📈Bonds Outperform into Elite 8 Earnings!

Pristine Market Analysis & Watchlist 7.29.25

Team,

Market conditions are quickly changing. Let’s take a look under the hood! HAGE🍻

-Andrew

Market Update 📊

Rotation to consumer defensive👇

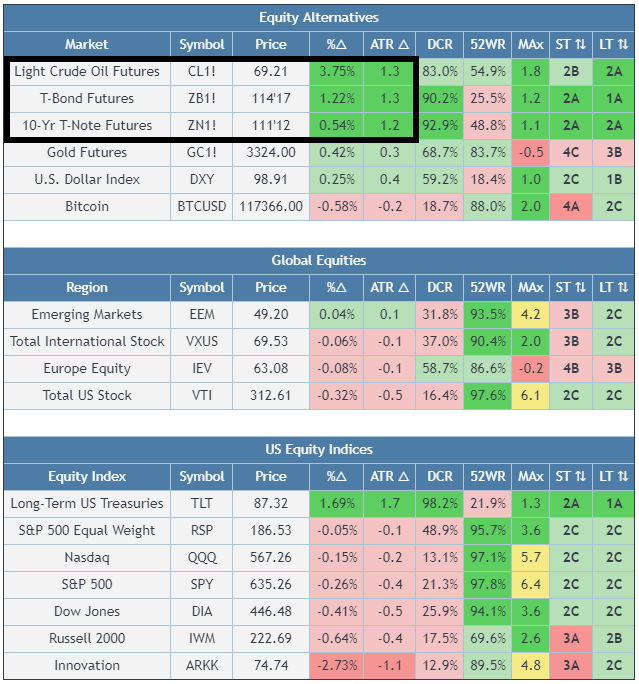

CL Crude oil & ZB ZN US Bonds both put in >1 ATR moves. This is highly unusual given that there was no market-moving economic data that came in today to move these assets. Moves like this tend to happen when geopolitical risk premium is being priced in👇

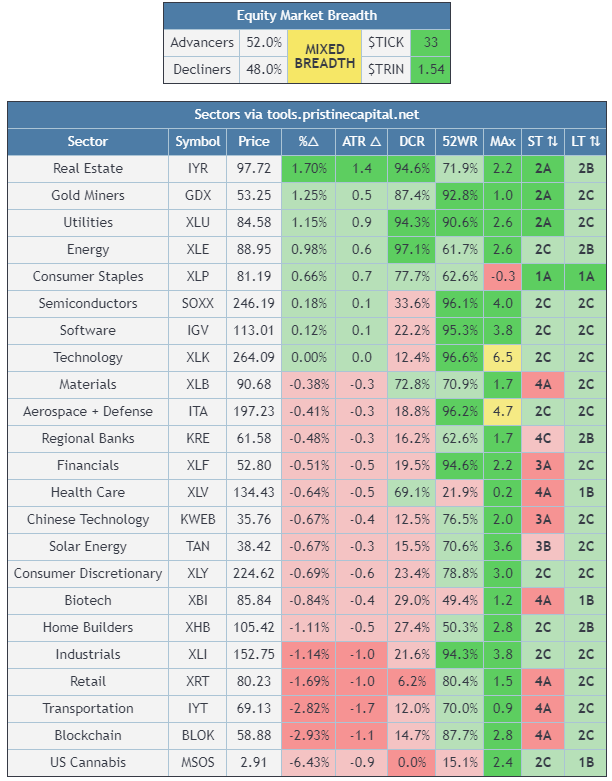

MIXED BREADTH as defensive groups IYR GDX XLU led the market👇

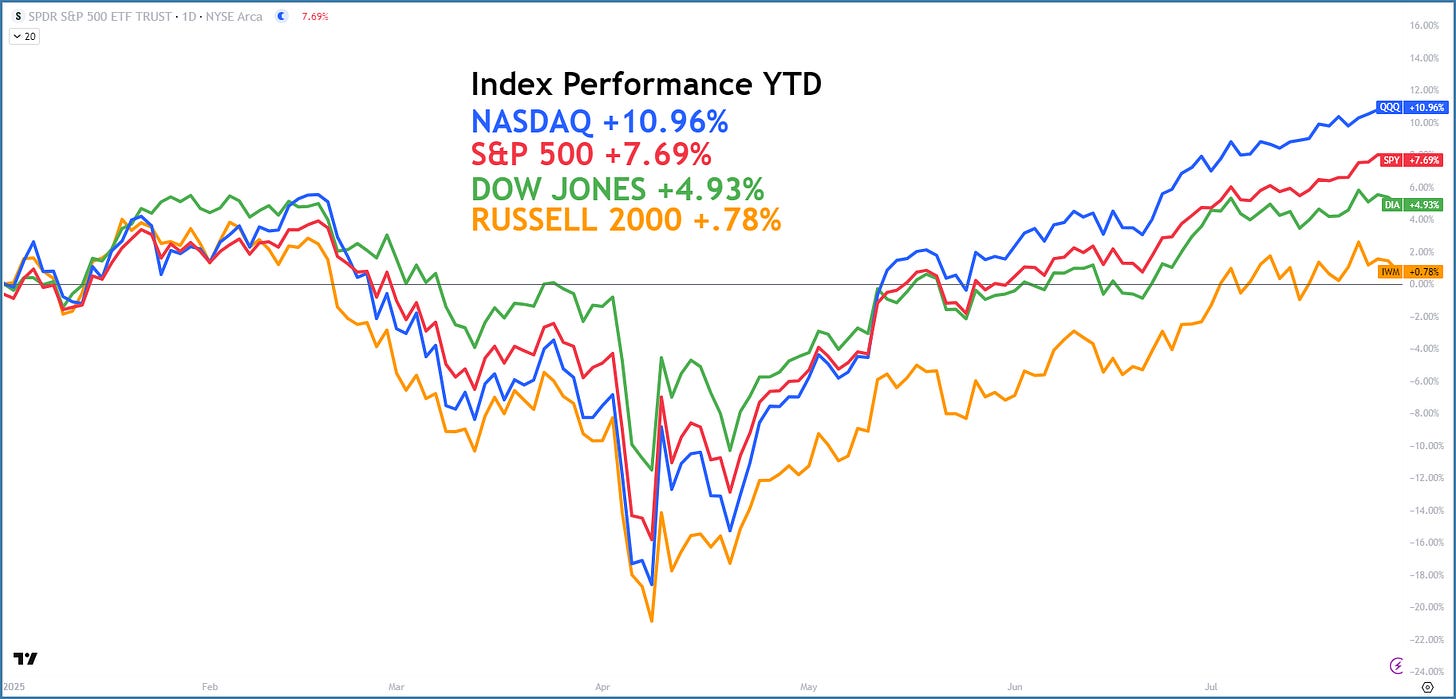

Index Performance YTD 📈

Portfolio progress is highly dependent on the market environment

Nasdaq is the only index in double digits YTD👇

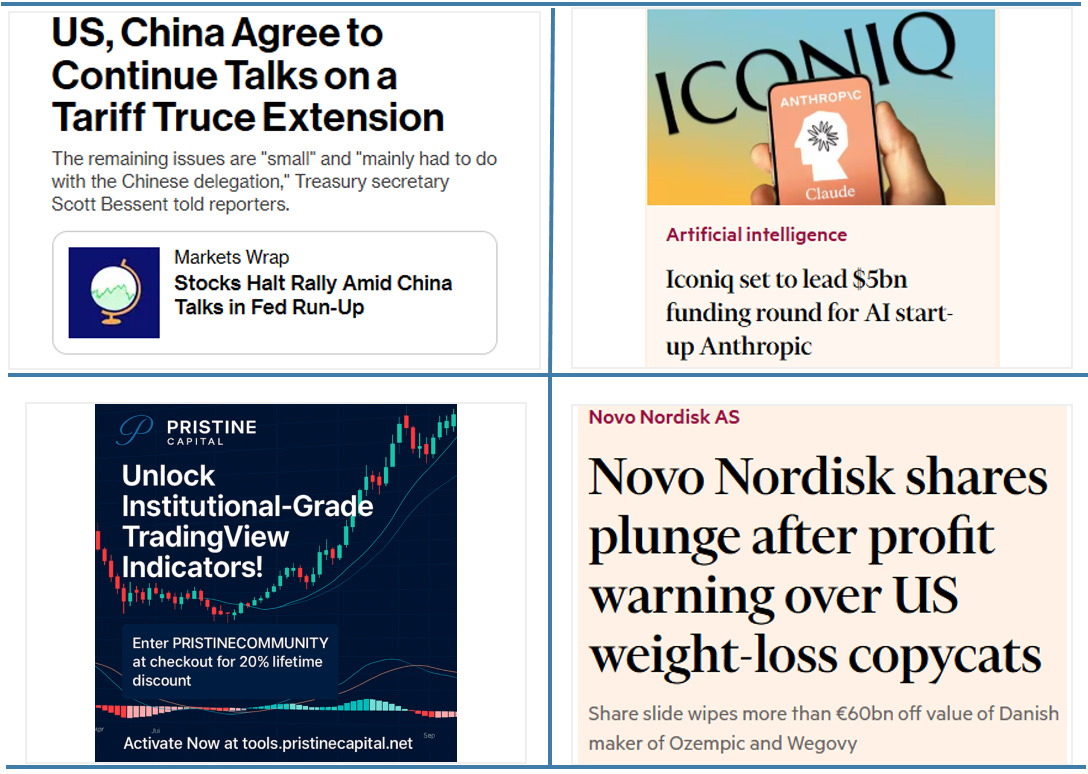

News Flow🌎

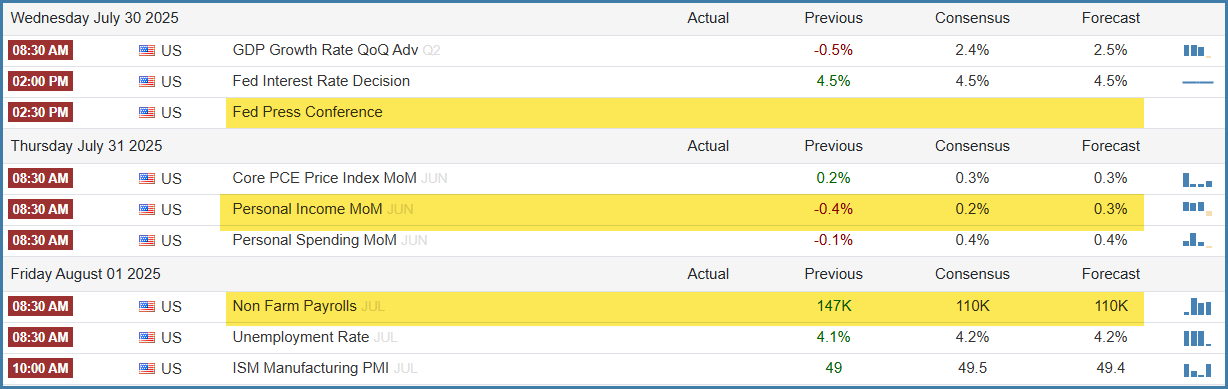

Economic Calendar - Fed Wednesday Incoming🌎

US Investing Championship Record🏆

│2025 YTD (6/30): -5.65% │2024: +254.0% │2023: +103.5% │

Below we’ll touch on market sentiment, upcoming earnings, outline three trading setups, and more. Just scroll down…