📊 An Air Pocket of Uncertainty

Pristine Weekend Watchlist

Hi Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

If you’ve been enjoying our free content, and are committed to putting in the work to make 2025 your best trading year yet, consider upgrading your membership and becoming a premium subscriber.

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

Style Factor YTD Performance

Momentum style factor is leading after putting up a stellar 2024 👇

YTD Sector Performance

GDX leading, which is arguably the most defensive group 👇

QTD Sector Performance

Identical to YTD given we are in Q1. XLE leading → Inflation worries 👇

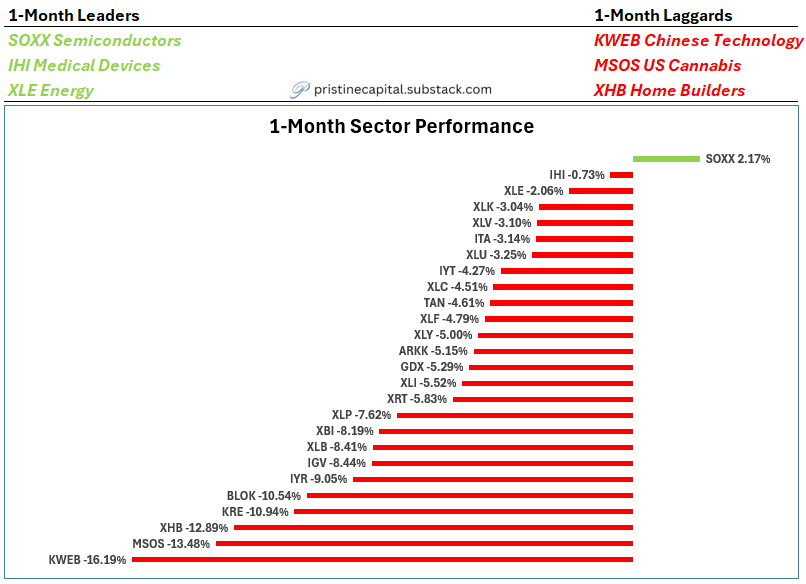

1-Month Sector Performance

SOXX semiconductors the only group with positive returns

KWEB China selling off in anticipation of the incoming Trump administration 👇

1-Week Sector Performance

MSOS cannabis sold off on news that the MJUS ETF would be shutting down 👇