Andrew's Daily Market Update - 12/28

Slow Motion Selloff

Good evening,

Last few days of 2022. Let’s make them count! 👊

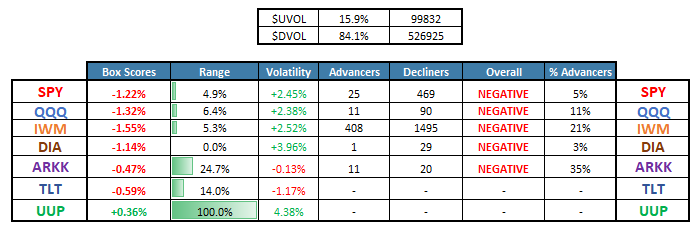

Market Dashboard

Negative price action across all of our tracked indices

Rising volatility, but no sign of a VIX panic!

15.9% UVOL - Dreadful market breadth🤢

Ideal market conditions? Absolutely not!

S&P 500 ES_F Price Action Analysis

Technical breakdown below the monthly value area low 3826.25 (now resistance)

Next level to watch on the downside is the 12/13 wick low at ~3789

So long as we trade below value, we must remain open to a test of the 3699.75 VPOC

VIX Analysis

Throughout 2022, the VIX traded in a range between ~19 and ~35

Significant S&P 500 tops occurred when the VIX hit 19

Significant S&P 500 bottoms occurred when the VIX hit 35

With the VIX at it’s current level of 22.14 and the S&P 500 having just broken down below the monthly value area, I have no conviction that the market is near a bottom. This remains a coinflip market into year-end, and if anything, the edge is to further downside continuation.

Finviz Heatmap

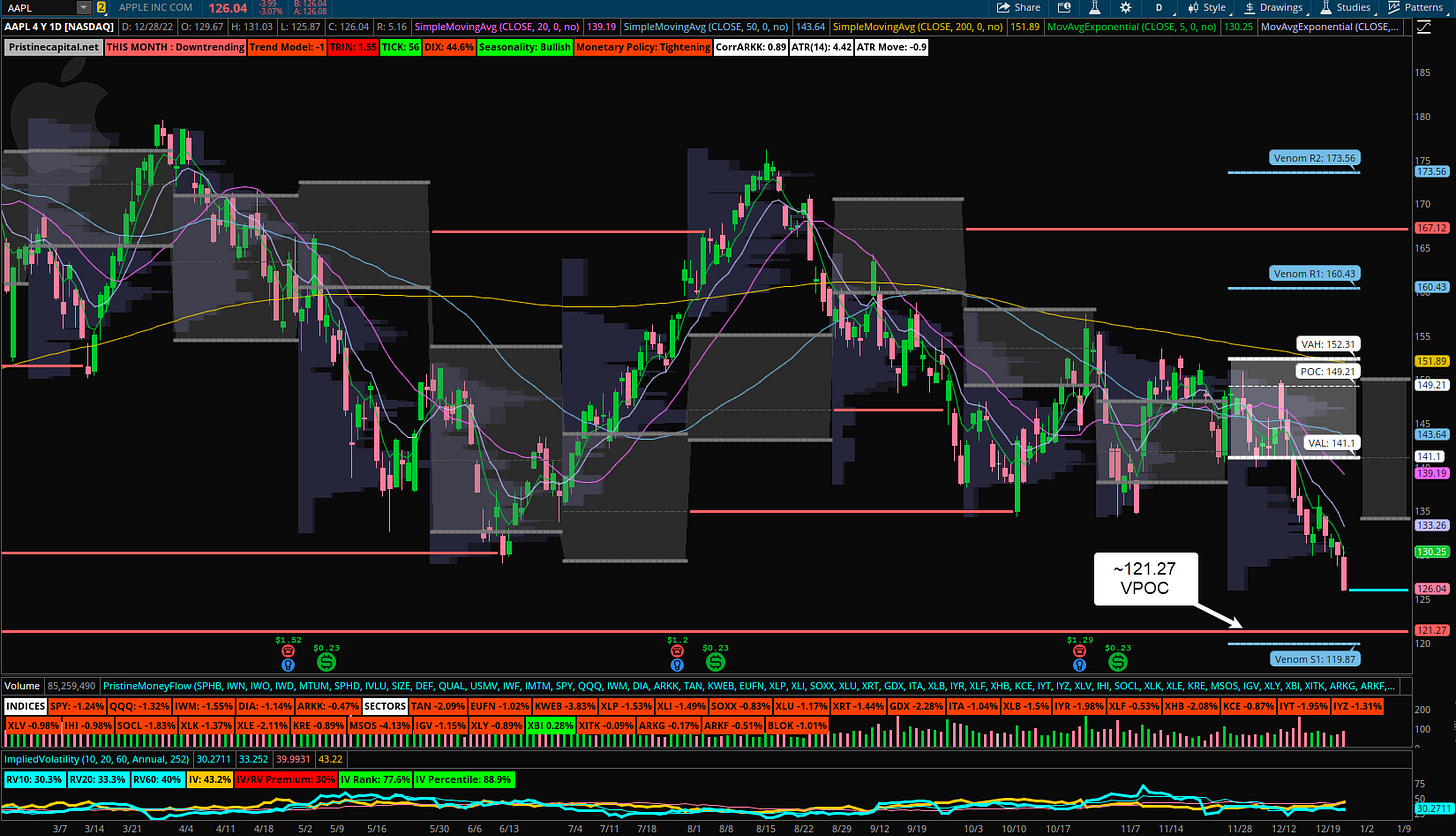

I have good news and bad news for you tonight! The good news is…Tesla finally had a green trading session…The bad news? AAPL broke down decisively below it’s summer lows😭

The 121.27 VPOC could come into play as a short-term demand zone in Q1 23’

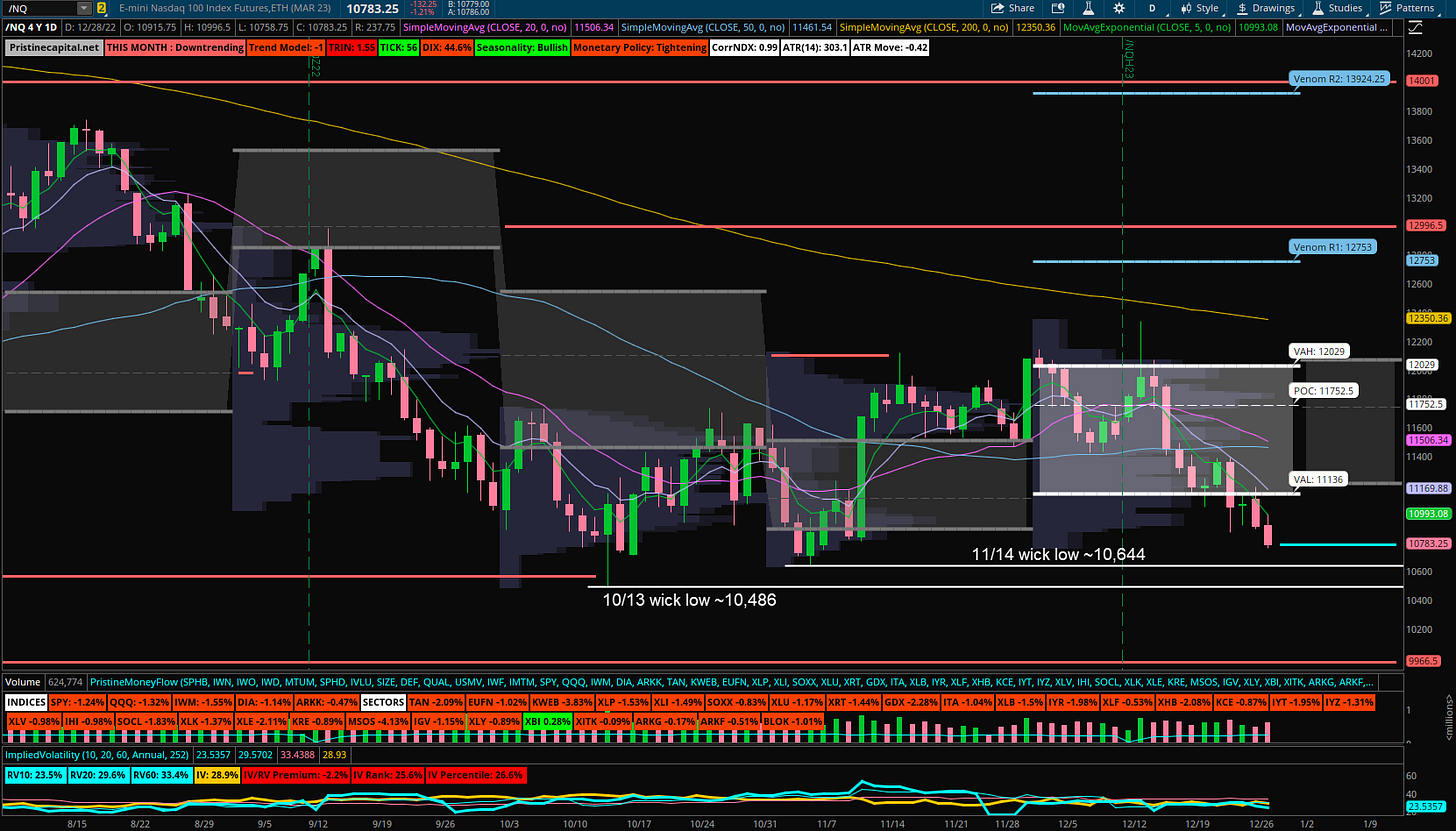

Nasdaq NQ_F Price Action Analysis

The Nasdaq continues to cascade as megacaps are sold into year-end

It is approaching prior demand zones at the 11/14 wick low of ~10,644 and 10/13 wick low of ~10,486

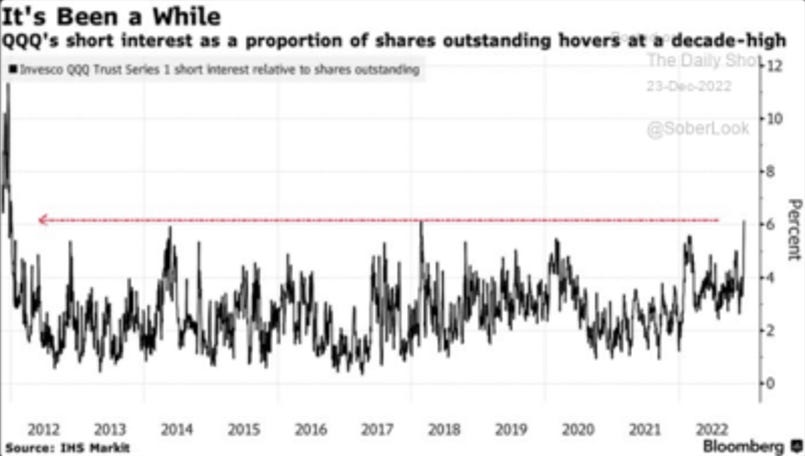

Nasdaq QQQ Short Interest

I still believe that there could be a great Nasdaq bounce trade in Q1 2023 given the following:

Highest short positioning in the Nasdaq QQQ ETF in over a decade

Price approaching prior areas of demand as mentioned above

The leveraged unwind in TSLA being largely behind us

For the moment, I prefer to wait on the sideline for a higher low to form, a long lower wick candle, or a spike in volatility, because while much of the downside could be in the rear view, the largest moves in a trend come at the end of it, not the beginning or middle. Attempting to catch the falling knife is rarely the power move, for this reason👊

Key Themes

The S&P 500 broke down from key technical support

The VIX shows no signs of fear or panic by investors

The Nasdaq will likely offer a powerful bounce trade when the dust settles

Holiday Trading Schedule

With most investment managers on holiday, and this being the final trading week of the year, it is time to reduce screen time to primarily the first and last hour of the trading session, and use the rest of the day to do post-trade analysis and prep for a successful 2023! If you have not yet checked out our Path to Victory Trading Calculator, I highly recommend doing so to map out a game plan for the new year:

Pristinecapital.net/tools

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Access - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅ Sector Relative Strength Analysis

✅ Trading Account Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the highest reward/risk opportunities

🚨An actionable options premium selling trade idea for tomorrow’s session🚨