🐂Bullish November Seasonality!

Pristine Weekend Watchlist 10.26.25

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this note, we’ll cover the following topics to prep for the upcoming trading week:

🦾 Sector relative strength analysis across multiple timeframes

🌎Macro Analysis

📈Three A+ Trade Setups

And much more! Let's get started! 👇

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

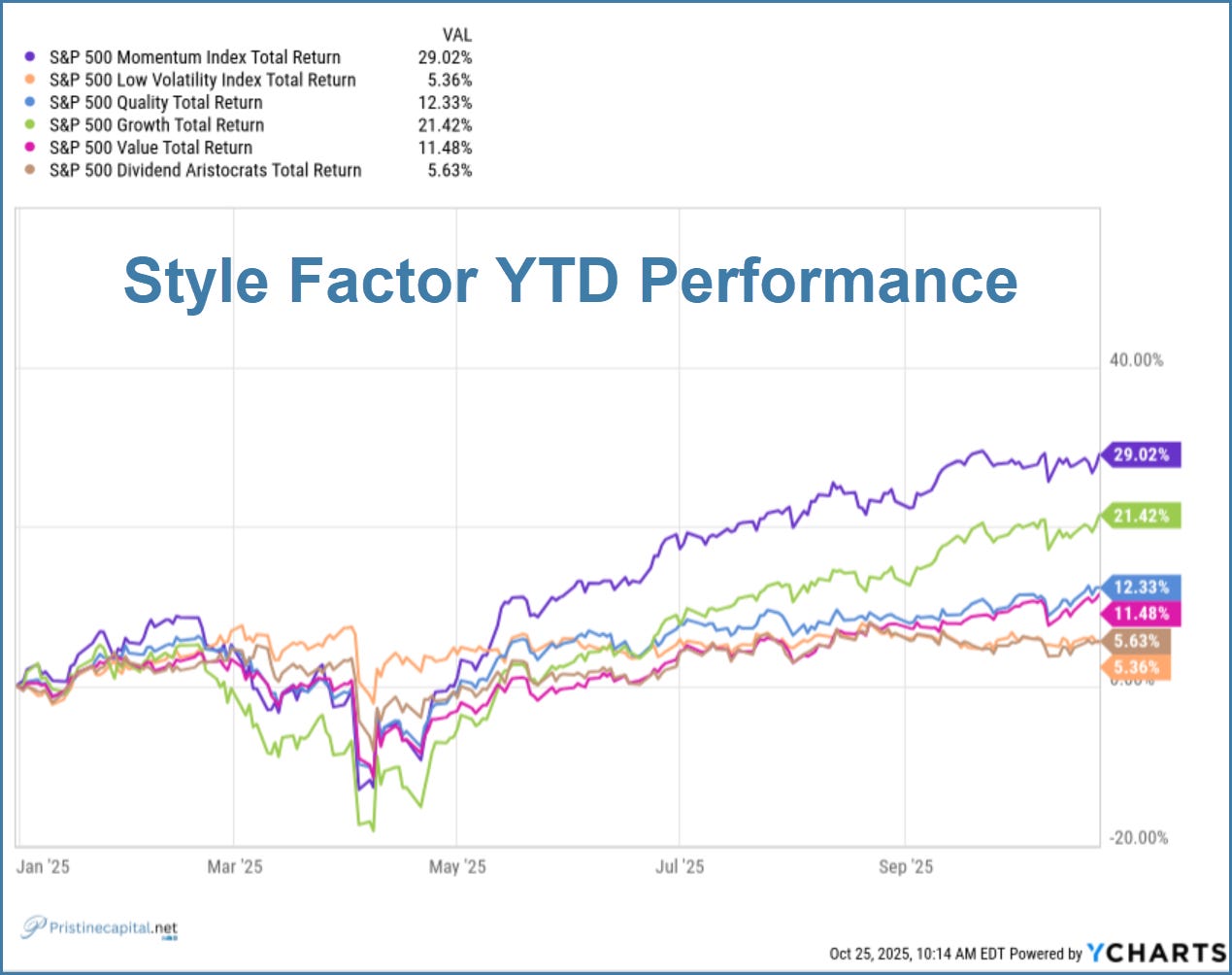

Style Factor YTD Performance

The momentum style factor is trading at YTD highs as we approach favorable November seasonality👇

YTD Sector Performance

GDX gold miners reign supreme in an era of monetary debasement 👇

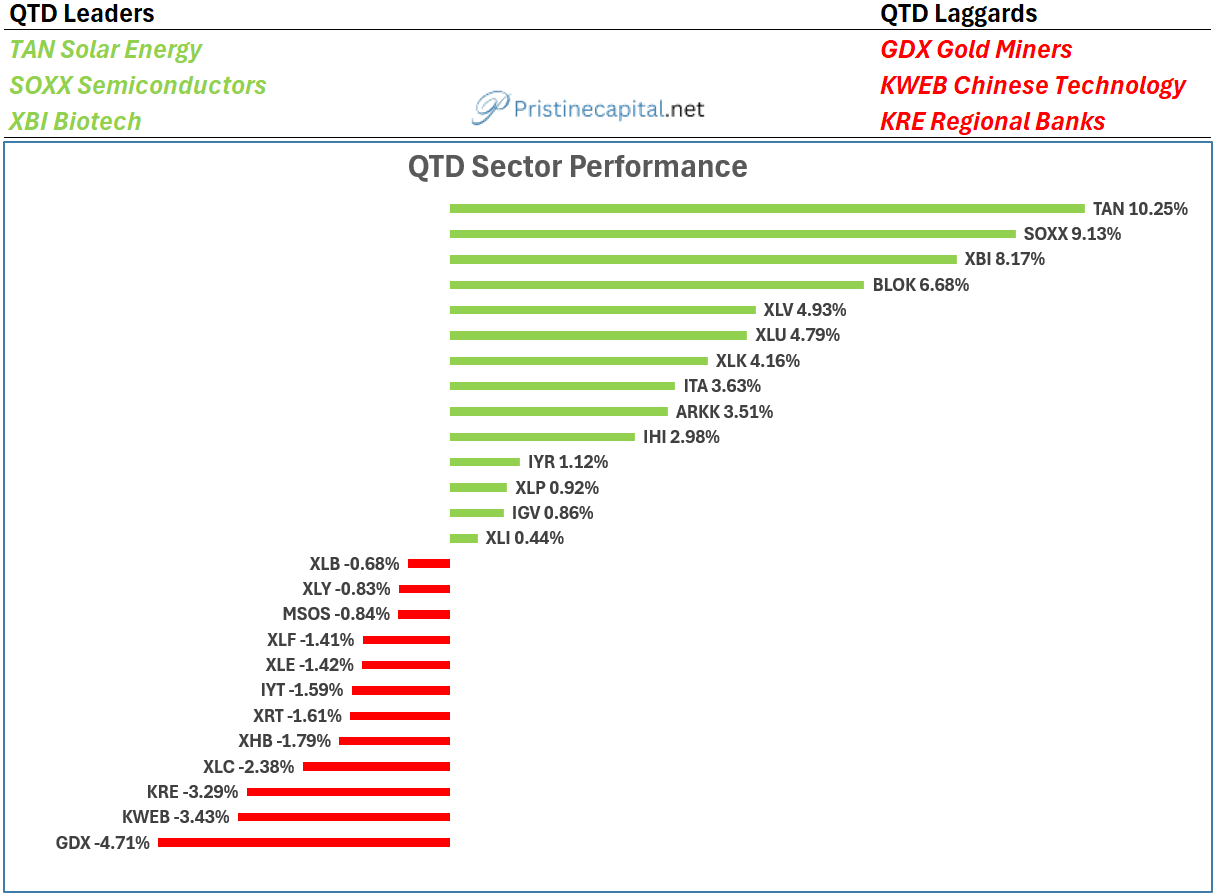

QTD Sector Performance

TAN solar leading in Q4 → AI datacenters are creating a dash for energy 👇

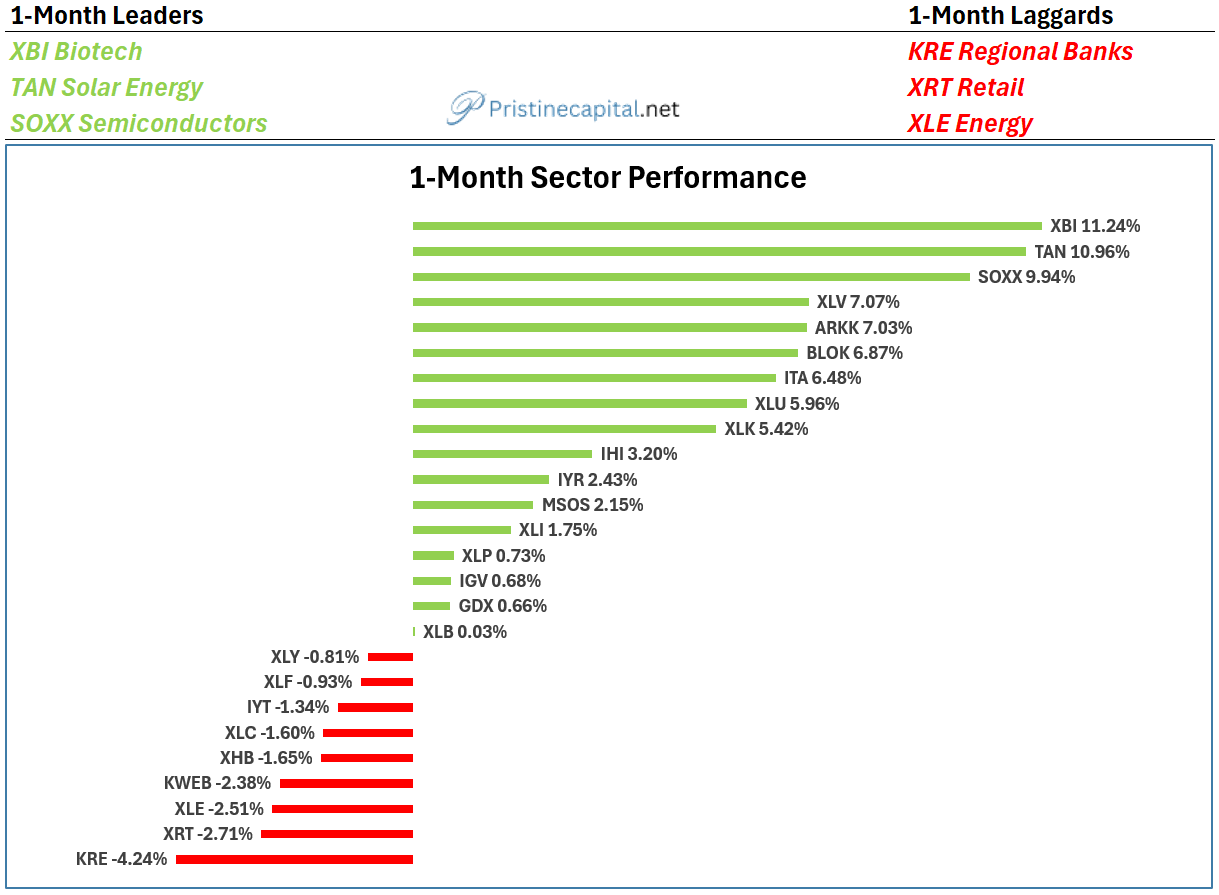

1-Month Sector Performance

XBI Biotech leading & KRE regional banks lagging on bank blowups 👇

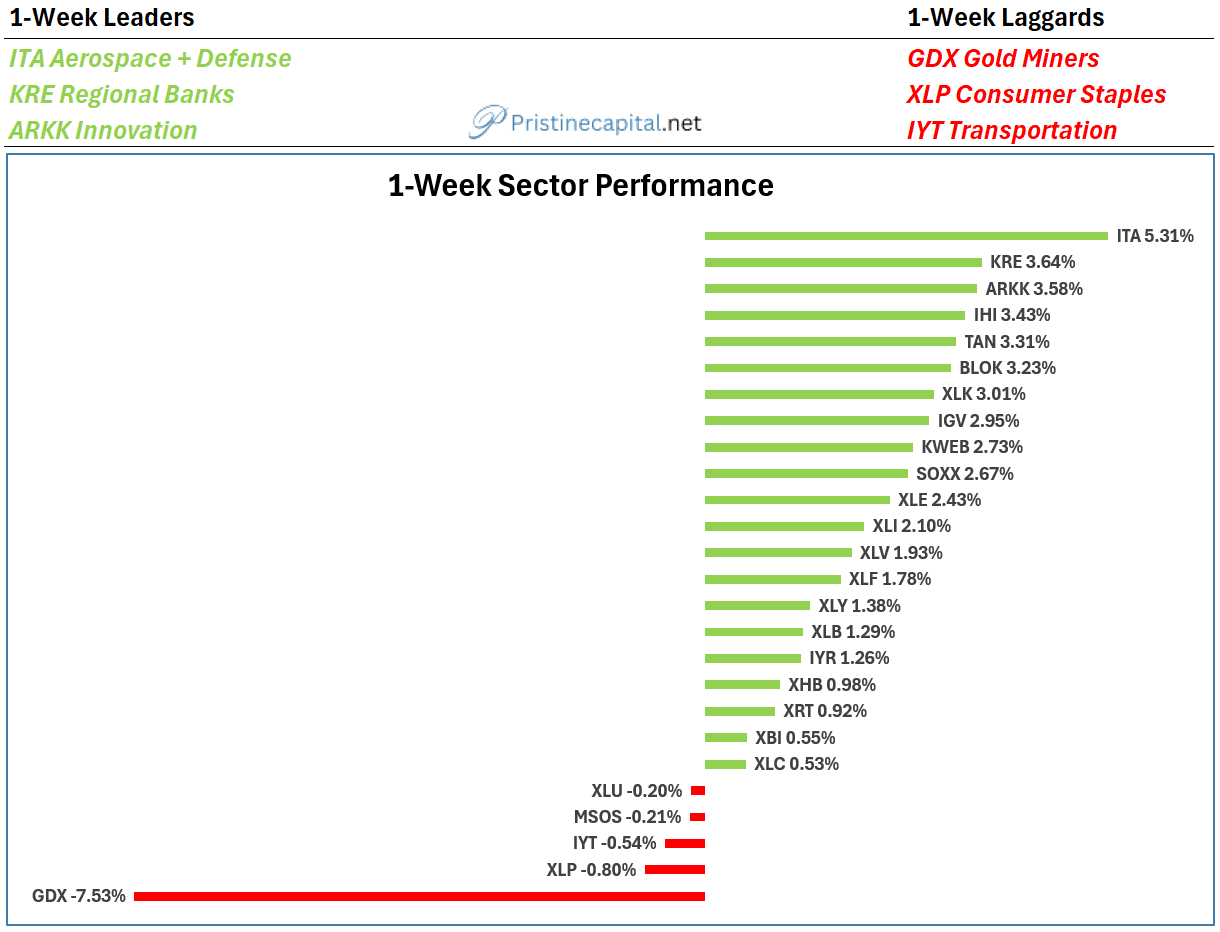

1-Week Sector Performance

ITA Aerospace & defense led…odd

GDX finally saw profit-taking 👇

Key Ideas/ Macro Backdrop🗝️