📊AMZN, META, MSFT Earnings Incoming!

Pristine Weekend Watchlist 7.27.25

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this note, we’ll cover the following topics to prep for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

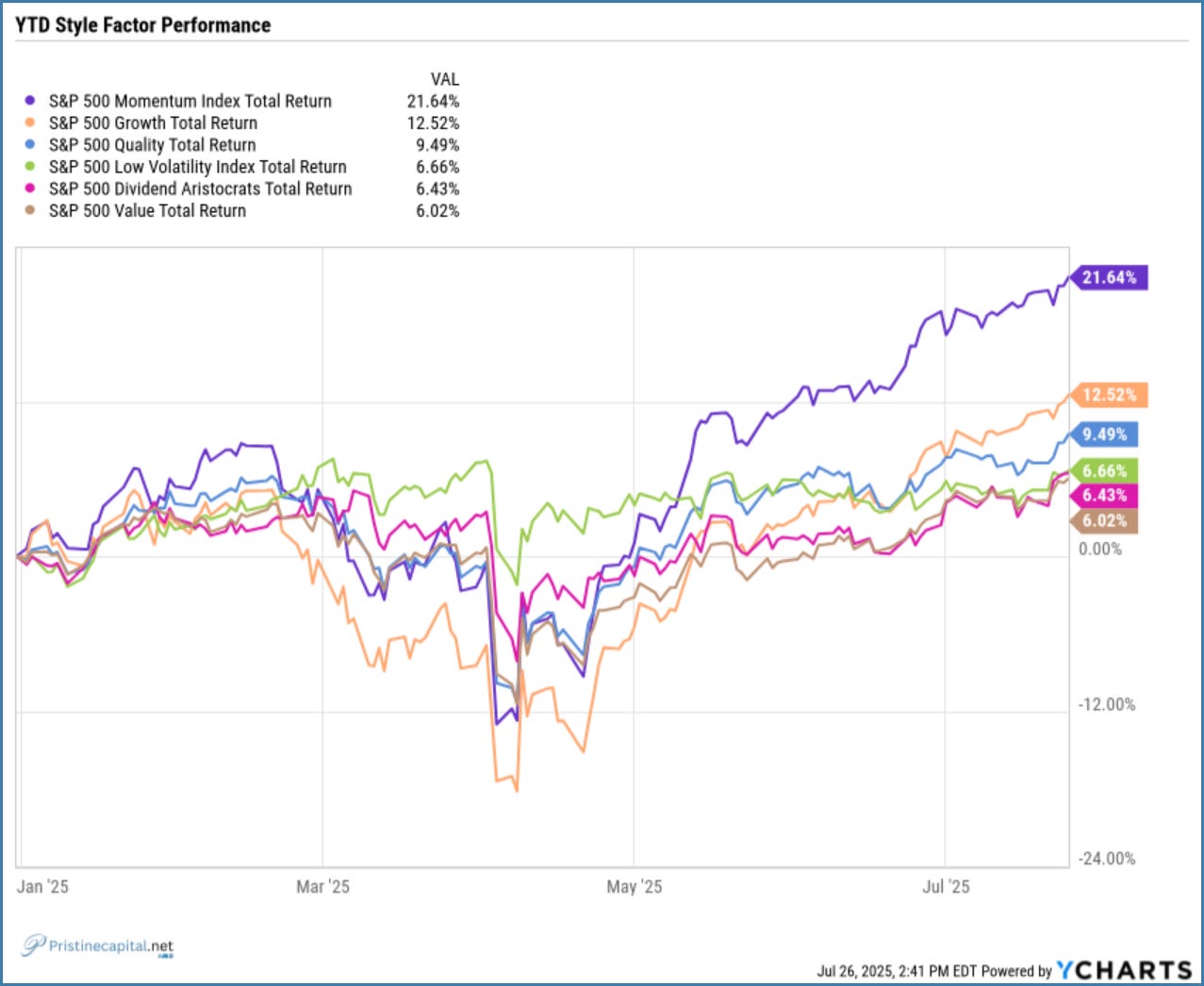

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

Style Factor YTD Performance

Momentum & growth style factors outperforming → risk on!

If/when a bear market rolls around, rotating out of growth and into value is the ultimate power move to prevent getting destroyed on the downside👇

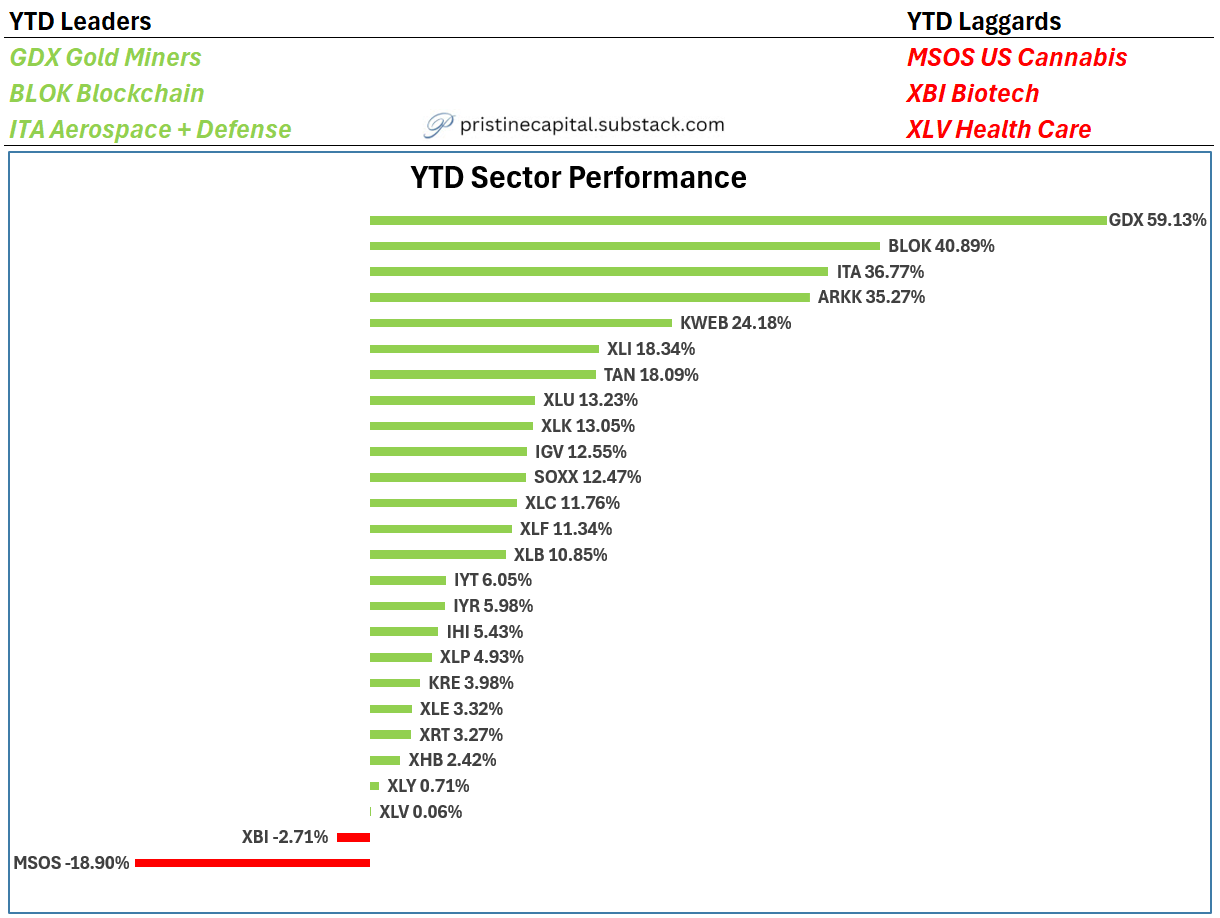

YTD Sector Performance

GDX & BLOK both represent dollar alternatives. And they are leading in 2025!👇

QTD Sector Performance

MSOS cannabis stocks are leading in Q3. This group is about as unloved as unloved gets 👇

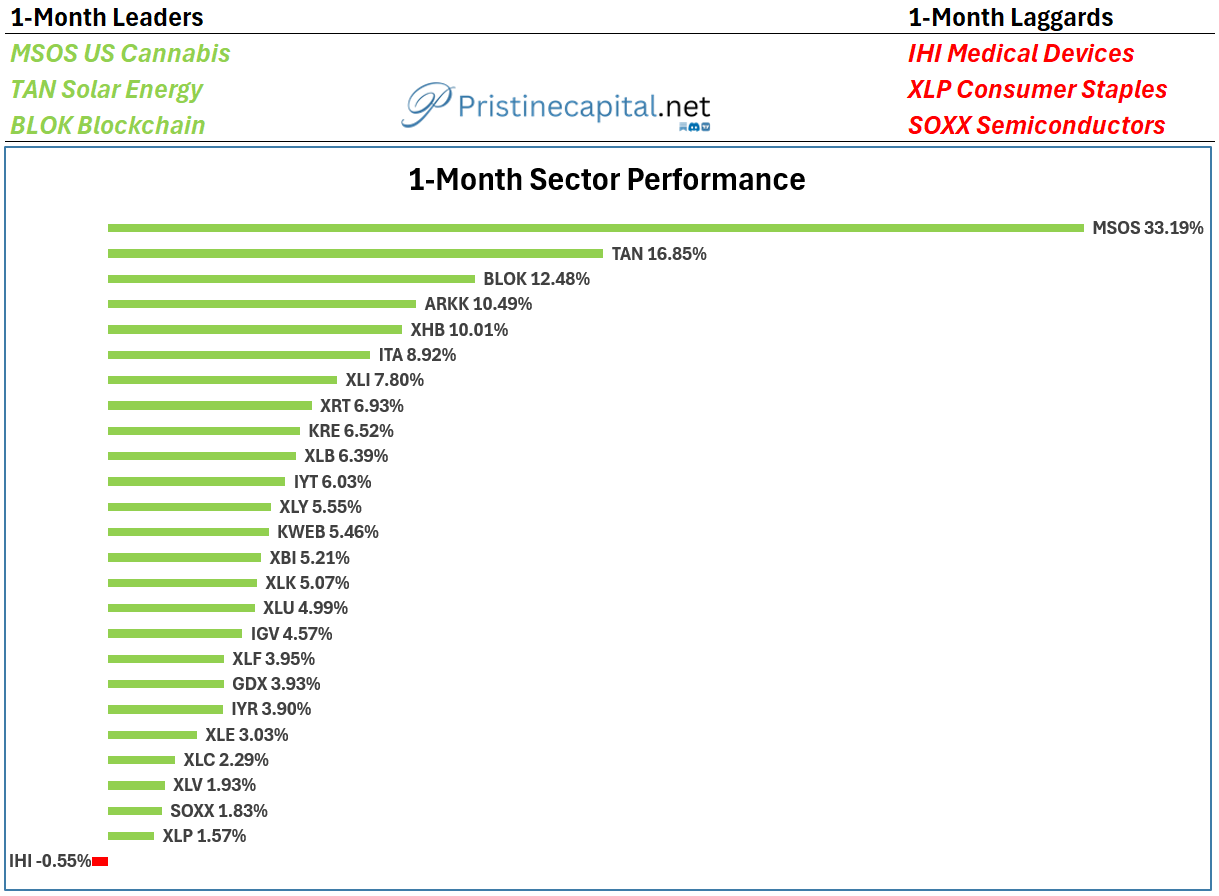

1-Month Sector Performance

MSOS Terry Cole was confirmed as head of the DEA on 7/23. He holds the keys to the rescheduling process (or maybe Trump does) 👇

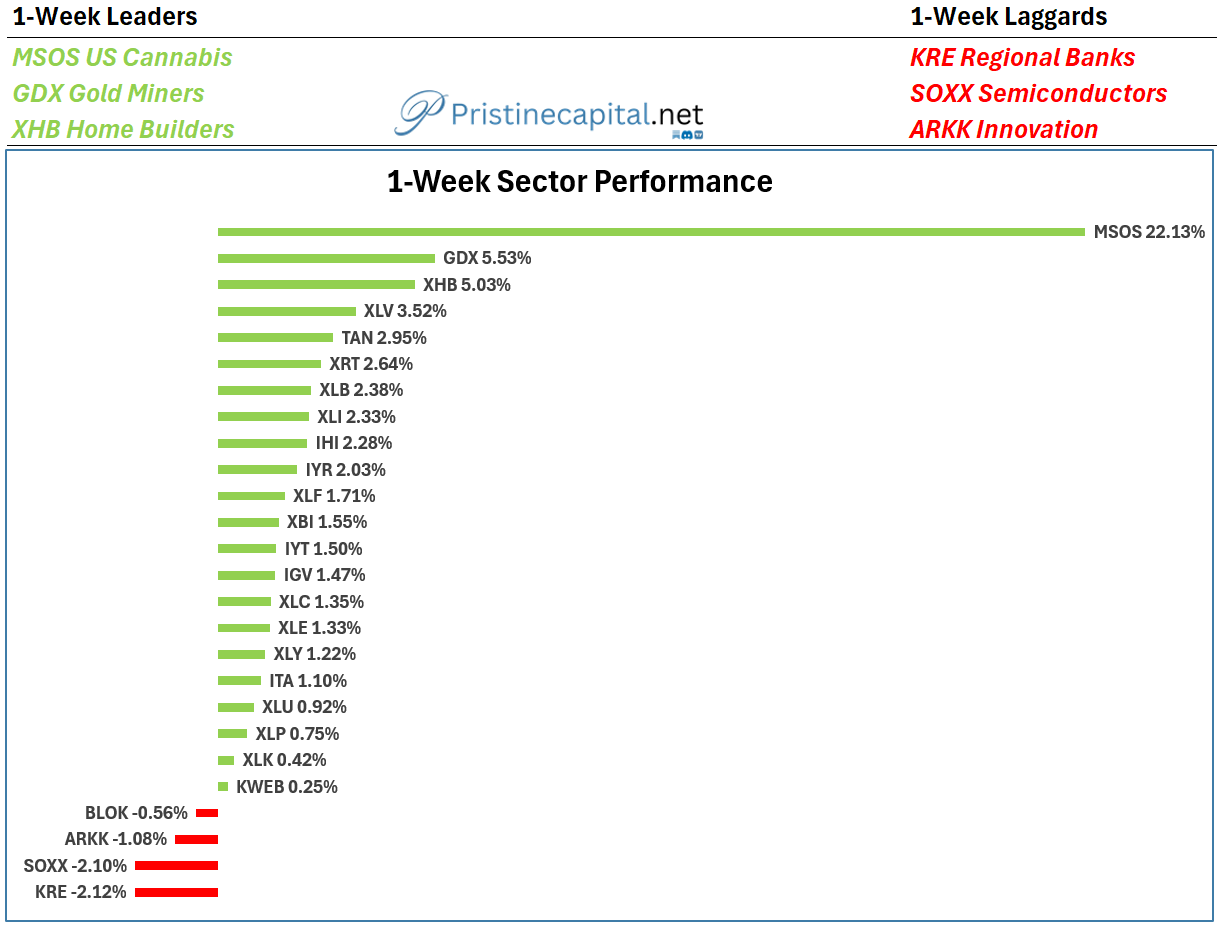

1-Week Sector Performance

High momentum groups SOXX ARKK BLOK underperformed last week👇

In the sections below, we’ll assess the macro landscape, cover the top YTD performers in all equity indices, and outline three trading setups for the week ahead. All that and more. Just scroll down👇