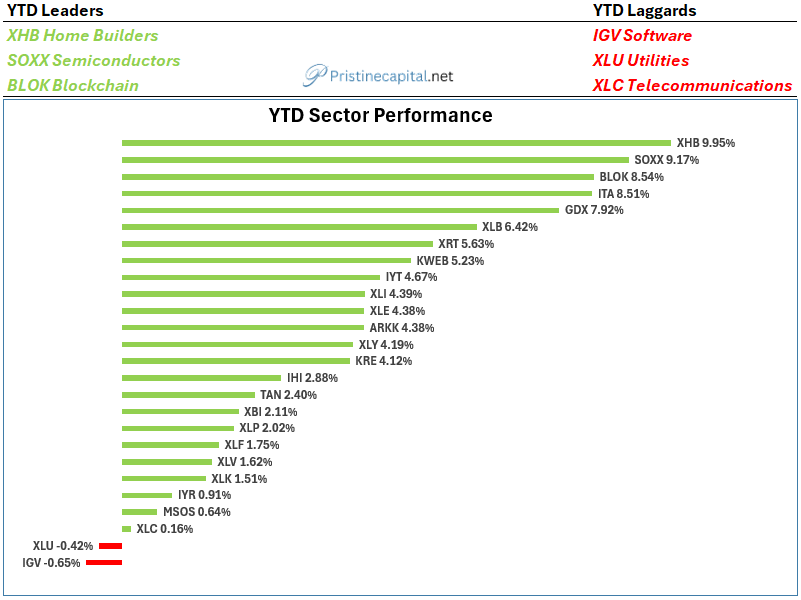

YTD Sector Performance

XHB homebuilders rallied on POTUS news of a $200BB MBS bond buying program to improve home affordability 👇

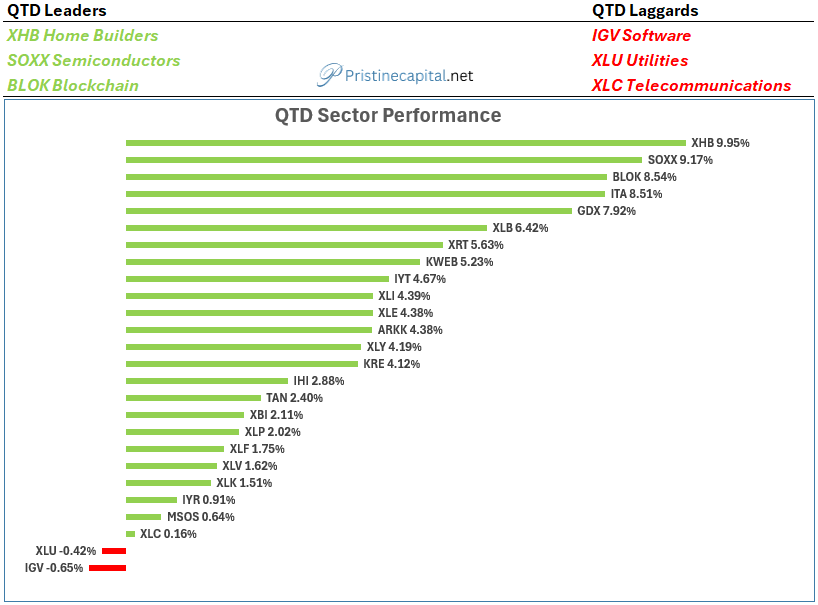

QTD Sector Performance

QTD performance is identical to YTD performance in Q1 👇

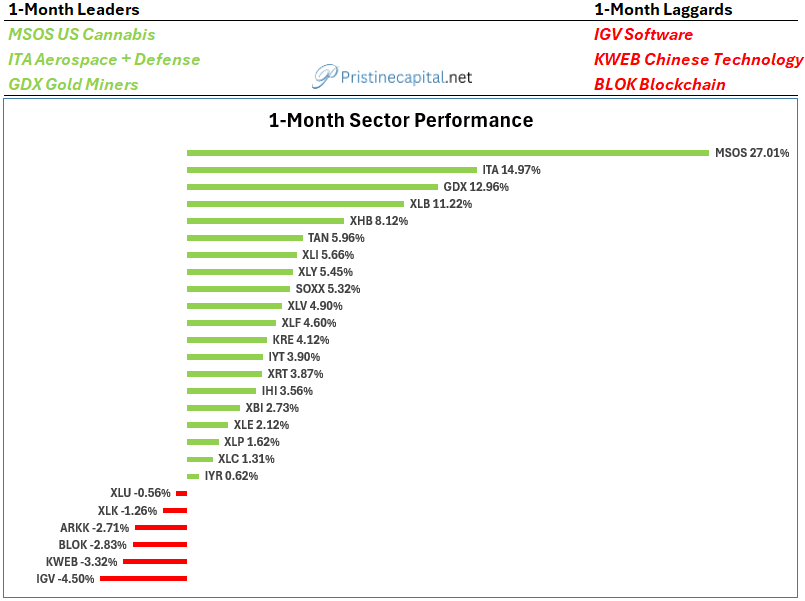

1-Month Sector Performance

MSOS rallied on POTUS signing an executive order to reschedule cannabis from schedule I to schedule III of the Controlled Substances Act (CSA)👇

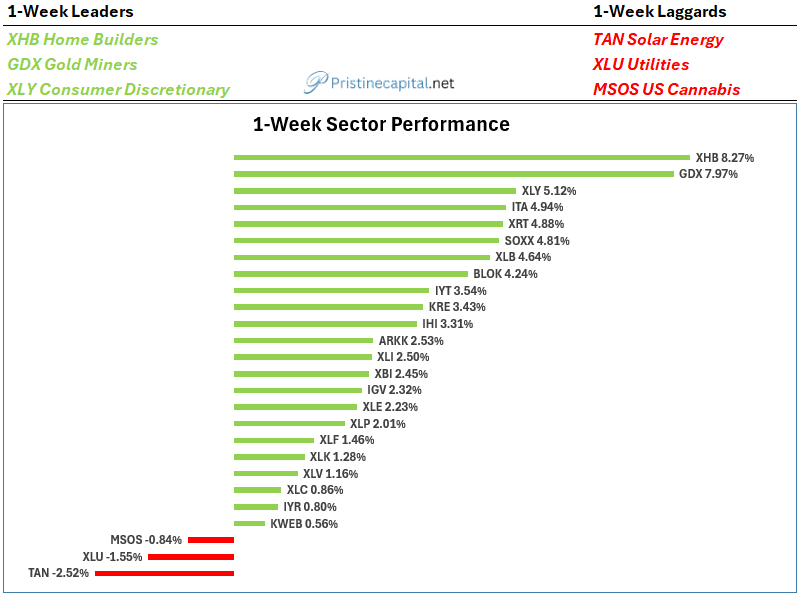

1-Week Sector Performance

GDX Gold miners followed up their stellar year in 2025 with a second place finish to start 2026! 👇

Key Ideas/ Macro Backdrop🗝️