Hi Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

If you’ve been enjoying our free content, and are committed to putting in the work to make 2025 your best trading year yet, consider upgrading your membership and becoming a premium subscriber.

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

Style Factor YTD Performance

The Low Volatility style factor made a big relative improvement last week. Worth noting if a key to your trading strategy is trading higher volatility stocks 👇

YTD Sector Performance

Our thesis has been that China tech will outperform US tech in 2025, and it is playing out before our very eyes

This is a pain trade, given how out-of-consensus the long China trade was heading into the Trump administration.

When the popular longs underperform and the popular shorts outperform, it can create instability in the market. We must respect risk the risk that a more meaningful unwind in popular momentum trades continues 👇

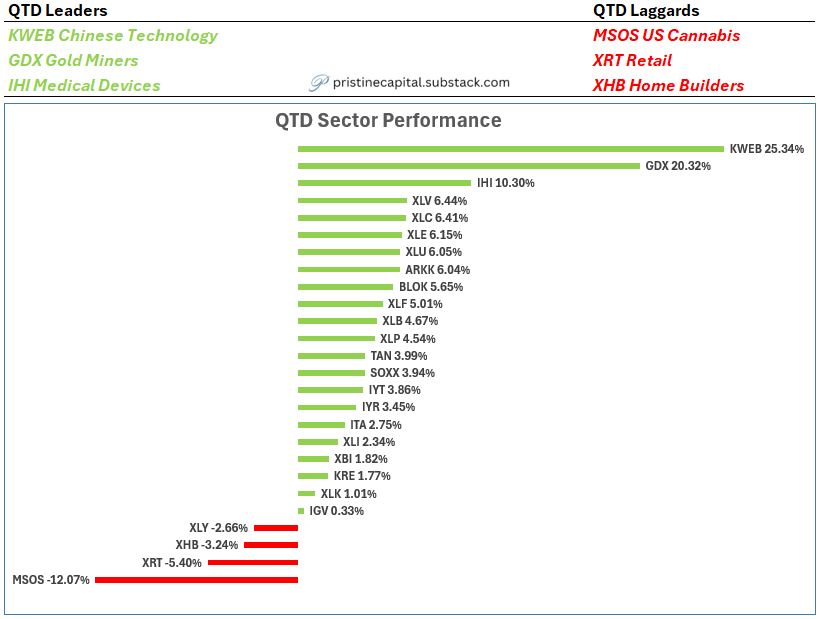

QTD Sector Performance

Identical to YTD given we are in Q1 👇

1-Month Sector Performance

KWEB stellar one-month performance. I closed my BABA position into the strength 👇

1-Week Sector Performance

XLU utilities, XLP consumer staples, & XLV healthcare tend to outperform when investors are concerned about low economic growth. All three outperformed last week 👇

Keep reading with a 7-day free trial

Subscribe to Pristine Capital to keep reading this post and get 7 days of free access to the full post archives.