🏈 CPI & Earnings Season Kick-off!

Pristine Weekend Watchlist 10.6.24

Hi Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

If you’ve been enjoying our free content, and are committed to putting in the work to make 2024 your best trading year yet, consider upgrading your membership and becoming a premium subscriber.

Sector/Style Factor Relative Strength Analysis

The momentum style factor is approaching it’s YTD high

Growth, Value, and Dividend style factors began to outperform in Q3 👇

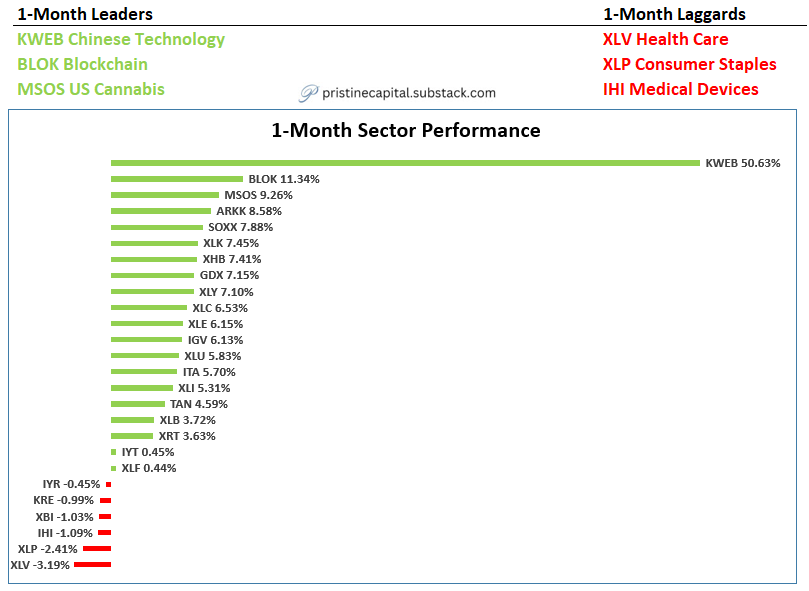

Out of nowhere, KWEB china tech is now the top performing group in 2024! I am looking to reallocate to this group on a meaningful dip👇

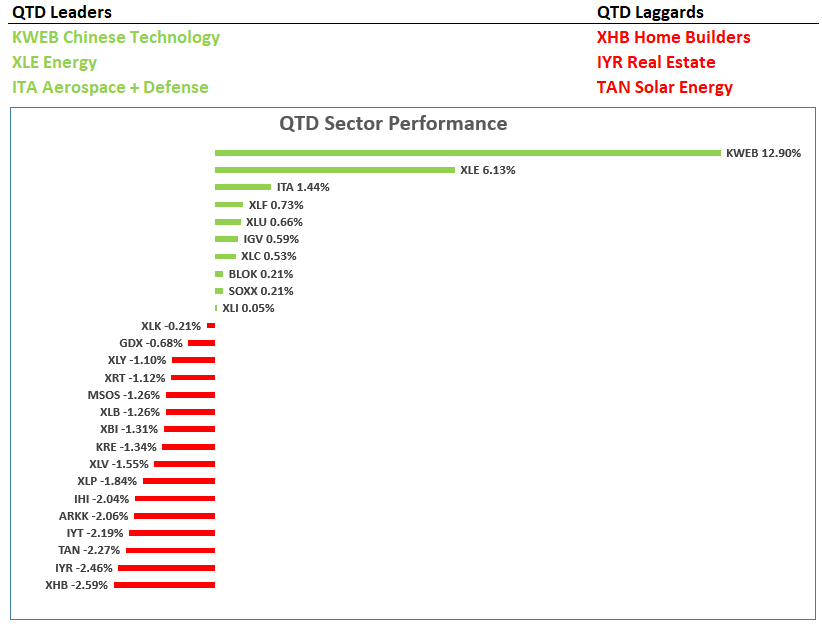

Q4 is still young! So far KWEB China, XLE energy, and ITA aerospace & defense are the top performers, which is likely catching many market participants off guard 👇

MSOS cracked the top 3 on the 1-month time horizon. Cannabis rescheduling will likely occur on 12/2. I’m a huge MSOS bull long-term 👇

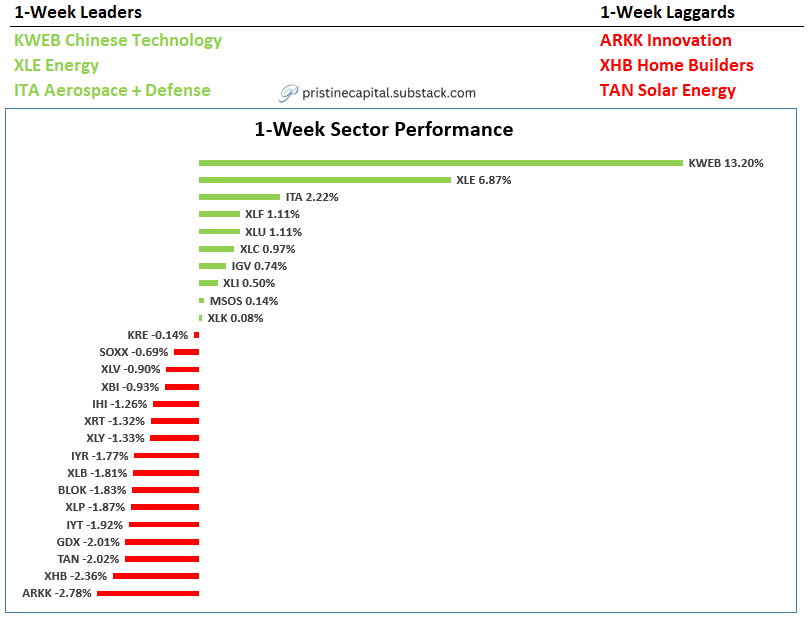

Duration sensitive groups ARKK innovation, XHB homebuilders, TAN solar were all negatively impacted by the 1-week move higher in bond yields👇