🐻A Bear Market is Brewing🍻

Pristine Weekend Watchlist 12.14.25

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this note, we’ll cover the following topics to prep for the upcoming trading week:

🦾 Sector relative strength analysis across multiple timeframes

🌎Macro Analysis

📈Three A+ Trade Setups

And much more! Let's get started! 👇

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

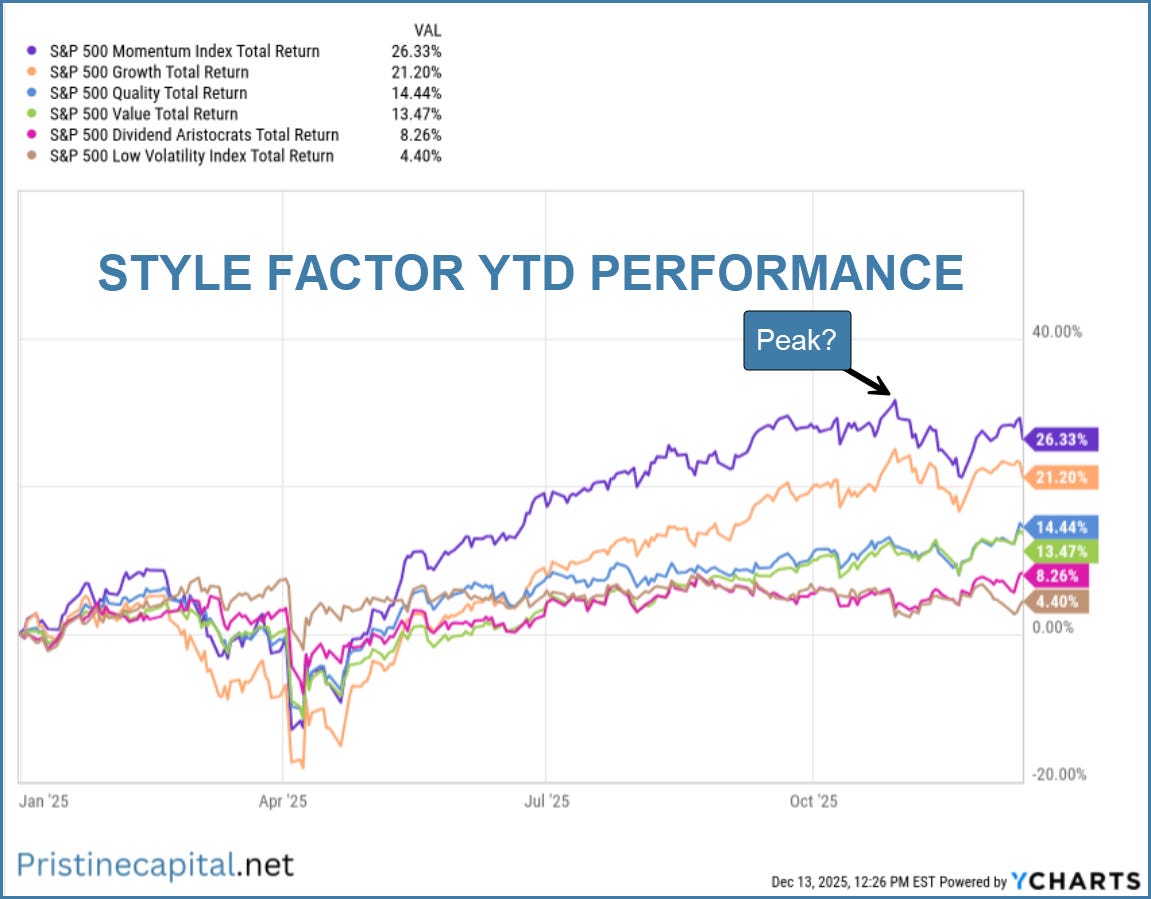

Style Factor YTD Performance

The momentum style factor is the leading group YTD, but it’s important to note that it peaked back in October. This could be a tell for the year 2026. My baseline assumption is that 2026 will be a weaker year than 2023, 2024, & 2025👇

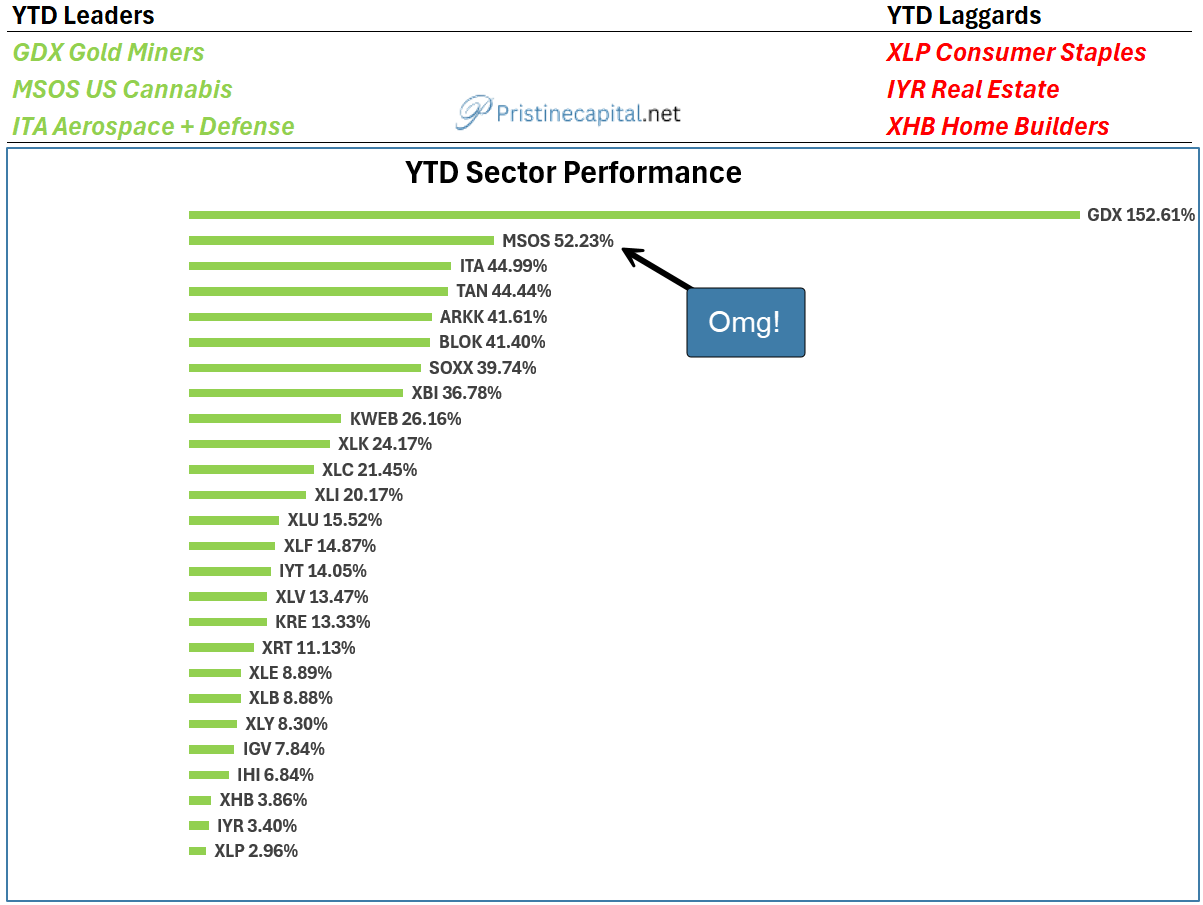

YTD Sector Performance

What a difference a day can make. MSOS cannabis moved from last place, to second place on our leaderboard 👇

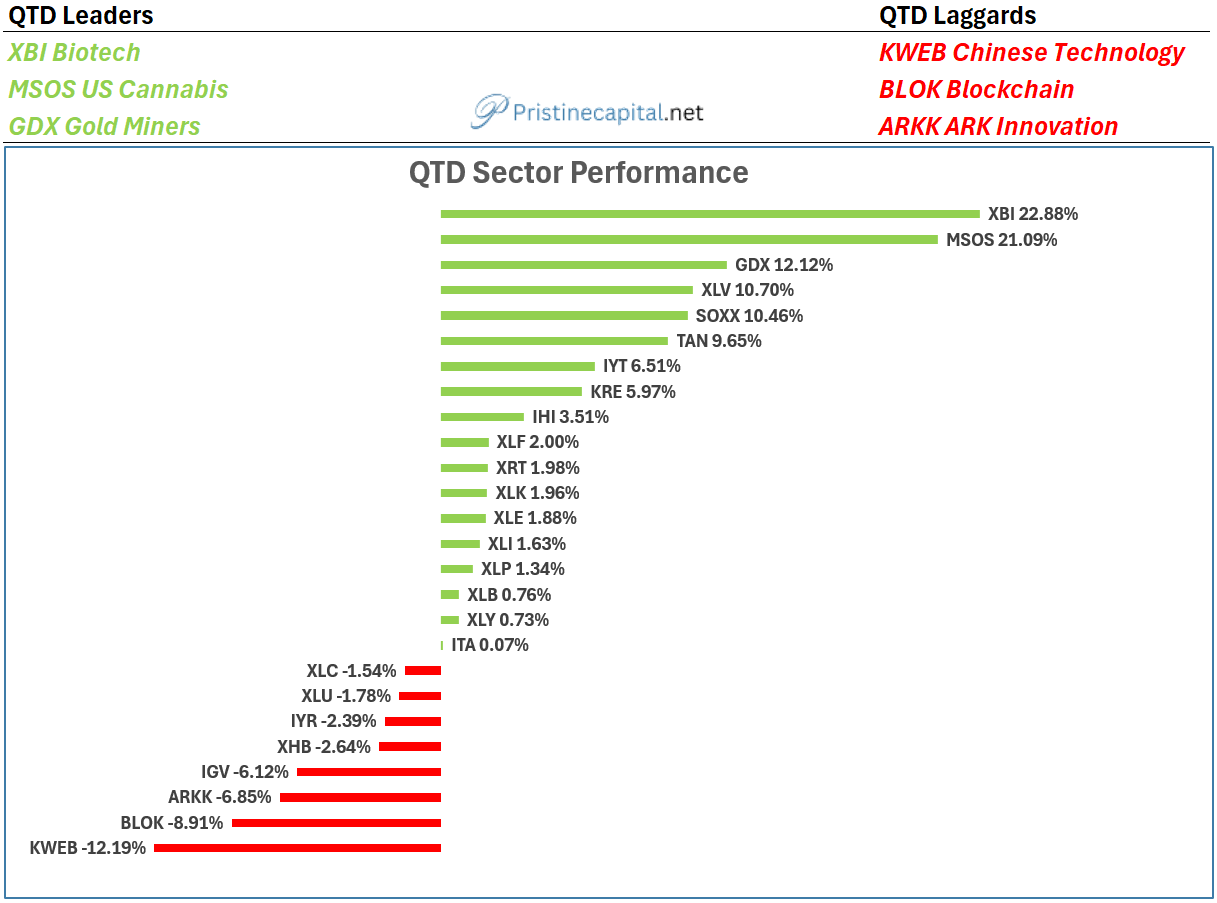

QTD Sector Performance

XBI Biotech leading in Q4. Could be related to expectations of an easier fed, and/or the rotation into small cap stocks more broadly as investors look for alternatives to megacap AI stocks 👇

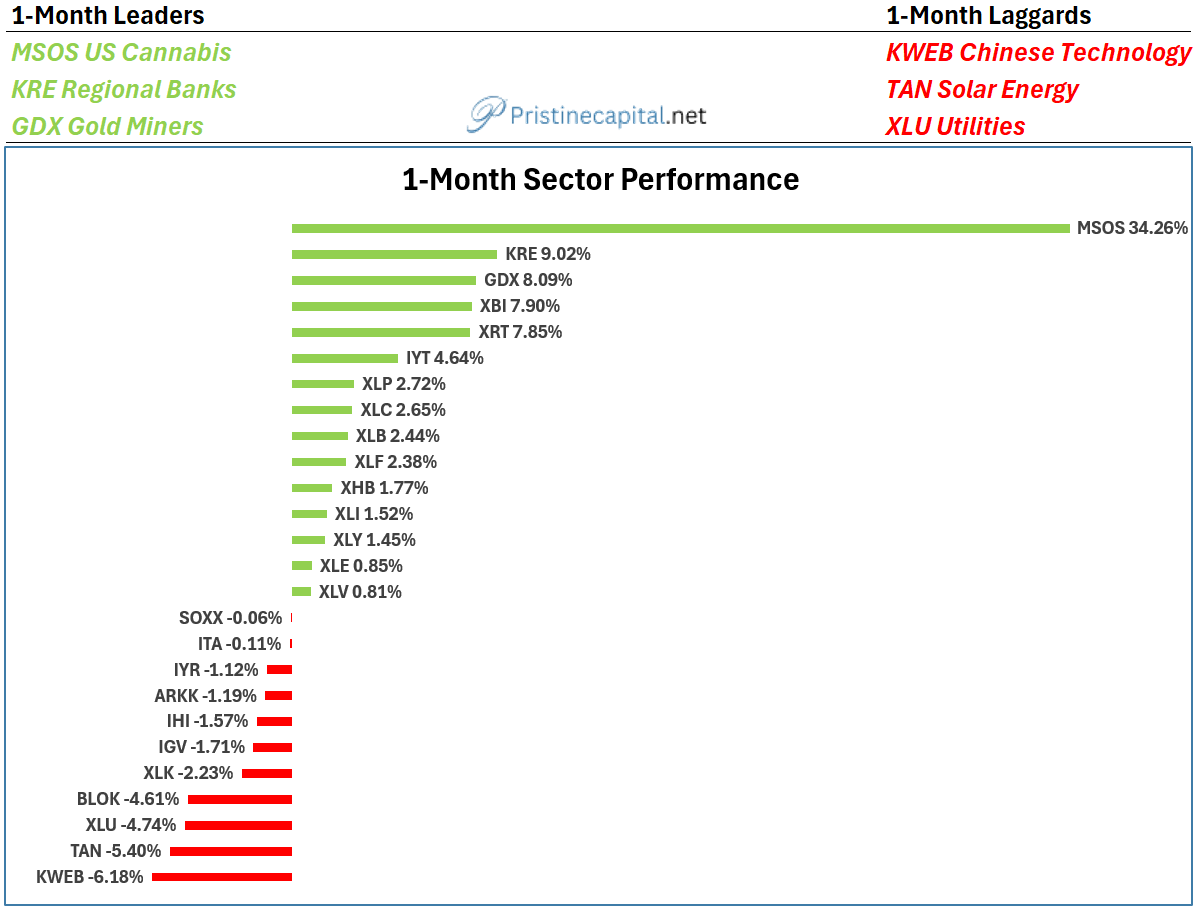

1-Month Sector Performance

We are seeing a clear rotation away from multi-year leaders, with notable underperformance in BLOK (blockchain), SOXX (semiconductors), and XLK (megacap tech) 👇

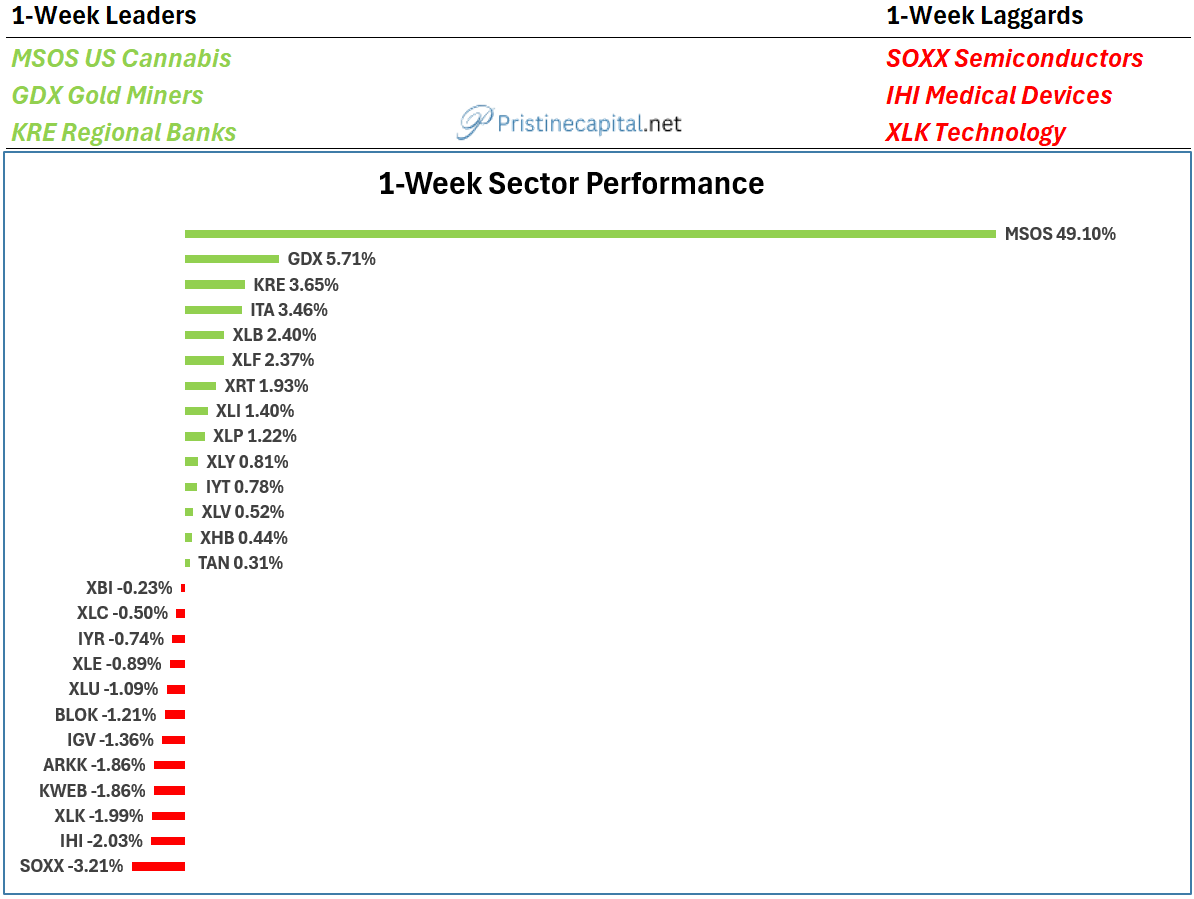

1-Week Sector Performance

MSOS rags to riches & GDX outperformance following Fed Wednesday 👇

Key Ideas/ Macro Backdrop🗝️