Cannabis Rescheduling Eve! 🥳

Market Analysis 12.17

Hey Gang,

Tonight’s research note will be short and to the point. Let’s just say i got lunch with an old friend and lost track of time. Time flies when you’re having fun 🥳

In tonight’s note, we’ll cover the following:

A review of today’s market action and how it fits into our “Bear Market is Brewing” logic (see our weekend research note for a refresher)

My game plan for trading the potential cannabis rescheduling catalyst tomorrow

The trend model flipped from -1 to -3 🔴 as the ES S&P 500 fell below its 20D SMA. Megacap tech stocks underperformed 👇

Let’s be honest. We are 3yrs into an AI bull market, and almost every investor is up to their eyeballs with AI exposure at the same time. My main questions into 2026 are as follows:

1) With the emergence of GOOGL TPU’s, AMZN Trainium chips, and more competitors joining the fray, does NVDA maintain its fat profit margins on GPU’s? ⚔️

2) Does OpenAI have a moat? GOOGL’s Gemini is a better model, GOOGL has access to more proprietary datasets, and GOOGL can fund itself with cash from its other business lines. Something OpenAI can’t do 👀

Methodology: I incorporate the fundamentals AND technicals into my process. If the price action strengthens and new leadership stocks emerge, I’ll change my cautious tune, but for now I’m not seeing that. I remain short PLTR via put options in small size. The goal for this trade is to have some sort of downside exposure in case AI stocks experience a more meaningful correction, but it shouldn’t be a big needle mover for me either way.

Cannabis Rescheduling:

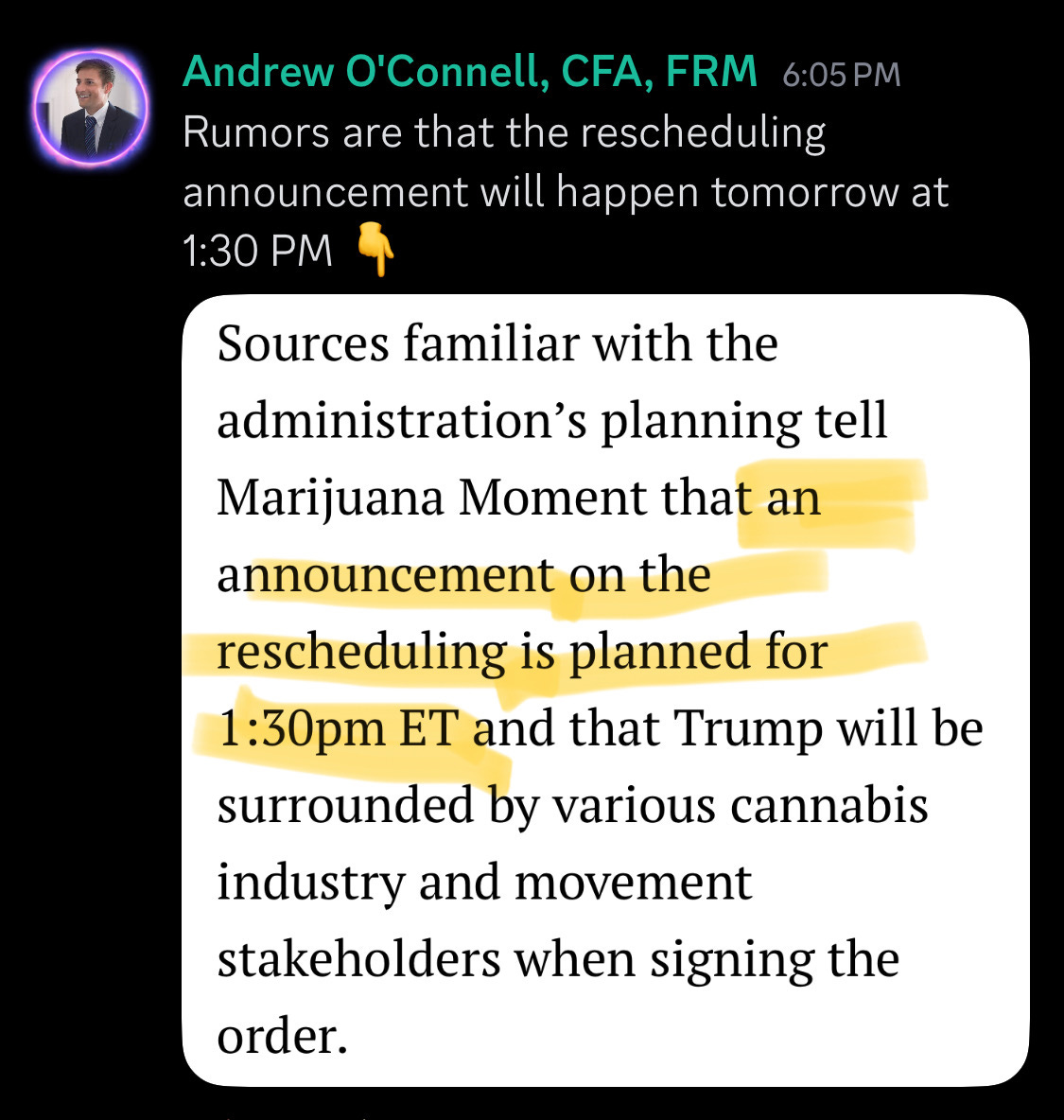

Tomorrow could be the big day! According to Marijuana Moment:

My gameplan is to take a piece of my overweight position in MSOS off the books into an announcement pop. My position is big, and to be honest it’s giving me some anxiety. Cannabis rescheduling could mark the start of a new bull market for these stocks, so I’ll hold a core position to participate:

Im meeting my wife for dinner now. I’ll be back tomorrow night with a full research note. Take care. And as always, thanks for supporting our work🙌

-Andrew O’Connell, CFA, FRM

MU had a good beat and raise. Guess we’ll see if that’s enough to calm the market!