Introduction

Thanks for being a member of Pristine Capital. My full-time trading journey would not be possible without your support. My goal is to share the lessons from my journey to help you achieve your dreams in trading as well.

Key Takeaways

The Market Matters! The S&P 500 had an amazing year, often rising by more than 1% in individual trading months. This allowed aggressive long trades to work effectively. If/when the S&P 500 declines, trading the long side aggressively will not work! Using the trend model and obeying my rules in each market regime was paramount to my success in 2024, and will be again in 2025

It is impossible to short THE TOP or buy THE BOTTOM. Most of my losing trades and/or periods of struggle came when I tried to pick a top or bottom in an asset. I often avoided getting long groups of stocks that were already ascending, because I thought they had run too much too fast. It is paramount to buy stocks that are already advancing, and short stocks that are already declining! Of course, I always want to catch trades early in the move, but in 2025, my goal is to ALWAYS get some form of technical confirmation, whether I am trading for a trend reversal or trend continuation

Do not short market leaders that emerged from PEG setups unless they are 12 ATR’s away from their 50D SMA. If I do, it should be a smaller trade. I spent the first few months of the year battling NVDA, and spent some time in the fall battling APP. Silly

Lean into Stage 1→ Stage 2 trend reversal setups. I did well trading BABA this year. Don’t be afraid to add to winning trades

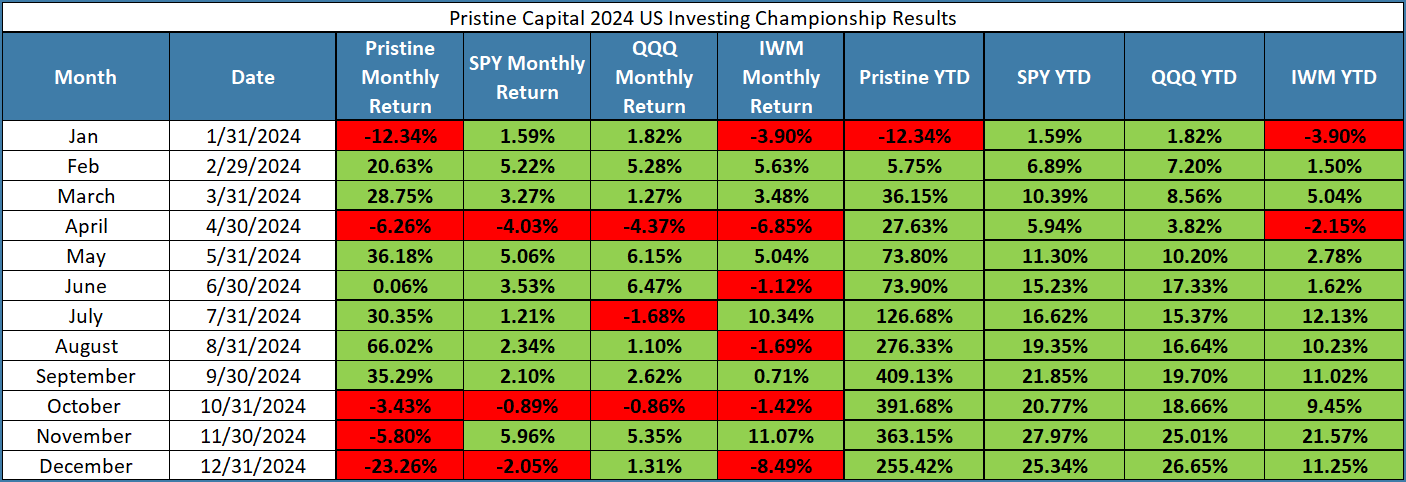

PnL 2024 Breakdown +255.42%

Sector Breakdown 2024

January Review -12.34%

NVDA broke out from monthly value area 1/8

SPY broke out from monthly value area 1/19

I traded MSOS to the long side, which was the best group for that month ✅

I traded China stocks to the long side, while KWEB was the the 2nd worst that month ❌

I traded puts in QQQ & NVDA, which were both big mistakes given the relative strength in both tickers ❌

I traded small cap stocks to the long side, while IWM underperformed ❌

February Review +20.63%

SPY ripped +5.22%, making it easy to trade the long side

Closed MSOS for gains ✅

Successfully traded NVDA puts, but had to double down on this position to make it work → Wait for 12 ATR extension from 50D SMA rather than 10 ATR extension

Got hit by a gap down in PDD and sold the position a few days too late ❌

Traded short puts in MSTR, when crypto was the best performing group ✅

March Review +28.75%

SPY +3.27%, favoring the long side

Gold miners emerged as a leadership group

Successfully traded SPY puts and closed on retest of 20D SMA ✅

Successfully traded NVDA puts into the end of the month ✅

April Review -6.26%

SPY -4.03%, favoring the short side

I traded BIDU & BABA to the long side, while KWEB was the #2 group that month ✅

Got chopped up in a bunch of other trades

Did a decent job controlling risk ✅

May Review +36.18%

SPY +5.06%, favoring the long side

Traded calls in TLT on a confirmed trend reversal ✅

Rode BABA as it made a move above a long stage 1 base and cleared all key moving averages. Sold the stock pretty close to the highs ✅

All my other trades were pretty much scratches

I didn’t trade SOXX semiconductors, which were the top group this month

June Review +.06%

SPY +3.53%, favoring the long side

Took a loss on the short side of NVDA on big size. Shouldn’t have put myself in this position ❌

Overall a sloppy month of back and forth trading for me. I’d say this month was a missed opportunity

Traded DOCN calls and short GLTB puts. Got lucky on DOCN with a quick scalp, but could have been trading stronger names ✅❌

July Review +30.35%

SPY +1.21%, favoring the long side

I sidestepped a big market dip in the first half of this month. I made money during the dip by being long TLT calls and RKT common stock. Redeployed that capital into equities toward the market low. Crushed it ✅

Had some good trades in MSTR, which had high relative strength ✅

This was a fantastic month for me in terms of navigating the market and being in the right names✅

Bot SPY puts right at the local top of the market. Sold them too early but still did well! ✅

August Review +66.02%

SPY +2.34%, favoring the long side

I went max long BABA calls and trimmed them toward a local top. Reloaded them toward a local bottom and rode the stock up again. Had this stock on a string in a way that I never have before ✅

I added to my BABA trade as the trade went in my favor ✅

Was long calls, common stock, and short puts in BABA at one point

Monetized a good long trade in RKT✅

Tried getting long ZIM and stopped out with minimal damage ✅

September Review +35.29%

SPY +2.10%, favoring the long side

Shorted NVDA via long puts successfully ✅

Bought MSTR common shares for gains✅

Monetized a huge run in BABA ✅

Started accumulating MSOS for the cannabis rescheduling trade

October Review -3.43%

SPY -.89%, favoring the short side

Tried shorting APP via puts as it was 10 ATR’s extended from the 50D SMA. It ended up consistently running higher and remained 12 ATR’s above the 50D SMA for a while. I shouldn’t have been focusing on this stock ❌

Had a dreadful purchase of TLT calls as it was free falling! ❌Closed this out quickly when I was wrong✅

Good long trade in MSTR commons ✅

Unsuccessfully traded a PEG in GOOGL ❌

November Review -5.80%

SPY +5.96%, favoring the long side

Tried trading a PEG in RBLX was was unsuccessful

Kept adding to MSOS, with the rescheduling catalyst in mind and amendment 3 in Florida. Also could have been a hedge if Kamala won the election. When Trump won, this gapped down 30%, catching me off guard. Stopped out of MSOS, but re-entered with bigger size at a lower price a few days later. This was the beginning of my skid in the contest ❌

Lost track of MSTR and it ran to the upside without me ❌

I was long BABA again, which also did poorly when Trump won the election

Was completely focused on the wrong names this month and not following what the market was telling me to be long ❌

December Review -23.26%

SPY -2.05% (as of 12/30), favoring the short side

I went on full tilt in December, as I could feel the USIC 1st place finish slipping through my fingers. I was max long MSOS thinking it would bounce due to rescheduling coming in January, but the negative momentum at the end of the year superseded the upcoming catalysts. This group completely crashed and I was long for the whole thing ❌

I tried trading my way out of a whole and sized too big on GOOGL calls as the market was turning down. My trend model shifted negative and I shouldn’t have been trading the long side in the second half of the month. The desire to win the contest made me break my rules, resulting in a poor finish❌

I finished 2024 with the best YTD performance of my career thus far, but with a salty taste in my mouth due to how I finished the contest. I am incredibly hungry to keep improving

Conclusion

I had the best yearly trading performance of my life in 2024

I learned that when I am trading my best, I am capable of being the best trader in the world at any given time

I need to stop shorting high relative strength stocks

I need to let the market tell me which groups to get long instead of always picking my own themes that I think will do well

I can’t control my performance. I MUST follow my trading process & trend model in 2025, no matter what the scoreboard is.

2025 is going to be our year!

-Andrew