Andrew's Daily Market Analysis - 12/27

Growth Capitulation

Good evening everyone,

I hope you all had a fantastic holiday break. Welcome back! 👊

Market Dashboard

Negative price action across all of our tracked indices paired with rising volatility. The best days for risk assets this year have occurred against a backdrop of TLT 0.00%↑ long-term treasury ETF rallying, and volatility declining. We experienced the exact opposite today!

Finviz Heatmap

While today's SPY 0.00%↑ session was muted, we continue to see evidence that investment managers are unwinding positions in megacap technology stocks. These are some of the most widely owned names among active and passive investors alike, and the large declines in both NVDA and TSLA demonstrate that investment managers are still under pressure in the last few sessions of the trading year.

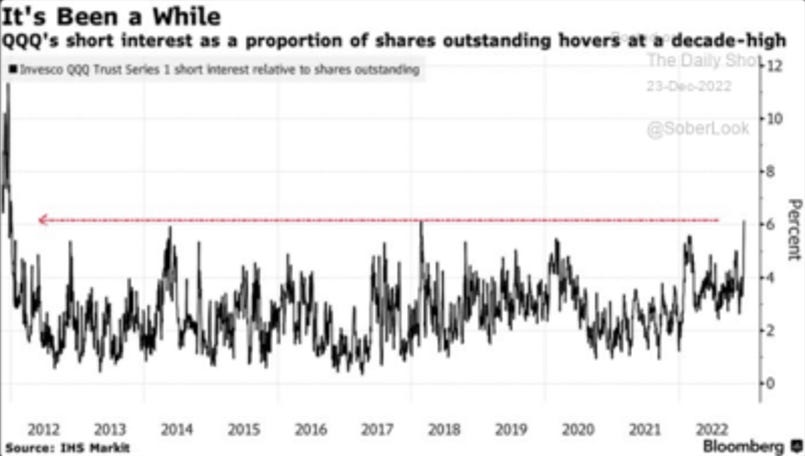

Nasdaq QQQ Short Interest

Speaking of unwinds in megacap tech, we entered today's session with the highest short interest in a decade for the Nasdaq QQQ 0.00%↑ ETF! Fears of another tough year for technology are certainly being pulled forward by investors, and the more investors panic now, the less likely we are to get a material downdraft in technology in Q1.

Nasdaq QQQ Price Action Analysis

I find it interesting that despite both NVDA and TSLA imploding during today’s session, we were not able to take out the QQQ $262.46 low of day from 12/22. It is worth monitoring the Nasdaq closely over the next few sessions to see if this level holds. If it does, that could present an opportunity for a long bounce trade with tight risk control, using the prior low as a pivot point.

S&P 500 SPY Price Action Analysis

The S&P 500 is consolidating below the monthly value area after falling sharply earlier in the month. We are still trading below all of the key moving averages, but we are seeing signs of demand at the ~$378 zone via long lower wicks. A close above the monthly value area high of $382.5 can be used as a bullish pivot level, but if this range fails to hold, we could be on the fast track to the downside VPOC at ~$367.59. As of now, this remains a coin toss, and the megacap tech stocks mentioned prior could be the deciding factor!

Key Themes

Investors are still being liquidated in the final days of the year

Growth stocks and technology are the epicenter of investor pain

These groups are becoming consensus shorts, and deserve to be carefully monitored for signs of a market bounce, or continued downside action

Strategy

With most investment managers on holiday, and this being the final trading week of the year, it is time to reduce screen time to primarily the first and last hour of the trading session, and use the rest of the day to do post-trade analysis and prep for a successful 2023! If you have not yet checked out our Path to Victory Trading Calculator, I highly recommend doing so to map out a game plan for the new year:

Pristinecapital.net/tools

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session.

✅ Trend Model Access - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅ Sector Relative Strength Analysis and technical analysis

✅ Trading Account Position Update - Track our entries and exits through time

✅Daily Watchlist - We scan thousands of stocks and hand-pick the highest reward/risk opportunities